What if the next life-changing cryptocurrency investment is already live and unfolding before everyone’s eyes? Meme coins, once dismissed as jokes, have flipped the script and become some of the most explosive performers in the digital asset space. Communities rally behind them, memes fuel momentum, and overnight millionaires are made. From Shiba Inu’s legendary run to the rise of fresh tokens like Brett, Gigachad, Just a Chill Guy, Pudgy Penguins, Bonk, and now MoonBull, the meme coin era is far from over.

MoonBull shines among the best cryptos to watch in 2025, standing out not just because of hype but because of real, structured opportunities for investors. While Brett and Bonk thrive on their raw community energy and Shiba Inu still holds a historic crown, MoonBull enters the field with powerful features, high ROI potential, and a presale that is already generating urgency. This article explores why MoonBull could be the next big crypto star, alongside other meme coins that are expected to dominate 2025.

1. Stake Big, Refer Smart: MoonBull’s Dual Reward System

MoonBull shines among the best cryptos to watch in 2025 because it delivers utility alongside hype. At Stage 10 of its presale, MoonBull unlocks 95% APY staking, allowing holders to grow their tokens without complications. With no minimum staking amount, participants can lock their tokens directly from the dashboard, earning rewards from a dedicated pool while retaining control of their assets. Rewards are calculated daily, making this system accessible, flexible, and powerful for anyone looking to build passive growth.

But that’s only half the story. MoonBull also introduces a referral system that feels like a game-changer. When someone joins using your referral, they instantly receive 15% extra tokens, while you pocket 15% of their purchase. To supercharge this model, the top referrers receive USDC bonuses every month, 10% for leaders and 5% for runners-up, distributed instantly with no manual claiming required. With 8.05 billion tokens allocated specifically for referrals, MoonBull builds community loyalty while rewarding those who spread the word. It’s simple, lucrative, and transparent, qualities that crypto whales and everyday investors can’t ignore.

MoonBull Presale Ignites: Early Access to Explosive Gains

The MoonBull presale is live now, and it’s already making waves across the top meme coin presale charts. With 23 stages mapped out, every stage pushes the price higher, and the window to grab tokens at ground-floor levels shrinks by the day. Stage 3 tokens were launched at just $0.00004057, with each subsequent stage increasing by 27.40%. By the time it lists at $0.00616, the ROI from Stage 1 to listing stands at a jaw-dropping 24,540%. To put that into perspective, a $200 purchase made early would have returned nearly $49,280 at listing. Numbers like these don’t come around often, and that’s why MoonBull is being called the MoonBull’s next big crypto play.

The presale hype in September–October has become an event in itself, with early access, exclusive presale bonuses, and limited supply driving urgency. Missing out on this phase means walking away from one of the highest ROI meme coins of 2025. MoonBull shines among the best cryptos to watch in 2025 because it isn’t just selling tokens, it’s offering entry into a movement before whales tighten their grip.

2. Brett: The Underdog with Momentum

Brett has emerged as one of the strongest community-driven meme tokens of 2025. Built around relatable internet humor and meme culture, Brett captures the kind of grassroots energy that often sparks viral growth. The project thrives on simplicity, making it easy for new investors to engage without confusion. Brett continues to ride waves of engagement across X and Telegram, demonstrating that humor combined with tokenomics can transform an underdog into a heavyweight. Brett earns its spot on the best meme cryptos 2025 list because of its consistent traction and loyal backers.

3. Gigachad: The Meme of Strength

Gigachad is more than just a meme; it’s a cultural symbol of dominance, confidence, and resilience. This crypto captures the idea of strength in the digital age, channeling internet culture into a project with growing investor backing. Its branding alone creates instant recognition, and its presence in the top upcoming presales discussions shows that investors are paying attention. Gigachad’s combination of cultural relevance and meme appeal secures its place as one of the top meme coins to join for long-term gains.

4. Just a Chill Guy: Relaxed but Effective

In a market often defined by hype and volatility, Just a Chill Guy offers a refreshing change. The project positions itself with a calm, community-first approach, which appeals to investors seeking a more laid-back vibe without sacrificing potential. Behind the lighthearted branding lies a growing, engaged base that has kept momentum alive. With increasing chatter on crypto forums and meme spaces, Just a Chill Guy is proving that even relaxed projects can deliver strong results. That’s why it comfortably lands in the best meme cryptos 2025 list.

