It was a great tradition and never a luxury for every family in Ovim, Abia State: in the morning, give the boy/girl a FULL loaf of 15 kobo Ezioma bread with Peak milk, 2 cubes of St. Louis sugar, and Lipton, to blend. It was so affordable that it did not require a lot of prayers because those prayers have already been answered!

Then every big Oriendu Market day, Our Society Bread, produced by a legendary Ovim businessman, Chief Umunna, in far away Enugu, would also be available. He made the bread in Enugu, transported it to Ovim, but it was still cheaper in Ovim than what he was selling in Enugu! You begin with Ezioma, you upgrade to Our Society!

But those days have disappeared. Ezioma and Our Society Bread brands had since folded along with many other things. But today, we are reading that Nigeria wants to return to the old path – abundance of food on family tables:

“Nigeria’s Bola Tinubu has declared a state of emergency on food security, following soaring prices of food items in the country. The move follows increasing outcry by Nigerians over the rising cost of living that has made life in the country unaffordable for many.”

This is a good policy and Nigeria must make sure it works. The #7 “Engagement of security architecture to protect farms and farmers” in the 17-point plan is right on the money. Good Luck, Nigeria.

- Inclusion of food and water availability and affordability issues within the purview of the National Security Council.

- Deployment of initiatives to reverse the inflationary trend and ensure future supplies of affordable foods.

- Short-term strategy to use savings from fuel subsidy removal to revamp the agricultural sector.

- Release of fertilizers and grains to farmers and households (free) as immediate intervention.

- Urgent synergy between the Ministry of Agriculture and the Ministry of Water Resources to ensure adequate irrigation and all-year-round farming.

- Creation of a National Commodity Board to review food prices and maintain a strategic food reserve.

- Engagement of security architecture to protect farms and farmers.

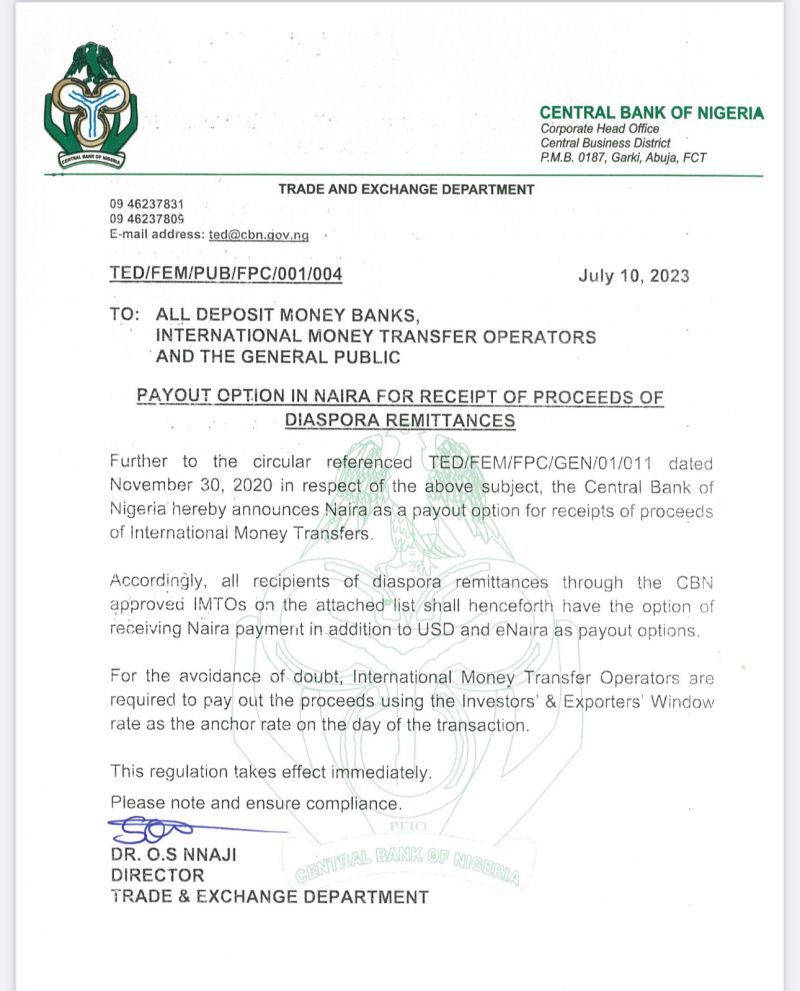

- Role of the Central Bank in funding the agricultural value chain.

- Activation of land banks and increase of available arable land for farming.

- Collaboration with mechanization companies to clear more forests and make them available for farming.

- Usage of river basins for irrigation to ensure continuous farming.

- Deployment of concessionary capital/funding to the sector especially towards fertilizer, processing, mechanization, seeds, chemicals, equipment, feed, labor, etc.

- Improvement of transportation and storage methods for agricultural products to reduce costs and food prices.

- Increase in revenue from food and agricultural exports.

- Improvement of trade facilitation by working with Nigerian Customs to remove bottlenecks.

- Massive boost in employment and job creation in the agricultural sector.

- Target to double the percentage of employment in agriculture to about 70% in the long term.

Comment on Feed

Comment 1: One of the reasons why “religious ignorance” thrives in Nigeria is because of bad leadership. In fact, most of the religious gatherings in Nigeria are organised for seeking the created than the creator. When there is an abundance of food, a lot of our religious jamboree and unnecessary prayers would stop.

Similarly, it’s not enough to declare a state of emergency on food. I wish to see words aligned with actions. Declaring a state emergency when farmers cannot transport their products to the city because of bad roads, a lot of tomatoes are spoiling because of the bad preservation process is like a roar of a toothless Lion.

We should move from vivid imagination to engaging in active and proactive measures. Till then, all political speech will be tagged propaganda and manifesto.

My Response: Sure – I did not write that in the context that it was praying for expectation. I wrote in the context that it had been given. In other words, those prayers were answered that “asking” moved to “thanking”.

Your statement “One of the reasons why “religious ignorance” thrives in Nigeria is because of bad leadership.” may not be correct. The most prosperous and most dynamic era in England was when it prayed most and was exceedingly religious. At the peak of the industrial revolution, England was the global leader in prayers, from John Wesley to all. In other words, they prayed and they had great leadership and they believed. Your statement is not factual.

Nigeria’s problem is not prayers. Our problem is that we do not practice the tenets of even what we pray for.

Comment 2: The news about Bola Tinubu declaring a state of emergency on food security in Nigeria is indeed a positive step. China did this years ago to revive the nerves of her economy. The rising cost of living and the struggles faced by many Nigerians make it crucial to address the issue promptly.

Please Dr, can you explain this to me, item 9.

Federal ministry of housing has land banks in over 26 locations in Nigeria. Lands are in the purview of state governors. Reason grazing path died. How is this going to end. States will reject releasing lands and money gone. pic.twitter.com/lA82WP7nqm— Ahamefula J. A (@picklescloud) July 13, 2023

My Response: It depends on the way the program is implemented. You can still do that and put that under the domains of LGAs and states. It must not be by the federal government. I do not see any issue there.