American entrepreneur and venture capitalist Mark Suster has recently disclosed that several bad actors in VC (venture capital) led to the collapse of silicon valley bank.

Mark Suster who still rates the bank as one of the biggest banks in the U.S. despite its present financial crisis, disclosed that more people in the VC community need to speak out publicly to quell the panic about Silicon Valley Bank. He stated that he believes the biggest risk to startups AND VCs (and to SVB) would be a mass panic which would further compound more problems for the bank.

Mark disclosed that even though the bank announced that they were selling long-term investments at a loss and investing in higher-yield investments to improve their financial metrics, he took that at face value, and strongly believes that they would get things sorted out, but unfortunately, it has been followed by the widespread panic which led to the collapse of the bank.

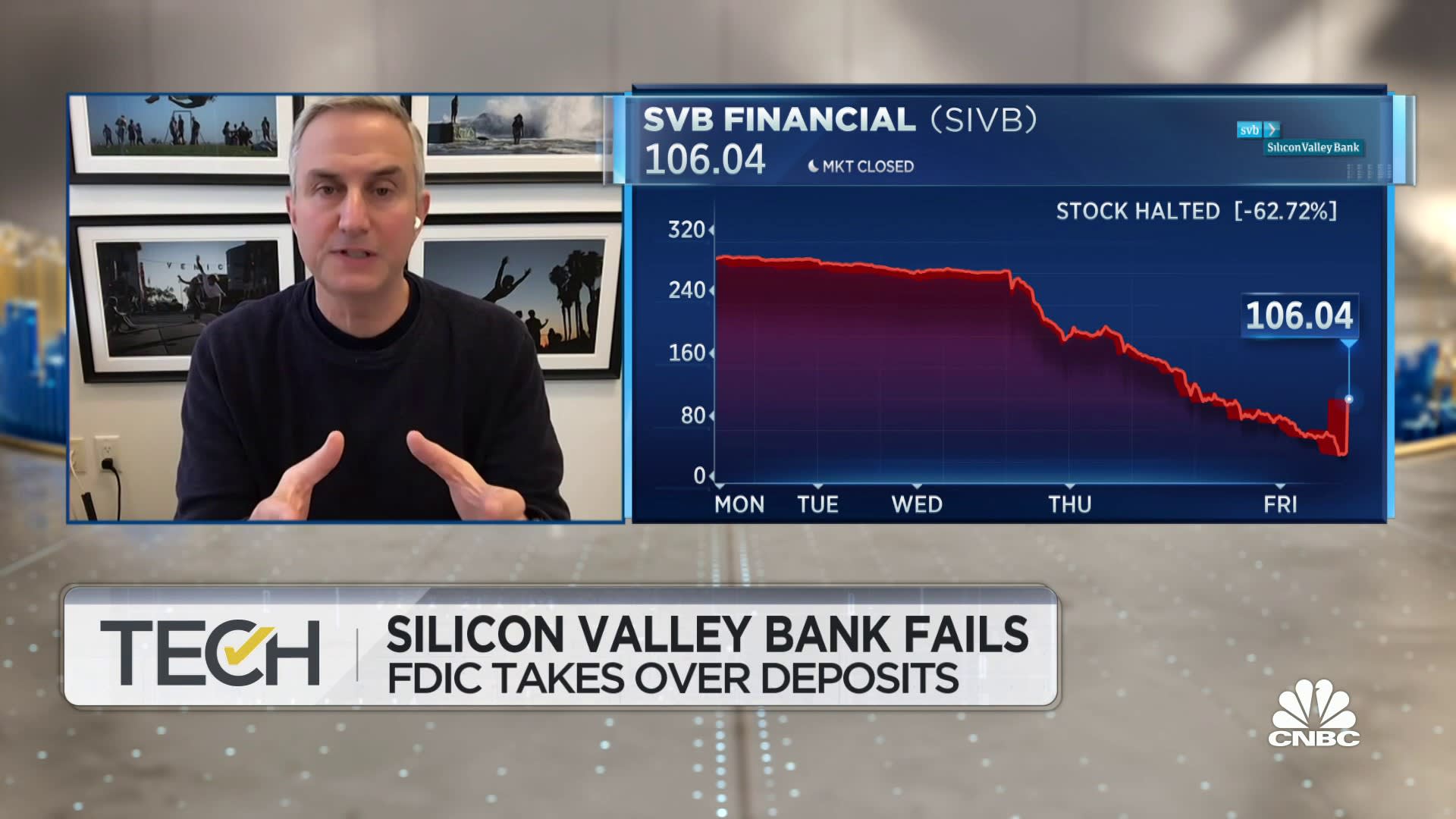

Within 48 hours, a panic induced by the very venture capital community that SVB had served and nurtured ended the bank’s 40-year run.

Mark who took to his Twitter handle to express his concerns via a thread wrote:

1/ More in the VC community need to speak out publicly to quell the panic about @SVB_Financial … I believe their CEO when he says they are solvent and not in violation of any banking ratios & goal was to raise & strengthen balance sheet

— Mark Suster (@msuster) March 9, 2023

“More in the VC community need to speak out publicly to quell the panic about Silicon Bank Valley. I believe their CEO when he says they are solvent and not in violation of any banking ratios & goal was to raise & strengthen balance sheet”

“They announced that they are selling long-term investments at a loss and investing in higher-yield investments that improve their financial metrics. They are raising $2.25bn to stabilize their balance sheet. But they say they are not insolvent & I take at face value”

“I believe the biggest risk to startups AND VCs (and to SVB) would be a mass panic. Classic “run on the bank” hurt our entire system. People are making public jokes about this. It’s not a joke, this is serious stuff. Please treat it as such”.

“I have founders contacting me saying “I heard XYZ firm is saying pull all your cash” but until such time as anybody has public statements or confirmed private statements I think you should at least be cautious about what is being said. Lots of innuendoes”.