5. Shiba Inu: The Legacy Giant

Shiba Inu remains one of the most influential meme tokens of all time. Known as the Dogecoin killer, it sparked a wave of meme coin adoption and continues to command massive market activity. With its ecosystem expanding through Shibarium and strong global community support, Shiba Inu continues to set benchmarks for meme projects everywhere. Even though it’s no longer the cheapest buy, its enduring popularity makes it impossible to overlook in any best meme cryptos 2025 list.

6. Pudgy Penguins: Cute but Profitable

Pudgy Penguins began as a beloved NFT collection and has evolved into a broader ecosystem that combines memes, collectibles, and crypto rewards. With partnerships and mainstream cultural references boosting visibility, Pudgy Penguins has proven that cuteness and profitability can align. Its fan-driven growth shows resilience and adaptability, giving it a lasting edge among meme-themed assets. This combination makes it one of the top meme coin presale mentions worth noting.

7. Bonk: The Solana Star

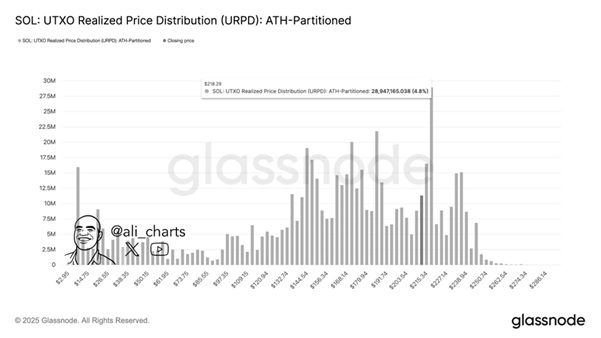

Bonk became the first meme token to explode within the Solana network truly, showcasing both the chain’s speed and the power of meme culture. With high trading volumes, strong liquidity, and an ever-expanding community, Bonk has grown from a niche experiment to a serious contender. Its ability to maintain relevance in a fast-moving market has made it a prime choice among low-cap meme coin gems. Bonk has proven it belongs on the list of the best meme cryptos of 2025 by staying both fun and profitable.

Conclusion: MoonBull’s Presale Is the Game Changer

Based on the latest research, MoonBull stands out among the best cryptos to watch in 2025, alongside Brett, Gigachad, Just a Chill Guy, Shiba Inu, Pudgy Penguins, and Bonk. Each coin carries its own story, but the MoonBull presale stands out with its dual reward system, presale hype, and explosive ROI potential.

The fact that the presale is now live and surging in its early stages creates an opportunity that investors rarely see twice. The stage-by-stage growth, exclusive presale bonuses, and high staking rewards position MoonBull as not just another meme coin but as the top meme coin presale that could deliver massive 2025 gains. Missing this wave means missing what could be the most lucrative presale of the year. The most brilliant move for anyone seeking 100x potential presales is to act now, before MoonBull’s listing makes headlines.

For More Information:

Website: Visit the Official MOBU Website

Telegram: Join the MOBU Telegram Channel

Twitter: Follow MOBU ON X (Formerly Twitter)

Frequently Asked Questions about MoonBull Presale

What makes MoonBull different from other meme coins?

It combines 95% APY staking with a lucrative referral system, creating real utility.

Is the MoonBull presale live right now?

Yes, it’s already live and moving quickly through its 23 stages.

How high is the ROI potential for MoonBull?

From Stage 1 to listing, it’s projected at 24,540%.

Glossary of Key Terms

APY: Annual Percentage Yield, the yearly return from staking.

Presale: Early sale of tokens before official listing.

Referral System: A program that rewards users for inviting others.

Liquidity: Ease with which tokens can be bought or sold.

Listing Price: The initial market price when a coin launches on exchanges.

Article Summary

Meme coins continue to dominate the crypto spotlight, and 2025 looks set for another explosive year. Among Brett, Gigachad, Just a Chill Guy, Shiba Inu, Pudgy Penguins, and Bonk, MoonBull shines among the best cryptos to watch in 2025. With its 95% APY staking, referral system, and a presale already live, MoonBull offers rare chances for both passive growth and explosive returns. It’s 23-stage presale promises up to 24,540% ROI from the first stage to listing. For investors seeking the next big crypto gem, MoonBull’s combination of utility and hype sets it apart from every other meme coin today.

Like this:

Like Loading...