Many questions on this topic from our Tekedia Institute learners. Very happy to share publicly here. During Live class on Saturday, I will discuss in detail via a presentation titled Investment Portfolios and Personal Economy, and next week, we will deepen the lecture with scenario mapping.

Yours truly will wear his ex-banking cap and doctorate in banking & finance over the next two weeks. After that, we will return back to engineering.

#PersonalEconomy with Tekedia Mini-MBA

Comment on Feed

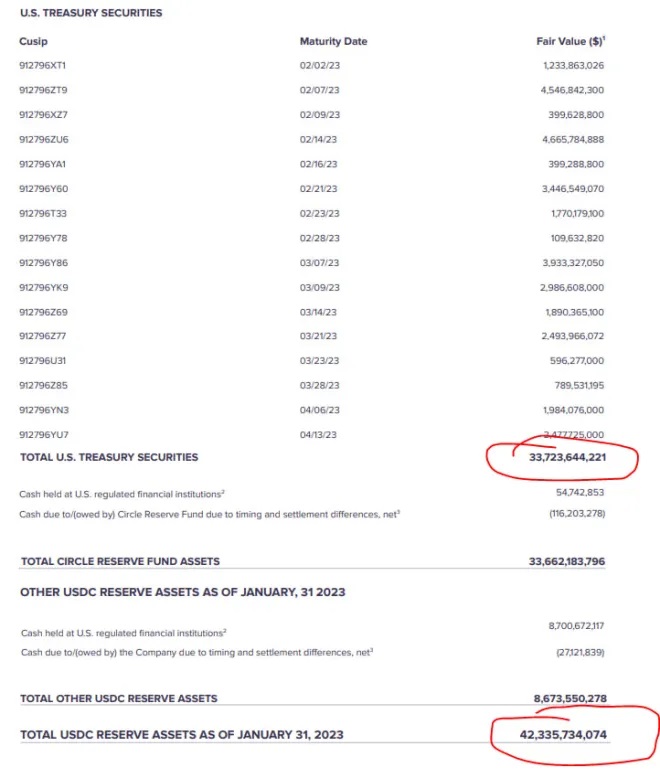

Comment: I have followed most of your postings on SVB and I think it can be added that as rates rises, future bonds cash-flows are discounted at higher rates which will make the price fall (hence the inverse relationship between bonds and interest rates) Also, the bank could have hedged their interest rates risk; when rates are rising, the ideal thing to do is to shorten duration. The market had expected Fed to raise rates long before they started to raise. I wonder what the bank’s asset & liability management were thinking-betting on fed not raising rates? Anyway just thought I should add that Keep up the good work

My Response: Great point but note another thing happened: startups were not raising money and decided to draw down from their money in the bank. That pushed SVB to look for capital, triggering the need to sell bonds before they could have liked to sell to boost liquidity. If the startups had not requested for their money, SVB would have just waited for a better time to sell.

On that video, I had a minor “mis-spoke” there. On the bond rate, I would have said bond price, not rate, on a sentence there.