January 17th, 2023, Sullivan & Cromwell (S&C) released some more information about FTX US. Some of this information was extremely helpful. They gave substantially more information on the assets that FTX US holds.

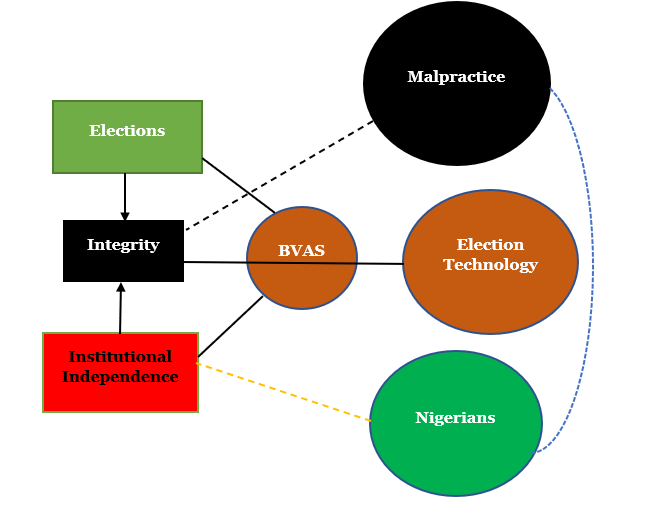

Some of what S&C released is extremely misleading. In particular, they write: “The assets identified as of the Petition Date are substantially less than the aggregate third-party customer balances suggested by the electronic ledger for FTX US.” And in a presentation, they said “Investigation has confirmed shortfalls at both International and U.S. Exchanges”.

These claims by S&C are wrong, and contradicted by data later on in the same document. FTX US was and is solvent, likely with hundreds of millions of dollars in excess of customer balances.

In the presentation that S&C formally filed on the Delaware Chapter 11 court docket, S&C failed to include $428m in FTX US’s bank accounts as an asset:

- $181m of digital assets, not including $428m USD in banks

- More than $181m of customer balances, including USD

- Thus, they concluded that FTX US had a “shortfall”

Later in the same report, S&C reveals that FTX US has an additional $428m USD in bank accounts, on top of the $181m of tokens—for roughly $609m of total assets.

Customer balances are likely around $199m, and certainly less than $497m (which they were a day earlier before massive withdrawals).

Thus FTX US had at least $111m, and likely around $400m, of excess cash on top of what was required to match customer balances.

FTX US is solvent. Customers should be given access to their funds.

Details

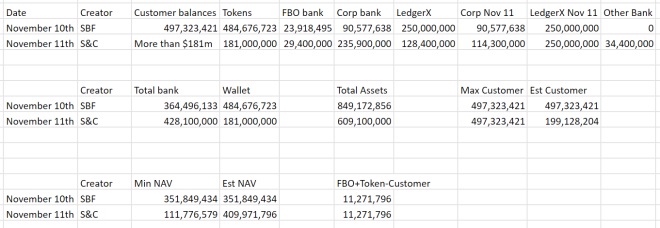

In my previous post, I outlined the last FTX US balance sheet we had created. This was created early in the morning on November 10th, 2022.

This balance sheet showed FTX US overcapitalized by roughly $350m.

As a contrast, S&C is now claiming that there is a “shortfall” at FTX US, where “the assets identified as of the petition date are substantially less than the aggregate third-party customer balances”. As far as I can tell, by “petition date” they mean November 11th, 2022. (November 11th is in fact the petition date for most entities, but not actually for FTX US; that was the 14th. You can tell they mean the 11th because they sequence this as happening before the hack late on the night of the 11th when they say “$90 million of which was subject to unauthorized third-party transfers post-petition”.)

That means that they’re using a snapshot about one day after mine, which means that while our net numbers should be similar, they are likely to find substantially lower asset and substantially lower customer balances that I did—as there were net withdrawals on November 10th.

