Back in 2020, the world of game economies and metaverses was built on the foundations of a strong bull market. ImmutableX (IMX) and Axie Infinity (AXS) were among the biggest winners. The Axie Infinity project built an immersive game around an amazing incentive structure that powered its native token, AXS, by over 33,000%. Blockchain games began to thrive shortly after Axie and ImmutableX launched in 2022. ImmutableX (IMX) specialized in NFT card games and created a scalable marketplace on Ethereum. Soon, NFT trading on the platform gathered immense interest, and volume consistently set new highs. The price of its native token, IMX, surged from mere decimal points to $4 delivering thousands of times returns on capital. Snowfall Protocol (SNW) is building a platform that allows users to easily transfer these NFTs and other blockchain assets across several blockchains. The price trajectory does not mimic the previous runups of both AXS and IMX but will most likely exceed them.

ImmutableX (IMX)

As blockchain games grew popular in 2021, the ImmutableX (IMX) project rose to power more and more blockchains by building a gas-free marketplace for non-fungible tokens (NFTs). Most in-game assets are NFTs, so creating an all-in-one marketplace to trade them conveniently was a great idea. ImmutableX (IMX) is based on Ethereum but utilizes zero-knowledge scaling solutions to provide a scalable platform that can service the fast-growing decentralized gaming industry. As ImmutableX succeeded, so did its native token, IMX. The token price went as high as 2500x from its initial launchpad price in 2021. Now, it looks to continue in solid shape, up 75% within the past few days, and as blockchain games expand, IMX will surely be leading the charge heading into the year.

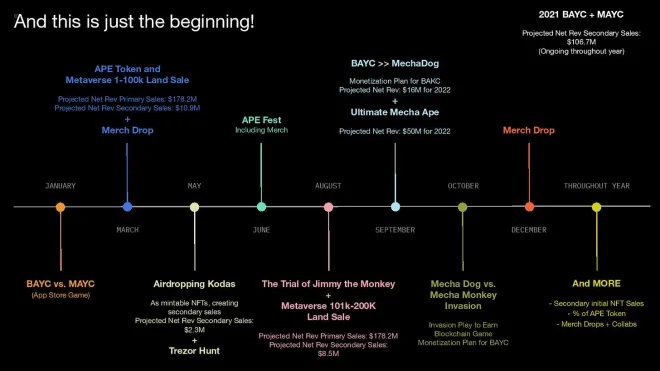

Axie Infinity (AXS)

In the middle of the pandemic, Axie Infinity (AXS) thrived in enormous user activity as people in third-world countries, mostly the Philippines and Malaysia, got their hands on the game as a means to earn passive income. Axie Infinity (AXS) is a blockchain game with alluring in-game economics that rewards users for playing and winning. The demand for its game grew to a point where it needed to leave the Ethereum blockchain and was forced to develop its blockchain – Ronin. The game’s token, AXS, faced huge demand pressure and easily breezed to over 30,000% ROI for investors. In 2023 as interest in blockchain games rekindled with metaverse enthusiasm, the AXS token was positioned as a frontrunner. Having risen 85% this year, this is merely the beginning.

Snowfall Protocol (SNW)

Snowfall Protocol (SNW) completes the holy trifecta of potential winners of the crypto market resurgence. Snowfall Protocol (SNW) was built in response to the need to bridge non-fungible tokens and fungible ones. This mechanism is based on the reorg of an asset’s base blockchain standard. This reorg works like a recalibration process with an API attached to the end to initiate the creation of the same asset on the destination blockchain. That enables the assets to be transferred swiftly with minimal fees.

The SNW token powers most of this process and will greatly benefit from the interoperability of blockchains to pump hard this year. Snowfall Protocol’s initial presale phases for SNW tokens sold out within hours of launch. The increased demand for Snowfall Protocol’s SNW tokens has also required the project team to do a final sale before the platform’s launch on February 3rd. These tokens are projected to sell out before then. Purchase some SNW tokens today!

get in while you can and invest in Snowfall Protocol (SNW) today!!!

Presale: https://presale.snowfallprotocol.io

Website: https://snowfallprotocol.io

Telegram: https://t.me/snowfallcoin

Twitter: https://twitter.com/snowfallcoin