It’s not surprising to anyone that the United States is the world’s leading superpower, from its dominant economy to its powerful military.

In the modern era, the international role of the US dollar is unrivaled.

There are over 180 currencies in circulation worldwide but only a handful play an outsized role in central bank foreign exchange reserves, finance, and international trade like the US Dollar (USD).

But how did the Dollar grow to become the principal reserve currency?

In this article, we’ll look at the USD’s journey to world dominance in the global trade space.

How the US Dollar Became Dominant in International Transactions and The Financial Markets

A reserve currency is a foreign currency held by central banks in substantial quantities.

It’s widely used to conduct international trade and financial transactions, eradicating the costs of settling transactions involving different currencies.

The US dollar has become the dominant currency in international transactions and financial markets for 5 main reasons:

1. The United States Has the Largest Economy in The World

Since the Dollar is used as the national currency for most international transactions involving the US, this gives the Dollar a unique level of liquidity and stability that other currencies lack.

Additionally, the US dollar is seen as a safe haven currency, meaning that investors often flock to it during times of economic uncertainty. Finally, the US government and central bank, the Federal Reserve, have a strong track record of maintaining the Dollar’s stability, which has helped to build trust in the currency and further cement its position as the dominant currency in international markets.

The United States dollar is the dominant currency in international transactions and financial markets due to its vast economy, with a gross domestic product (GDP) that is larger than the combined GDPs of the next three largest economies. This makes the Dollar a natural choice for many international transactions, as it is widely available and easily convertible into other currencies.

2. The United States Has A Stable Political System

This, along with a well-established system of property rights and contracts, makes it a safe and reliable place to do business.

This stability and predictability attract investors and businesses from around the world, who use the Dollar to buy and sell goods and services in the United States and abroad.

3. The United States Has A Large and Sophisticated Financial System

The US boasts a network of banks, investment firms, and other financial institutions capable of handling complex international transactions.

This financial infrastructure makes it easy for people and businesses to buy and sell dollars and to use them to make payments and investments around the world.

4. The United States Has A Long History of International Trade and Investment

For decades, the Dollar has been used in these transactions.

Over time, the Dollar has become a widely accepted and trusted currency, and many businesses and governments around the world have come to rely on it for their financial transactions.

5. The United States Has A Strong Military and A Dominant Position in Global Politics

This gives the United States a certain degree of influence and power in international affairs.

This has helped to reinforce the Dollar’s position as the dominant currency and has made it difficult for other currencies to challenge its dominance.

A Timeline of how the US Dollar Dominated the Global Trade Space

For most of the last century, the outstanding role of the USD in the global economy has been reinforced by the size and strength of the American economy, its stability and openness to trade and capital flows, the rule of law and strong property rights.

- The first documented use of paper currency in the US dates back to 1690 when the Massachusetts Bay Colony issued colonial notes.

- It wasn’t until 1776 that the first $2 bill was introduced—9 days before independence.

- 9 years later, in 1785, the U.S. officially adopted the dollar sign, using the symbol for the Spanish American peso as a guide.

- The government established the Office of the Comptroller of Currency (OCC) and the National Currency Bureau in 1863. These 2 agencies were charged with handling new banknotes.

- Centralized printing began at the Bureau of Engraving and Printing in 1869.

- The U.S. Treasury assumed the official responsibility of issuing the nation’s legal tender in 1890.

- The Federal Reserve Act of 1913 created the Federal Reserve Bank to respond to the unreliability and instability of a currency system that was previously based on banknotes issued by individual banks. This was the same time the U.S. economy became the world’s largest.

- Printing began a year after the establishment of the Federal Reserve as the nation’s central bank with the passing of the Federal Reserve Act in 1914.

- Countries pegged their currencies to the Dollar after WW1, ending the gold standard. The United States became the lender of choice for many countries that wanted to buy dollar-denominated U.S. bonds.

- Three decades later, the Dollar officially became the world’s reserve currency. Britain finally abandoned the gold standard in 1931, which decimated the bank accounts of international merchants who traded in pounds. By then, the Dollar had replaced the pound as the leading global reserve currency .

- In WW2, the United States served as the Allies’ main supplier of weapons and other goods. Most countries paid in gold, making the U.S. the owner of the majority of the world’s gold by the end of the war. This made a return to the gold standard impossible for the countries that depleted their reserves.

- WW2 reshaped the global financial system. When WW2 was coming to an end, global leaders started deliberating on a stable financial system for international transactions.

