Since September 28, 2022, the candidates of the 18 political parties cleared for the 2023 presidential election by the Independent National Electoral Commission (INEC) have been campaigning aggressively using different platforms. From the digital sphere to the physical sphere, each candidate has informed Nigerians and is still engaging with them on programmes and policy agendas that would be implemented when he is elected as the new president on February 25, 2023. Like the previous presidential campaigns, where candidates dished out party manifestos using different techniques, the 2023 presidential candidates are not quite different in their adoption of words and terms that are elusive in their meanings and practicability.

The candidate of the All Progressives Congress, Senator Bola Ahmed Tinubu, has been promoting and marketing himself and the party with the message of “renewed hope.” Mr. Peter Obi, the Labour Party candidate, has largely campaigned using “Our Pact with Nigerians,” aiming to create a new Nigeria. Many have described him as the “new bird” and a “person with the potential of rewriting patterns of presidential election outcomes in Nigeria” because of his acclaimed youth-supportive movement across the country. Alhaji Atiku Abubakar, the candidate of the People’s Democratic Party, does not really see reason in changing his campaign message theme because contesting for the Office of the President is not new to him. For the 2023 presidential election, Alhaji Atiku Abubakar decided to use his 2019 policy document tagged “My Covenant with Nigerians.”

These candidates have used and are still using themes for building and creating divisions based on their use of an organised persuasive communication strategy that has elements such as fake news, misinformation, disinformation and purposeful manipulation of citizens’ religious interests and ethnic hegemony. For many citizens, who could not separate politics from personal and business relationships, discussing the candidates and their ideological differences has mainly consisted of exchanging severe banter as well as unnecessary criticism. Our analysis of several political-related interactions on digital platforms, especially Facebook, Twitter and WhatsApp, shows people are attacking personalities rather than addressing the issues and needs the candidates are promoting.

This is not new in a democratic setting. Other democracies in the global south, where Nigeria belongs, and the global north have experienced a toxic campaign environment like this. In the United States of America and the United Kingdom, for instance, many academics and think tanks reported how presidential candidates’ campaign strategies increased people’s toxic relationships and possible interest in considering suicide when their preferred candidates lost the election.

A recent poll in the USA noted that many Americans dropped friends and family members who have different political views. According to the poll, nearly one in five voters said political divisions hurt their relationships. This means that they felt unsupported, misunderstood, demeaned, or attacked. This, according to many scholars and established reports, may contribute to a toxic social environment that can lead to stress, depression, anxiety, and even suicide.

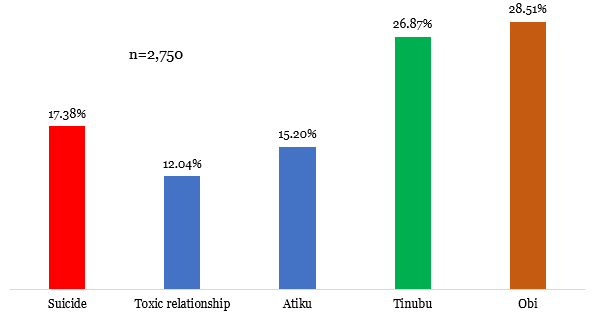

With this background insight, our analyst examines the interest of Nigerians who use the Internet to seek information about the candidates and the two issues (toxic relationships and suicide, one of the possible outcomes of toxic relationships) between September 28, 2022 and February 3, 2023. In terms of having interest in the candidates, our analysis shows that Nigerians developed more interest in Mr. Peter Obi and Senator Bola Ahmed Tinubu than Alhaji Atiku Abubakar when they (Nigerians) were considered within the campaigns and elections category of Google Trends. During the period, the interest in suicide was greater than the interest in toxic relationships. Further analysis reveals an 18.3% connection between toxic relationships and suicide, indicating that the more Nigerians engaged in conversations that were toxic during the period, the more they developed an interest in understanding suicide. In essence, an interest in toxic relationships led to more than 18 searches for suicide information.

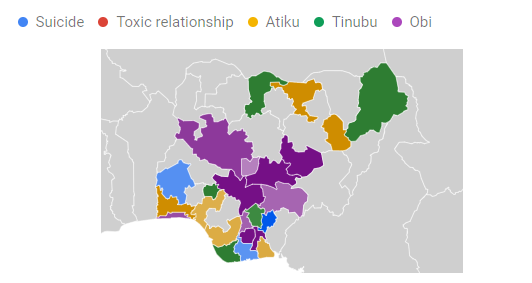

Exhibit 1: Public interest in candidates and two issues by state

The interest in the three candidates collectively accounted for 12.6% interest in suicide ideation and 17.2% interest in toxic relationships. Individually, having interest in Mr. Peter Obi was more determined by a toxic relationship (2.1%) than other candidates (Alhaji Atiku Abubakar = 0.4% and Senator Bola Ahmed Tinubu = 0.5%). Nigerians’ interest in suicidal ideation was more determined by their having an interest in Senator Bola Ahmed Tinubu (0.9%) and Mr. Peter Obi (0.5%) than Alhaji Atiku Abubakar (0.2%). These results suggest that mental health experts, family members and relatives of people who are having toxic conversations in the digital sphere and in various physical settings need to pay specific attention to them. They need to be comforted every time. This is primarily imperative for people in Ebonyi, Benue, Rivers, Oyo and Ogun States, including the Federal Capital Territory, where people significantly developed interest in the two issues (suicide ideation and toxic relationships) during the period of our analysis.

Exhibit 2: Position of candidates and the key issues relative to public volume of searches

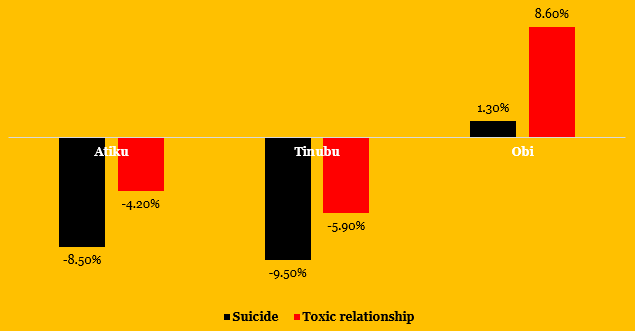

Exhibit 3: Connection of public interest in the two issues with candidates