A straightforward reading of S&C’s statements suggests they are making a large and basic mistake. They claim that “the FTX Debtors have identified approximately $181 million of digital assets associated with FTX US as of the Petition Date”. “Digital assets” isn’t defined, but one might interpret it to include tokens but not bank balances. They go on to say that “The assets identified as of the Petition Date are substantially less than the aggregate third-party customer balances suggested by the electronic ledger for FTX US.” ‘The assets’ is not defined, but it would be reasonable to suspect it’s the same asset class as referenced above—which is to say, potentially only tokens and not cash. ‘Third-party customer balances’, on the other hand, does not specify anything about non-USD balances, and so one could imagine it referring to full customer balances, including USD. If both of those guesses were true, their statement would merely be saying that full customer balances, including USD, were larger than digital wallet assets, excluding bank balances, and that the “shortfall” might simply be customer balances that are fully backed by dollars in one of FTX US’s bank accounts—not a real shortfall at all.

This does in fact seem to be the mistake they made. They claim there were “$181m of digital assets” on November 11th. As of November 11th, FTX US Derivatives (LedgerX) had $250m in a segregated bank account, meant to eventually be used as regulatory capital if the futures margin proposal were to be approved. $250m > $181m, so we can prove that, in fact, the $181m does not include bank balances.

And a graphic confirms this: that the whole $181m ended up in either a hot wallet, BitGo cold storage, or hacked. In other words, digital tokens.

So we can confirm that they are not including bank balances as part of “the assets”, and are then comparing “the assets” to “customer balances” (including customer USD balances). It’s a meaningless comparison!

We can do more here, though, because they gave out more info in the slide deck.

$428m! That’s $428m of cash in bank accounts that S&C failed to include when they determined there was a ‘shortfall’ based on $181m of assets.

There are a few nuances here. The bank balances they quote show $128.4m in LedgerX. That likely means it was taken after they transferred some money from LedgerX to FTX US (possibly to cover the FTX US hack); given that I think there was previously $250m in LedgerX, they likely moved roughly $122m or so over. It’s not exactly clear to me what “Other Restricted Cash” means. My calculations are all prior to the $88m hack; so as of today, maybe things are $88m worse. And finally, there seems to be roughly $34m in corporate bank accounts of other subsidiaries that aren’t part of the Chapter 11 process.

Anyway—here’s what I get, comparing my records to S&C’s presentation.

The presentation and press release don’t actually say what customer balances are, but by claiming that FTX US has $181m of digital assets and also has a customer shortfall, S&C is implying that customer balances are greater than $181m. They’re almost certainly less than $497m—what they were a day earlier—given the withdrawals in between. So that gives two bounds on what it could be. My best guess comes from looking at changes in FBO bank accounts and tokens. In theory those two should be at least equal to customer balances; in the balance sheet on the 10th, FBO + tokens were roughly $11m greater than customer balances. “Max Customer” and “Min NAV” make the conservative assumption that somehow customer balances were still $497m on the 11th; “Est” makes the reasonable assumption that [FBO + Token – Customer Balances] stayed constant at $11m between the two days. Or, in other words: if nothing unusual happened on November 10th, the $298m decrease in FTX US’s custodial assets would imply a $298m decrease in customer balances, both stemming from $298m of customer withdrawals.

That would imply that customer balances were roughly $199m. Anyway, this is a long way of saying: I had estimated roughly $350m more cash on hand than customer balances required (NAV). Using the extremely conservative estimates, their presentation implies a NAV of roughly +$111m, and using the more reasonable estimate you get a NAV of +$409m—pretty close to my number.

All of which is to say: one way or another, their data actually confirms that FTX US was extremely likely to be solvent when I handed it off, with at the very least $111m of excess cash; it also implies that my estimate of +$350m excess cash was probably roughly correct, though there isn’t enough information to actually prove that

S&C claims that FTX US has a shortfall. That claim is false. Based on S&C’s own data provided in the same court presentation, FTX US had roughly $609m of assets ($428m USD in bank accounts, plus $181m of tokens) backing roughly $199m of customer balances. FTX US was solvent when it was turned over to S&C, and almost certainly remains solvent today.