- In 1944, more than 700 delegates from 44 Allied countries met in Bretton Wood, New Hampshire, to devise a system to manage foreign exchange that would not disadvantage any country. The delegation decided that the world’s currencies would no longer be linked to gold but could be pegged to the U.S.

- Thanks to the Bretton Woods Agreement, the U.S. dollar was officially crowned the world’s reserve (global) currency and was backed by the world’s largest gold reserves. Instead of gold reserves, other countries accumulated reserves of U.S. dollars. The US fixed the value of the Dollar to gold at $35 an ounce.

- Other countries then fixed their exchange rate in tune with the Dollar, making it the central mode of exchange of the system.

- In the 1960s, the US started racking up huge deficits and running out of its gold reserves, and the government found it too expensive to maintain the promise.

- The Bretton Woods system of currency pegs had outlived its usefulness. Japan and Europe had rebuilt their economies, and growing consumer demand made fixed exchange rates unsustainable. This led to fears of a run that could wipe out United States gold reserves.

- By the early 1970s, countries began demanding gold for the dollars they held. They needed to combat inflation. Rather than allow Fort Knox to be depleted of all its reserves, President Nixon separated the Dollar from gold.

- This led to the floating exchange rates that exist today. The Dollar’s value was now set by a mishmash of economic and political forces, ranging from the frenetic buying and selling of traders worldwide to central bank decisions.

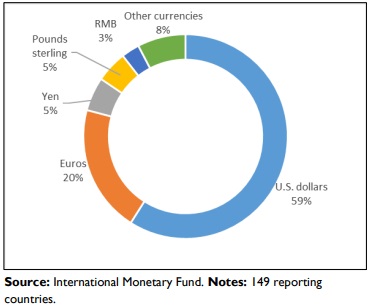

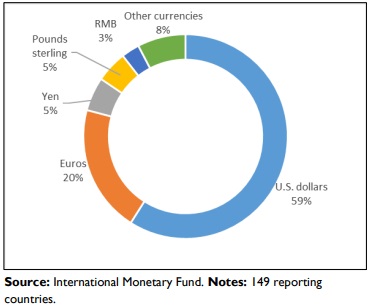

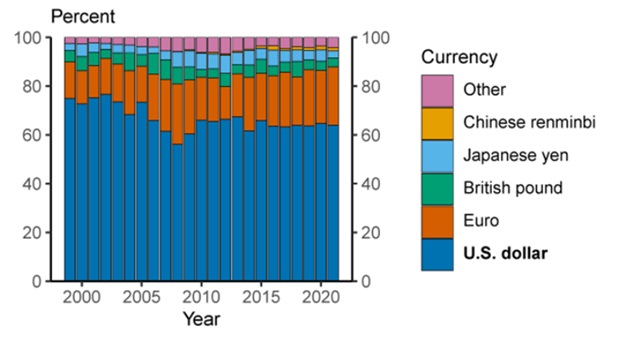

- According to the International Monetary Fund (IMF), the Dollar remains the world’s reserve currency today. Central banks hold around 59 percent of their reserves in U.S. dollars , more than double the collective foreign holdings of euros, renminbi, and yen. That makes it the de facto global currency, even though it doesn’t hold an official title.

- The Dollar has a huge footprint in offshore funding markets. Here, financial market participants obtain loans or raise debt in foreign currency. Over 60 percent of the world’s debt is issued in dollars, meaning foreign banks need a lot of dollars to conduct business.

- In 2015, The Economist revealed that the United States accounts for 12 percent of merchandise trade and 23 percent of the global GDP.

- In part because of its dominant role as a medium of exchange, the U.S. dollar is also the dominant currency in international banking.

- The relative strength of the U.S. economy supports the value of the Dollar. It’s the reason the Dollar is the most powerful currency . As of the end of 2020, the U.S. had $2.04 trillion in circulation.

- The dollar rules in the foreign exchange market. Approximately 90 percent of forex trading involves the U.S. dollar. The US Dollar’s dominance in global FX markets is generally linked to its use as a vehicle currency for forex transactions, meaning that non-US dollar currency pairs aren’t exchanged directly but via the Dollar.

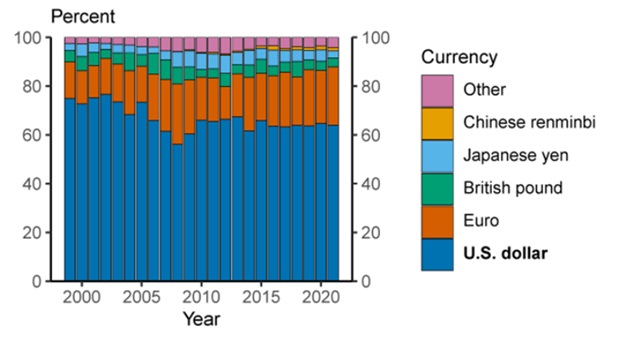

- Although there are many speculations that the US dollar will be dethroned by the Chinese Yuan, the general consensus is that the US dollar will remain the world’s global currency.

