My social media channels are classrooms. And most times, I write things which deviate from the “typical” consensus, partly because of my experiences and multifaceted training. I hold degrees in technology, banking, finance, and engineering, with experiences that cut across banking, oil & gas, semiconductors, finance and education.

What if I tell you that fuel subsidies are not Nigeria’s main problem? What if I tell you that what you see as a “fuel subsidies” problem is actually inefficiency in government? When you do not know how much petrol you use, is that a fuel subsidy problem? When you do not have the ability to control your borders, feeding smugglers, is that a fuel subsidy problem? When you pay for “imported” fuel which never arrived, paying fake invoices, is that a fuel subsidy problem?

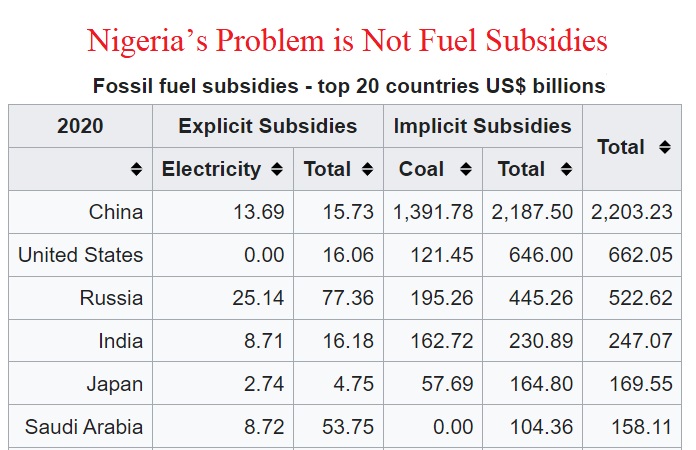

Simply, when you fail on those and many, you need an excuse and that excuse is to kill what benefits economies. Good People, there is no major country which does not subsidize fuel. But while they subsidize fuel, they use that cheap energy to drive PRODUCTION because energy is a very important component of the manufacturing process. China leads the world. The United States follows. Japan is 5th. With energy subsidies, they have a manufacturing base, and when they tax the outputs from those industries, they recover their money!

Nigeria’s fuel subsidy problem is that it was designed to feed corruption (you can photoshop invoices and the government will keep paying you because you have one special connection in Abuja). In my book, Nanotechnology and Microelectronics, which received a Book of the Year award from IGI Global, and upon which I received an invitation from Harvard Business Review, I explained how nations drive technology growth, looking at 2,000 years of data.

The US postal service has not made a single profit in the last 20 years. That is a massive subsidy to improve the supply chain, across America, by making sure commerce works. But they’re smart: the money used to subsidize post office is recovered when profits of companies which depend on the postal system are taxed. Provided there is no corruption, the government has no need to turn the post office into a direct profit-making machine. Recently, the government tried to clean the books, and even after, the postal service still recorded red! That subsidy is a platform strategy as we do in startups.

Postal Service Net Income/Loss By Year

- 2021 – $9.7 billion loss (projected)

- 2020 – $9.2 billion loss

- 2019 – $8.8 billion loss

- 2018 – $3.9 billion loss

- 2017 – $2.7 billion loss

- 2016 – $5.6 billion loss

- 2015 – $5.1 billion loss

- 2014 – $5.5 billion loss

- 2013 – $5 billion loss

- 2012 – $15.9 billion loss

- 2011 – $5.1 billion loss

- 2010 – $8.5 billion loss

- 2009 – $3.8 billion loss

- 2008 – $2.8 billion loss

- 2007 – $5.1 billion loss

- 2006 – $900 million surplus

- 2005 – $1.4 billion surplus

- 2004 – $3.1 billion surplus

- 2003 – $3.9 billion surplus

- 2002 – $676 million loss

- 2001 – $1.7 billion loss

Fellow Nigerians, we need better journalism because for decades our citizens are not well informed. Nigeria needs fuel subsidies to build a competitive production economy. But since we cannot reduce corruption, the subsidies have become a victim; that is unfortunate. As that happens, according to Manufacturers Association of Nigeria (MAN), our manufacturers in Nigeria spent around N144 billion on alternative sources of energy (yes, generators) last year! We can do better.

President Biden last year signed into law the 2022 Postal Service Reform Act, which is expected to save a combined $107 billion for USPS by eliminating existing debt and taking future liabilities off of its books. Setting aside that savings, the Postal Service saw a net loss of nearly $500 million in fiscal 2022.

Nigeria needs fuel subsidies to build a competitive production economy. Fuel subsidy is not the main problem; corruption is. Deal with corruption and you will get the “productive” dividend of subsidizing energy. Even the debt servicing will become better. Yes, the borrowing we see in financing energy subsidies is not because of fuel subsidies; it is simply that fuel subsidies were not put into a production system because the benefits were muted by corruption. In other words, when you borrow and waste the money on financing corruption, there is no way the system will work. But if you have borrowed, and used the funds to subsidize energy, you will likely improve your balance of payment and tax base, and that will help to pay the debts easily.

Comment on Feed: Thanks Prof. Whilst I agree with inefficiencies in our governance, the data above will be more balanced if the costs of energy in these countries are provided.

My Response: The cost of energy in the countries will not change anything in the overriding theme. You have a decent sample to make a decision, from energy producing countries like Saudi Arabia to non-native producers like Japan, and those in-between like India. More so, using the cost without adjusting for purchasing power parity (ppp) makes no sense. My point is that the absolute cost of energy in the US and what it costs in Nigeria will not matter; you focus on the PPP and if you do, you will see that the US would have subsidized even if its energy cost is at the Nigerian level.

You have said it all. Those justifying subsidy removal are just ignorant or following bandwagon. First, it isn’t feasible considering the purchasing power of most citizens, secondly, subsidy itself is not the problem, but subsidy scam. Government should address the REAL problem!

— Arsenal Babe (@arsenalbabe_) June 30, 2023