Crypto investors in 2025 are another time exploring possibilities where small investments should translate into life-changing wealth. While mounted gamers like Bitcoin, Ethereum, and Solana stay cornerstones of the market, the spotlight is more and more turning to presale projects with explosive upside ability. Among those, Ozak AI stands out.

Its mixture of artificial intelligence and blockchain utility, coupled with early-level pricing, is sparking exhilaration among both whales and retail buyers. The real query is: what should a $500 investment in Ozak AI today be really worth by using 2026, and the way does it evaluate to putting the equal quantity into different most important coins?

Ozak AI: The $500 Growth Story

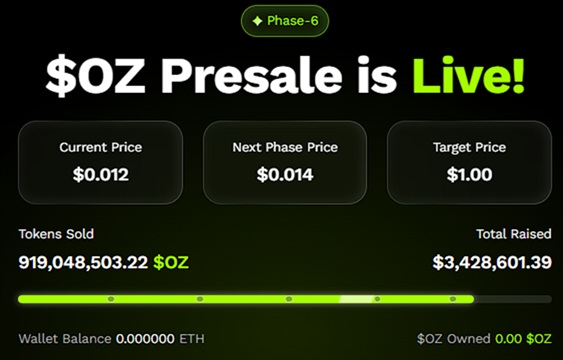

Ozak AI is currently in Stage 6 of its presale, with tokens priced at $0.012 every. To date, it has raised extra than $3.4 million and bought over 915 million tokens, highlighting both strong momentum and investor confidence. For $500, customers can stable 41,666 OZ tokens, a figure that offers huge exposure compared to the constrained quantities one could purchase in better-priced belongings like Bitcoin or Ethereum.

If Ozak AI hits $0.10 by 2026, the $500 stake would be worth $4,166. At $0.50, that number rises to $20,833, and at the ambitious target of $1.20, the same $500 grows into $50,000. These scenarios highlight the asymmetric opportunity that presale projects like Ozak AI bring—small amounts of capital with the potential for exponential growth.

Ozak AI’s Partnerships That Boost Confidence

What sets Ozak AI apart from typical presale hype tokens is its foundation of partnerships that strengthen its roadmap. Its collaboration with Perceptron Network (@PerceptronNTWK), with more than 700,000 active nodes, provides critical infrastructure for scaling AI-driven systems. In addition, partnerships with SINT and HIVE further enhance its ecosystem. SINT contributes AI agents and voice-driven execution, while HIVE integrates blockchain data APIs with Ozak’s 30ms market signals, ensuring real-time insights for traders and bots.

For investors, these alliances offer more than hype—they provide reassurance that Ozak AI is building an ecosystem with real-world use cases. This is why whales are actively accumulating tokens in OZ presale stages, validating its potential as a long-term project.

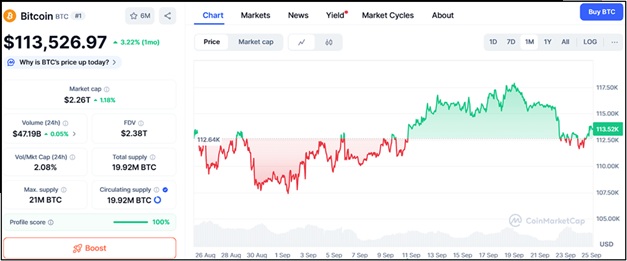

Bitcoin (BTC)

Bitcoin remains the most trusted asset in crypto, trading around $112,755 in mid-2025. For $500, an investor can acquire just 0.0044 BTC. If Bitcoin rises to $150,000 via 2026, that stake could grow to about $660. While BTC gives limited upside as compared to Ozak AI, it offers extraordinary balance, making it the anchor of most portfolios. For investors seeking exponential returns, but, Bitcoin does not give you the 100x multiples that when described it.

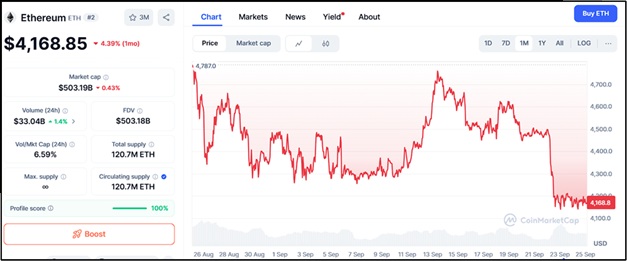

Ethereum (ETH)

Ethereum continues to strengthen decentralized finance and NFT ecosystems, buying and selling close to $4,196. A $500 funding these days secures around 0.119 ETH. Should Ethereum climb to $5,200, the allocation would be worth about $618. While Ethereum remains critical for long-term portfolios, its sheer length limits how an awful lot it could grow. For many, ETH is a dependable boom play however now not the automobile for transformative ROI in the next cycle.

Solana (SOL)

Solana has become a major force with its high throughput and thriving DeFi ecosystem. At $220, a $500 stake secures about 2.27 SOL. If Solana reaches $300 by 2026, that investment would be worth $681. Solana offers strong potential as a growth asset, but like Ethereum, it cannot compete with the explosive upside of early-stage tokens like Ozak AI.

Comparing Growth Potential

The comparison makes the differences clear. A $500 stake in Bitcoin, Ethereum, or Solana would likely grow to $600–$700 by 2026, reflecting steady but modest gains. In contrast, Ozak AI offers a pathway to potentially $4,000, $20,000, or even $50,000, depending on adoption and execution. This disparity explains why both retail investors and whales are treating Ozak AI as one of the most exciting opportunities of the cycle.

A $500 stake in Ozak AI today buys tens of thousands of tokens at just $0.012, with projections suggesting life-changing returns by 2026 if the project succeeds. While Bitcoin, Ethereum, and Solana continue to deliver steady growth and remain safe anchors in any portfolio, they cannot match the explosive upside of Ozak AI’s presale opportunity. For investors chasing transformative gains, Ozak AI may be the project that defines the next bull cycle.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter : https://x.com/ozakagi