Will the US Dollar Continue to Dominate World Trade?

You may think that after holding the title of “the world’s most dominant currency” for so long and experiencing a series of events that negatively affected the US economy, the USD would be replaced. After all, no king rules forever.

It’s difficult to predict with certainty whether the US Dollar will continue to dominate world trade in the future.

Recent developments have the potential to enhance the international usage of other currencies.

Factors such as shifts in political and economic conditions, changes in the global monetary system, technological developments (e.g., crypto assets), and the increasing economic power of other countries could potentially lead to a decline in the Dollar’s dominance.

- The Rapid Growth of China

China’s GDP already exceeds United States GDP on a purchasing power parity basis and is expected to exceed United States GDP in nominal terms in the 2030s.

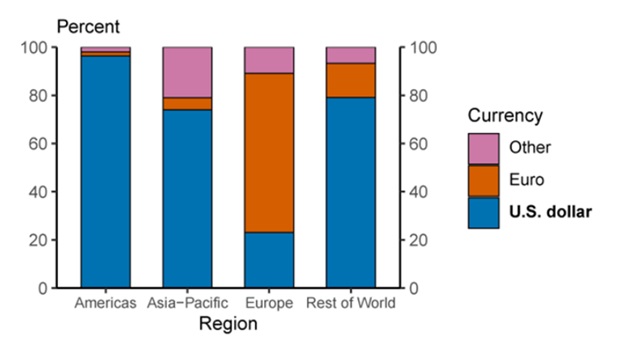

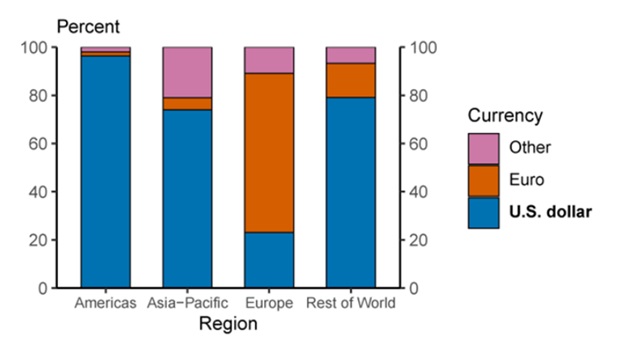

While the US dollar accounts for the lion’s share of international trade, a small subset of other currencies (renminbi, Euro, British Pound, Japanese Yen, and Swiss Franc) is also actively used in international trade alongside the U.S. dollar.

China has been working to internationalize its currency, the renminbi (RMB), to cut its dependence on the US dollar and assert more control over its own economy. Some economic experts believe that the RMB could eventually challenge the US dollar as a dominant currency in international trade.

However, many experts agree that the RMB will not overtake the Dollar as the world’s leading reserve currency anytime soon.

- The Race to Create Widespread Digital Currencies

Over the past decade, the private sector has developed thousands of cryptocurrencies over the past decade.

A cryptocurrency is a digital currency that uses cryptography for security. It’s decentralized and operates independently of a central bank or government.

While cryptos remain a small, volatile, and niche market, they have gained a significant amount of attention and investment in recent years. Some large multinational corporations like JP Morgan seek to create more stable digital currencies for use on a larger scale.

Central banks are also exploring the possibility of issuing their own digital currencies, which could also impact the future of the monetary system.

However, the diminution of the USD’s status seems unlikely in the near future. There has been only one instance of a predominant currency switching in modern history —the replacement of the British pound by the Dollar.

The US dollar still holds many benefits over other currencies, such as the stability of the US political system, the large size and liquidity of the US economy, and the depth of US financial markets. It’s also widely used as a reserve currency by central banks and international organizations.

Therefore, it’s unlikely that the US dollar will stop playing a major role in international trade in the near future.

Conclusion

Overall, the dominance of the US dollar in international transactions and financial markets is the result of a combination of factors, including the size and strength of the US economy, the stability of its political system, the sophistication of its financial system, its history of international trade and investment, and its military and political power. These factors have all contributed to making the Dollar the most dominant currency in the world today.

Like this:

Like Loading...