Nigeria’s labour market has recorded a significant concentration of employment opportunities in a few key sectors, while new signs of growth are emerging in digital and health-related industries. Fresh data from Hotnigeranjobs, a leading job listing platform covering the last two months, highlights how education, government and consulting dominate recruitment, yet it also points to promising momentum in information and communication technology, healthcare, and energy.

The education sector accounted for the single largest share of job listings, recording 4,315 openings during the two-month period. This means that more than one in every four jobs advertised came from teaching, training or related educational activities. The result is not surprising given the growing demand for teachers and trainers across schools, vocational institutions, and private academies. In addition to formal schooling, the expansion of digital learning and community training initiatives has created further opportunities. Analysts expect this trend to continue, although growth will be steady rather than explosive as schools respond to the pressures of enrolment and government budgets.

Government ministries and agencies followed closely with 3,293 advertised vacancies. These postings reflect the ongoing recruitment drives across public services and the expansion of administrative capacity in areas such as health, infrastructure, and regulatory oversight. While such recruitment tends to move in cycles linked to political decisions and budgetary allocations, the public sector remains one of the country’s largest and most stable employers. Stakeholders note that demand for skilled graduates in administration and project management continues to be strong.

Consulting, recruitment and human resource services ranked third with 2,187 vacancies. This industry plays a central role in Nigeria’s labour market as it supports other sectors in finding and managing talent. Its expansion is often a mirror of broader employment trends. When total job creation rises, consulting and recruitment firms tend to see increased activity. Current figures suggest that these firms are benefiting from high demand for placement services across both private and public organizations.

Banking and financial services contributed 1,525 jobs. While this remains a major employer, growth is relatively modest compared to technology and healthcare. The sector is stable but increasingly shaped by digital transformation as fintech companies expand and traditional banks upgrade their platforms. Analysts expect modest gains rather than dramatic increases in postings from this sector over the short term.

Healthcare and medical services recorded 1,178 advertised roles. This figure places the sector among the fastest growing, driven by rising investment in hospitals, clinics, and specialist care. Shortages of skilled health workers are also driving employers to expand their search. International organizations and donor-funded programs further reinforce recruitment demand. This combination means healthcare is one of the sectors expected to record a sharper increase in postings in the coming six months.

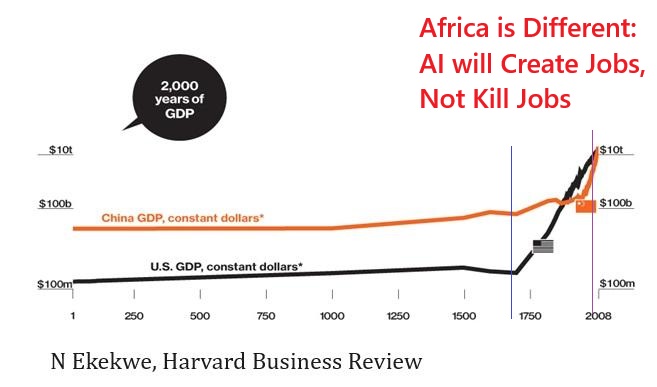

Information and communication technology services and software contributed 921 jobs. This figure may appear smaller than that of education or government, but the pace of growth is stronger. As businesses digitize operations and as fintech, cybersecurity, and artificial intelligence solutions gain traction, recruitment in ICT is forecast to expand by as much as 25 percent in an optimistic scenario. Training and capacity-building in digital skills are therefore critical priorities for government and private actors alike.

Manufacturing, production and fast-moving consumer goods accounted for 1,252 listings, while energy and power contributed 607. Both sectors are important for Nigeria’s economic diversification. Manufacturing is benefiting from consumer demand and regional trade initiatives, while energy recruitment is increasingly linked to renewable power projects and the need for technical experts in distribution. Stakeholders view both areas as strong mid-tier employers with potential for growth.

By contrast, oil and gas recorded 584 jobs. Although still important to Nigeria’s economy, its share of new job postings is modest compared to service-oriented industries. Future hiring will depend heavily on global energy prices and domestic investment decisions. Low-volume categories such as creative arts, sports, and professional bodies remain niche and are unlikely to contribute substantially to overall employment in the near term.

In the next six months, our forecasts suggest that education will continue to provide the largest number of jobs, though its growth will be gradual. Government hiring is likely to remain stable with slight increases tied to new budget cycles. Consulting and recruitment services will rise in line with overall labour activity. ICT and healthcare are expected to record the most rapid growth, with ICT driven by digital transformation and healthcare by workforce shortages and investment in infrastructure.

Our analyst notes that acquiring digital skills, health-related qualifications, or training expertise can open doors in the fastest-growing fields. Policymakers need to prioritize skills development in ICT, healthcare, and renewable energy while also maintaining support for education. Employers in slower-growth sectors such as oil and gas may face greater competition for skilled workers, while consulting firms will continue to shape hiring across industries. For investors and NGOs the opportunities lie in education technology, healthcare infrastructure and energy transition programs that create jobs as well as services.