In this article, we’ll discuss the recent 4.74% surge in Near Protocol (NEAR) as it experiences a remarkable increase in daily users, approaching it’s all-time high. We will also delve into the innovative Collateral Network (COLT), which is currently in its presale phase and has already witnessed a noteworthy 40% gain as a result of its game-changing use case.

>>BUY COLT TOKENS NOW<<

Analyzing Near Protocol’s (NEAR) Growing Popularity

Near Protocol (NEAR) has recently been experiencing a surge in user activity, with daily users averaging 62,000 during the last 30 days — a 13.3% increase compared to the previous 30-day period.

This remarkable growth can be attributed to the various developments and infrastructure upgrades implemented by Near Protocol (NEAR) over the past year, such as the release of the Blockchain Operating System (BOS) — a common layer that makes it easier to navigate Web3.

These improvements have made it much easier for developers to build applications on Near Protocol (NEAR). In fact, active developers are also on the rise, with a 5% increase compared to the previous month.

This surge in user activity has led to Near Protocol (NEAR)’s price soaring 4.74% over the past 24 hours, which means that Near Protocol (NEAR) is now 71% up since the turn of the year. As more users adopt Near Protocol (NEAR) and developers continue to build applications on Near Protocol (NEAR), these gains are likely to keep increasing.

Analysts predict that the price of Near Protocol (NEAR) will continue to range under $2.80, with a breach of this resistance leading to Near Protocol (NEAR) quickly moving to the $6.00 level within weeks.

Collateral Network (COLT) Gains 40% During Presale

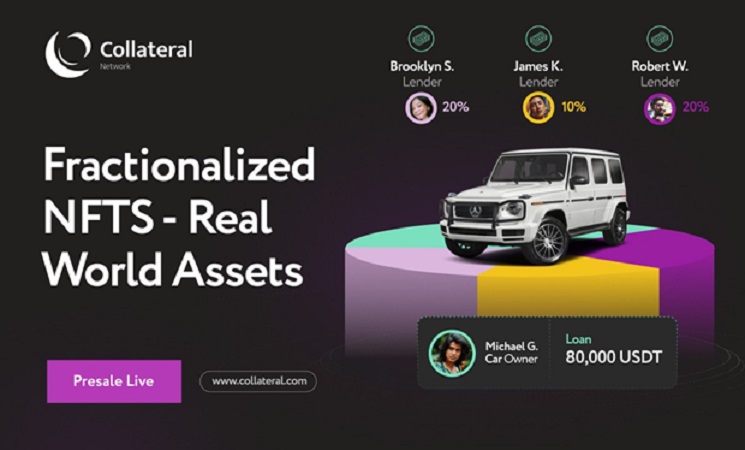

Collateral Network (COLT) is a blockchain-based lending platform that allows users to borrow against their physical assets. It’s the unique way that these assets are used as collateral that has led to its 40% gain during the presale phase. Cars, jewelry, fine art and even expensive bottles of wine can be used for a loan.

Collateral Network (COLT) tokenizes collateral into fractionalized NFTs that can be broken into smaller sizes and stored on the blockchain. This makes it easier for users to borrow against their physical assets, without having to deal with a bank or other financial institution.

With collateral broken into smaller pieces, different lenders can finance different parts of the collateral. This is a game-changer for the lending industry as now potential lenders aren’t locked out of the industry due to high minimum loan amounts.

Collateral Network (COLT) streamlines the process further with smart contracts that automatically execute the loan agreement, eliminating the need to wait for manual processing. Plus, with all loan information stored inside the NFT metadata, there is a transparent, auditable record of the loan agreement.

The COLT token is used as a means of exchange between all parties on Collateral Network (COLT). Plus, COLT holders receive the best borrowing rates, reduced fees, passive income staking, and more as Collateral Network (COLT) expands.

Analysts note that the unique use case of the COLT token and the fractionalization of collateral make Collateral Network (COLT) a game-changing product. If Collateral Network (COLT) can capture just a small chunk of the $800 billion peer-to-peer lending market, then its 40% gain during the presale phase will be only a fraction of what is yet to come.

Find out more about the Collateral Network presale here:

Website: https://www.collateralnetwork.io/

Presale: https://app.collateralnetwork.io/register

Telegram: https://t.me/collateralnwk

Twitter: https://twitter.com/Collateralnwk