Market turbulence has many investors living on edge. Bitcoin is at annual lows. Ethereum is struggling to rise and fan favorites like Polygon continue to decline. But the crypto space isn’t all doom and gloom.

New projects like BONK and Orbeon Protocol are bringing a refreshing change to the market, rising in value and offering huge returns for investors. Here’s why experts predict both projects will have massive gains in 2023.

>>BUY ORBEON TOKENS HERE<<

Orbeon Protocol Defies The Status Quo With Huge Returns

At first glance, the market for DeFi applications appears somewhat saturated. Every new project promises to be the next big thing, only to deliver substandard results and poor investor returns. Orbeon Protocol is changing this, having already surged in price during its presale. So how does it stand out from the crowd?

Orbeon Protocol offers a unique launchpad that revolutionizes startup investing. It opens the crowdfunding industry up to everyday investors, and lets exciting new startups raise funds without relying on large venture capitalists or banks.

The Orbeon Launchpad works by using NFT technology. Startups create NFTs representing equity in their business and sell these directly to investors. Each NFT is fractionalized, meaning investors can buy a small share of an NFT for as little as $1.

Orbeon Protocol has already experienced an exponential price increase during its presale, with the price of ORBN, its native token, increasing from $0.004 to $0.0435 since October 2022.

As well as benefiting from this price increase, ORBN holders also earn a range of bonuses, including staking benefits, early access to investor rounds, voting rights, and access to a private VIP investor club called the “Winners Circle.”

Security plays an extremely important part in the project, with various comprehensive security measures in place. For example, new ventures are extensively vetted before they can release NFTs. The token liquidity pool is also locked for 10 years, and team tokens are locked for one year and will be released quarterly to prevent any risk of a rug pull.

The Orbeon Protocol smart contract has also been fully accredited by Solid Proof. Finally, on the Orbeon Launchpad, a unique “fill or kill” mechanism delivers full recompense should a startup miss its targets.

With so much to offer as well as an ecosystem consisting of a swap, exchange, decentralized wallet, and even a Metaverse, the value of ORBN is expected to rise exponentially in 2023.

>>BUY ORBEON TOKENS HERE<<

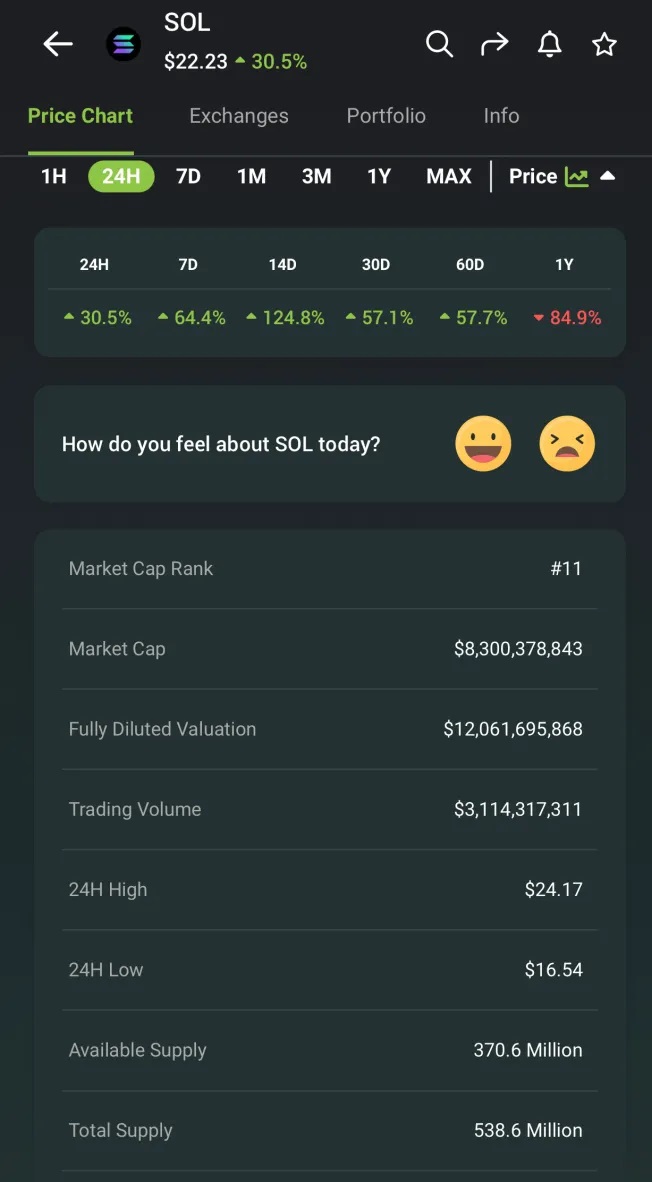

BONK Experiences a 983% Increase In Four Days

BONK shocked the 2022 crypto market upon release on December 25th, rising 983% in value in just four days. It’s the latest memecoin to make headlines, having 50% of its supply airdropped to Solana NFT holders.

Despite many new memecoins struggling to gain traction, BONK quickly caught on and already has several partners such as Orca, Solend, Raydium, and the Famous Fox Federation.

The project was created to give all investors a “fair shot” in the market, as some investors believe crypto has been monopolized by whale investors. BONK is currently available on Uniswap, though with so much potential, it’s expected to be available on additional exchanges by the end of January.

Find Out More About The Orbeon Protocol Presale

Website: https://orbeonprotocol.com/

Presale: https://presale.orbeonprotocol.com/register

Telegram: https://t.me/OrbeonProtocol