“I believe SVB is one of the 20 largest banks in the US. I do not believe the US government would like to see them fail. I know it is NOT in the Tech & VC’s interests to see them fail. I believe they could only fail if everybody panics so I would urge calm decisions based on facts”.

“I know some have already withdrawn money. I know some are advising this. I know it’s scary. More VCs need to speak up. It doesn’t matter exactly what banking solutions are chosen – what matters is that we don’t have or create mass hysteria”.

“Finally, I believe (but can’t say for sure) that the timeframe for their funding round is 7-10 days (not months) and that GA is also backing SVB.”

He further added that if the market can avoid panic, he believes things would settle quickly, with the hope that that would be the case eventually.

Commenting on his Tweet, only very few users agreed with his point raised while several others quite disagreed with him.

@btc_banker wrote, “Businesses withdrawing their deposits are behaving rationally, given the hysteria. Nobody wants to be the calm one holding the bag.”

@robertmclaws wrote, “If you have more than $250k at any single bank then your money is at risk if the bank goes south. SVB is a bank for VCs, not for startups. I would question ANY VC that is not advising their companies to minimize their risk and protect their runway.”

@MalibuAlex wrote, “The biggest risk to any company is running out of cash. Not having access to money is the same as running out, which could happen if there’s a run. Since it’s easy to move the cash out of SVB – and that lessens whatever unknown risk there is, why not do that?”.

Silicon Valley Bank’s downward spiral began late Wednesday when it informed investors with the unpleasant news that it needed to raise $2.25 billion to shore up its balance sheet. This spurred customers to withdraw a staggering $42 billion of deposits by the end of Thursday. Meanwhile, those who remained with SVB face an uncertain timeline for retrieving their money.

Silicon Valley Bank’s failure is reported to be the largest since Washington Mutual went bust in 2008, a hallmark event that triggered a financial crisis that hobbled the economy for years.

The 2008 crash prompted tougher rules in the United States and beyond. Since then, regulators have imposed more stringent capital requirements for U.S. banks aimed at ensuring individual bank collapses won’t harm the wider financial system and economy.