The setting up of Nigeria’s 10th National Assembly has passed the most crucial stage with both the Senate President and the Speaker of the House of Representatives and their deputies elected on Tuesday.

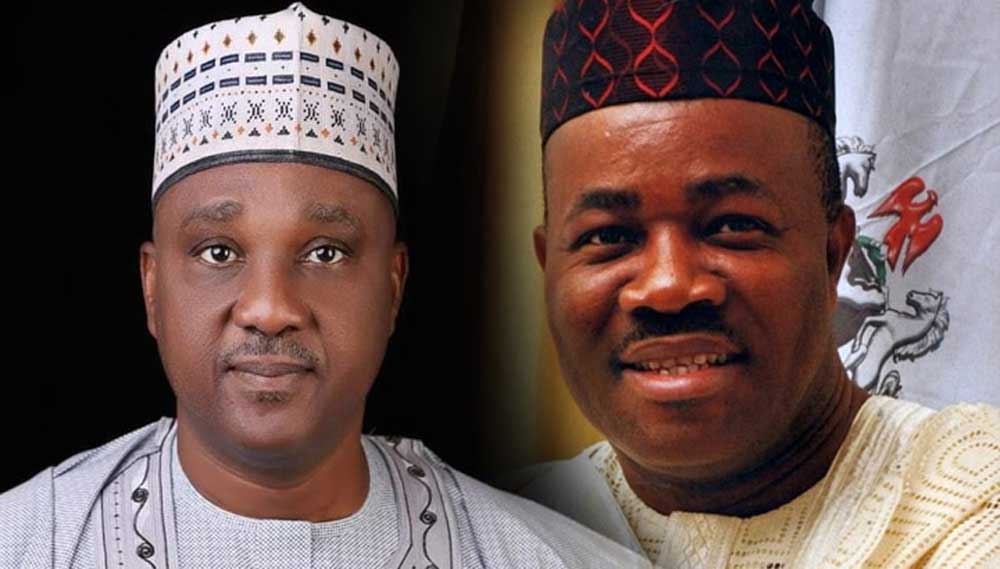

Senator Godswill Akpabio emerged as the Senate President of the 10th Senate, defeating Abdul’aziz Yari. Senator Barau Jibrin was elected unopposed as the Deputy Senate President. Akpabio secured 63 votes, while Yari received 45 votes, with one Senator-elect abstaining from voting.

Following Senator Ali Ndume’s citation of Akpabio and nomination for Senate President, and Senator Solomon Adeola’s seconding of the nomination, Senator Elisha Abbo read the citation of Abdul’aziz Yari and nominated him for the same position. Senator Jimoh Ibrahim seconded Yari’s nomination.

After no further nominations were made, the Clerk to the National Assembly, Sani Magaji Tambuwal, called for additional nominations. With no further nominations, Tambuwal declared the nominations closed and initiated a division to allow the Senators-elect to cast their votes.

After the votes were counted, it became clear that Akpabio had emerged as the winner, leading to jubilation among his supporters. Tambuwal officially declared the results, announcing Akpabio’s victory with 63 votes, while Yari received 45 votes, and one Senator-elect abstained from voting. Akpabio was then led to take the chair as the Senate President. He took his oath of office and allegiance, signed the oaths, and used the gavel for the first time.

The Clerk subsequently called for nominations for the position of Deputy Senate President. Senator Dave Umahi presented Senator Barau Jibrin’s citation and moved for his appointment as the Deputy Senate President, which was seconded by Senator Saliu Mustapha. As no other nominations were made, Tambuwal declared Jibrin duly elected as the Deputy Senate President without opposition.

There was a brief moment of disagreement when Senator Mohammed Tahir Monguno opposed Yari’s nomination, citing Order three rule three. However, the Clerk overruled him and upheld Yari’s nomination.

Governors Hope Uzodinma, Dapo Abiodun, former Kano Governor Abdullahi Ganduje, and other dignitaries were present in the Red Chamber to witness the voting and celebrate with Akpabio after his victory.

Following Jibrin’s swearing-in as the Deputy Senate President, Akpabio presided over the swearing-in of all other Senators, conducted by the Clerk to the National Assembly. Akpabio then delivered his inaugural speech and adjourned the plenary until the next day at 10 am.

The lower chamber of the National Assembly also witnessed the election of principal officers.

Tajudeen Abbas, the anointed candidate of the All Progressives Congress (APC), secured the highest number of votes and emerged as the Speaker. Out of the 360 members-elect, 359 participated in the process.

The race had three contestants, and the winner was expected to secure a simple majority. Tajudeen Abbas, representing Kaduna State, was the APC candidate backed by the presidency. The other contenders were Ahmed Idris Wase and Aminu Sani Jaji, who are also members of the APC.

A significant majority of the members-elect openly declared their support for Abbas. As of now, Abbas is on the verge of defeating his opponents, with outgoing Deputy Speaker Ahmed Wase and Sani Jaji receiving one and two votes, respectively.

Earlier, aspirants Muktar Betara, Yusuf Adamu Gagdi, Miriam Onuoha, and Sada Soli withdrew from the Speakership race in favor of the APC’s consensus candidate.

The inauguration is taking place in improvised meeting rooms that were used as the Chamber by the previous 9th House due to the ongoing renovation of the National Assembly complex.