China has begun requiring semiconductor manufacturers to source at least half of the equipment used in new or expanded production lines from domestic suppliers, according to three people familiar with the policy, who spoke to Reuters.

The move marks one of Beijing’s most forceful steps yet to reduce reliance on foreign technology.

The requirement, which is not publicly documented, has been communicated directly to chipmakers seeking government approval for new fabs or capacity expansions. Companies are now expected to demonstrate through procurement tenders that a minimum of 50% of their equipment will be Chinese-made, the sources said. Projects that fail to meet the threshold are typically rejected, although regulators may show flexibility in cases where domestic alternatives are unavailable.

The measure underlines how China’s semiconductor strategy has shifted from encouragement to enforcement, particularly since Washington tightened export controls in 2023, barring the sale of advanced AI chips and key chipmaking tools to Chinese firms. While those U.S. restrictions cut off access to the most advanced equipment, the new rule goes further by actively steering manufacturers toward domestic suppliers even when foreign tools from the United States, Japan, South Korea, and Europe remain technically accessible.

“Authorities prefer if it is much higher than 50%,” one of the people said. “Eventually they are aiming for the plants to use 100% domestic equipment.”

China’s industry ministry did not respond to a request for comment. The sources asked not to be identified because the policy has not been formally announced.

The requirement fits squarely within President Xi Jinping’s call for a “whole nation” approach to building a self-sufficient semiconductor ecosystem, an effort that mobilizes state funding, research institutions, equipment makers, and chip fabs in tandem. Beijing has framed semiconductors as a strategic vulnerability, especially as technology rivalry with the United States intensifies.

That push spans the entire supply chain. Earlier this month, Reuters reported that Chinese scientists were working on a prototype machine capable of producing cutting-edge chips, an area Washington has spent years trying to keep out of China’s reach. At the same time, state-backed investors have continued to funnel capital into domestic champions through the so-called Big Fund, which launched a third phase in 2024 with 344 billion yuan ($49 billion) in fresh capital.

The impact of the 50% rule is already being felt on factory floors. Domestic fabs that once preferred established foreign suppliers are increasingly turning to Chinese equipment makers, sometimes out of necessity, sometimes under regulatory pressure.

“Before, domestic fabs like SMIC would prefer U.S. equipment and would not really give Chinese firms a chance,” said a former employee at Naura Technology, China’s largest chip equipment maker, referring to Semiconductor Manufacturing International Corporation. “But that changed starting with the 2023 U.S. export restrictions, when Chinese fabs had no choice but to work with domestic suppliers.”

Procurement data points to a surge in local demand. State-affiliated entities placed a record 421 orders this year for domestically produced lithography machines and components, worth around 850 million yuan, according to publicly available records. That wave of orders is helping accelerate learning curves for Chinese suppliers that had previously struggled to break into advanced manufacturing processes.

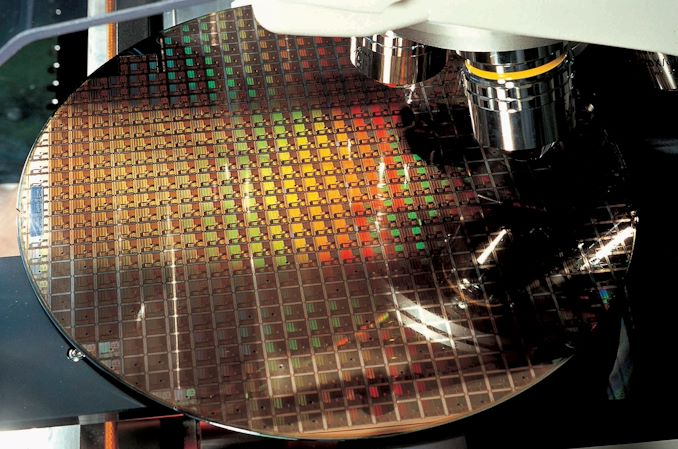

The policy is producing clear winners. Naura and smaller rival Advanced Micro-Fabrication Equipment (AMEC) are gaining ground in etching, a critical process that sculpts transistor structures on silicon wafers. Sources say Naura is now testing its etching tools on SMIC’s advanced 7-nanometre production line, an early-stage milestone that follows successful deployment at the 14-nanometre level.

Advanced etching equipment in China was long dominated by foreign firms such as Lam Research and Tokyo Electron. Under the new procurement regime, those tools are increasingly being replaced, at least partially, by domestic alternatives from Naura and AMEC.

Naura has also emerged as a key supplier to Chinese memory chipmakers, providing etching tools capable of supporting chips with more than 300 layers. In another sign of forced localization, the company developed electrostatic chucks to replace worn components in Lam Research equipment that could no longer be serviced after U.S. export controls took effect, according to people familiar with the matter.

None of Naura, AMEC, YTMC, SMIC, Lam Research, or Tokyo Electron responded to requests for comment.

The momentum is visible not only in factories but also in innovation metrics. Naura filed a record 779 patents in 2025, more than double its filings in 2020 and 2021. AMEC filed 259 patents over the same period, according to Anaqua’s AcclaimIP database, figures verified by Reuters. Financial performance has followed suit: Naura’s revenue jumped 30% in the first half of 2025 to 16 billion yuan, while AMEC reported a 44% increase to 5 billion yuan.

Analysts estimate that China has now reached around 50% self-sufficiency in photoresist-removal and cleaning equipment, a segment once dominated by Japanese suppliers but now increasingly led by domestic firms, particularly Naura.

“The domestic equipment market will be dominated by two to three major manufacturers, and Naura is definitely one of them,” a separate industry source said.

The trend is unsettling for global chip equipment makers. China has been one of their largest markets, and the quiet imposition of domestic sourcing thresholds threatens to erode that position further. However, the trade-off appears deliberate for Beijing: sacrificing short-term efficiency and choice in favor of long-term strategic autonomy, even if it means forcing domestic suppliers to learn on the job under intense pressure.