In 2023, three cryptocurrencies are generating buzz among the community as potential investment opportunities. These are Collateral Network (COLT), VeChain (VET), and Algorand (ALGO). Of these, Collateral Network recently launched it’s presale offering investors the chance to grab COLT tokens before they reach the public exchanges.

The token is currently trading at $0.01 however experts believe this token could 35x by the time it launches on exchanges.

>>BUY COLT TOKENS NOW<<

Collateral Network (COLT)

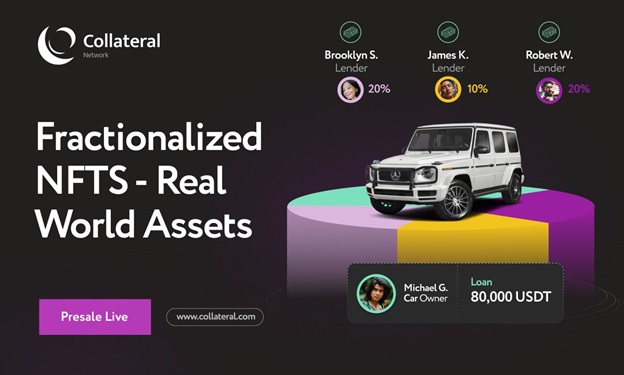

Imagine a lending platform that makes borrowing funds a breeze with physical asset like gold, diamonds, or real estate as collateral. That’s what Collateral Network (COLT) offers, but with a unique twist: it mints an NFTs that represents the collateralized asset.

When the NFT is minted it is then fractionalized into smaller pieces. This approach enables multiple lenders to fund the same borrower, improving liquidity and expediting loan approvals. Lenders on Collateral Network (COLT) benefit from lowered barriers to entry and potentially higher returns compared to other platforms and traditional lending routes.

Collateral Network (COLT) relies on smart contracts to manage every aspect of the lending process, from initiation to repayment. Collateral Network (COLT)’s automated system ensures all parties follow a predetermined set of rules, minimizing the likelihood of disputes between lenders and borrowers.

The native token of the platform, COLT, is used for transactions within the network. Holding COLT also comes with discounts on marketplace fees, staking rewards, and improved borrowing rates.

The Collateral Network (COLT) presale is currently underway, and investors interested in getting in early can do so at a discounted rate. With Collateral Network (COLT)’s unique approach to lending and its potential for growth, now may be the perfect time to invest in this exciting project before it officially launches.

VeChain (VET)

Already adopted by numerous industry powerhouses like DVN GL and PwC, VeChain (VET) demonstrates the promising potential for long-term growth.

Furthermore, with a recent sponsorship from the UFC, VeChain (VET) appears poised to capture mainstream attention and solidify its presence in the market.

VeChain (VET) is an innovative cryptocurrency project that leverages blockchain technology to revolutionize supply chain management and traceability systems for businesses. VeChain (VET) provides an array of services, including product lifecycle management, asset tracking, and anti-counterfeiting.

The VeChain (VET) platform is powered by two tokens: VET and Thor Power (THOR). VET acts as a form of value transfer within the VeChain (VET) network, while THOR is used to pay transaction fees and enable VeChain (VET)’s smart contracts.

By harnessing the power of VeChain (VET)’s technology, companies can acquire in-depth insights into their supply chain processes, leading to enhanced efficiency, reduced costs, and ultimately, greater profits.

>>BUY COLT TOKENS NOW<<

Algorand (ALGO)

Notwithstanding the advanced technology it offers, Algorand (ALGO) has faced difficulty in capturing the same level of enthusiasm as other digital assets in recent times. A primary reason for this is its underwhelming price trajectory; since its introduction in June 2019, Algorand (ALGO) has seen a decline of more than 90%.

Algorand (ALGO) stands as a groundbreaking, open-source blockchain network, designed to provide developers with the tools and environment to build decentralized applications (DApps) of the future.

Conceived by MIT professor Silvio Micali, Algorand (ALGO) uses a consensus mechanism dubbed Pure Proof of Stake (PPoS), which is revered for its ability to reach consensus quickly and securely without sacrificing decentralization.

The Algorand (ALGO) ecosystem is powered by its native token, ALGO, which plays multiple roles, from rewarding Algorand (ALGO) network participants to enabling staking, voting, and covering transaction fees on the platform.

Find out more about the Collateral Network presale here:

Website: https://www.collateralnetwork.io/

Presale: https://app.collateralnetwork.io/register

Telegram: https://t.me/collateralnwk

Twitter: https://twitter.com/Collateralnwk