The incessant cases of Nigerian entertainers refusing to show up at the last minute or showing up late for events they have been billed to perform is getting out of hand.

The entertainers should know that when they are billed to perform they have entered into a legally binding contract for service and they are expected to carry out the requirements and contents of such contract to the last detail, if not they can be held for breach of contract.

Nigerian A-list musicians are notorious for breaching terms of contracts; they will be paid to perform in a concert and they will show up late and sometimes refuse to even show up at all after they have pocketed the money they were paid.

Some of them even boast that they will refund the money they were paid, little do they know that refunding the money for the service you were paid and you didn’t render is not all there is in ameliorating breach of contract; after you have refunded back the money, you will have to as well pay for damages your breach caused to assuage the damage you have done.

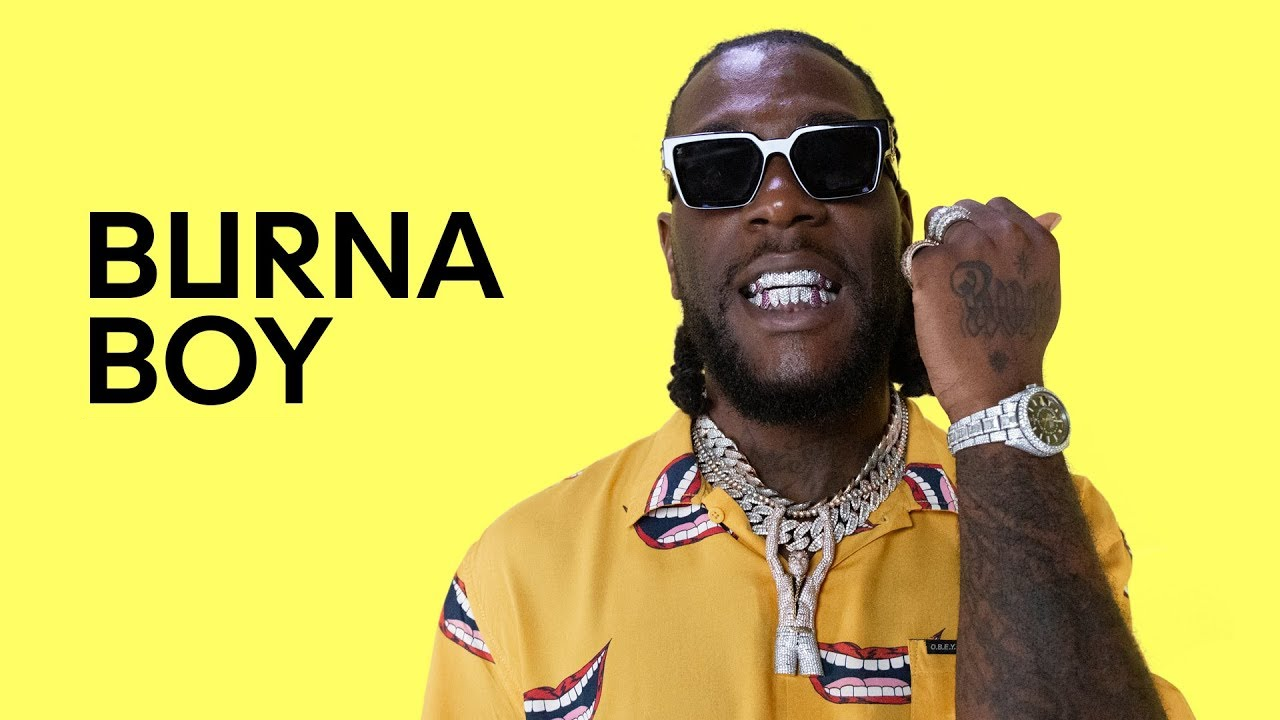

Burna Boy in his New Year, Lagos Loves Damini Music Concert showed up several hours late and thereby breached the contract. Wizkid some weeks back also breached his contract by refusing to show up for a show he was paid to headline in Accra, Ghana without an apology or explanation. Kizz Daniel some months ago as well breached his contract when he refused to perform in Zanzibar after he had been paid and flown to the venue by the organizers of the show.

This is now looking like a trend amongst A list Nigerian musicians; Enter a contract with show organizers and promoters, agree to the terms, sign the contract paper, collect payment for the service and on the day of the performance they breach the contract by either showing up late or refusing to show up at all.

What then is a contract for service?

A contract for service is an agreement between an employer and an employee where one party who is the employer hires the other party who is the employee to render some services. In a contract for service, an independent contractor, such as a self-employed person or vendor, is engaged for a fee to carry out an assignment or project.

A contract for services is formal and legally binding and every party to the contract is expected to live up to the contract terms and perform what is expected of him or he can be sued for breach of contract.

A contract for a live performance or singing or recording a song is a contract for service and it is a formal contract, when an artiste has been paid and he had agreed either orally or in writing to perform, he is expected to perform to the satisfaction of those that employed him to render such service if not he will be sued for breach of contract.

Legal advisers and lawyers to Nigerian entertainers need to be letting those entertainers know this because ignorance of the law is never an excuse.