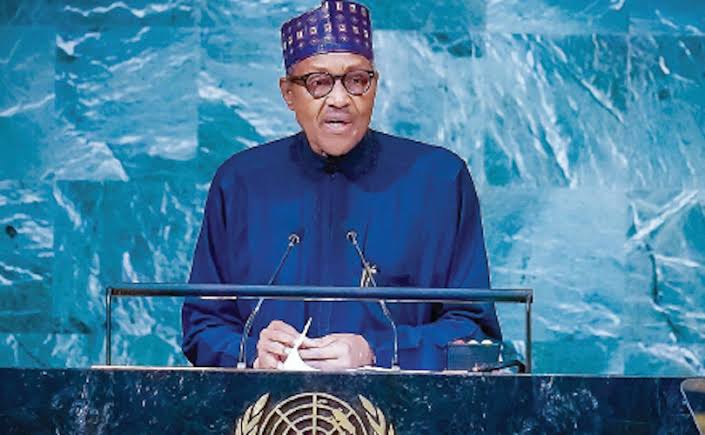

By Muhammadu Buhari

Part of my nation is underwater. Seasonal flooding is normal in Nigeria, but not like this. Thirty-four of the country’s 36 states have been affected. More than 1.4 million people have been displaced.

Together with drought-driven famine in the Horn of Africa, cascading wildfires across the North and wave upon wave of intensifying cyclones in the South, climate disasters in Africa form the backdrop to this year’s U.N. Climate Change Conference (known as COP27) in Egypt.

Many of my peers are frustrated with Western hypocrisy and its inability to take responsibility. Governments have repeatedly failed to meet their commitments to the $100 billion fund for climate adaptation and mitigation in the developing world — for the mess their own industries caused. According to the United Nations, Africa is the continent worst affected by climate change despite contributing the least to it. Even though the COP27’s agenda notes the need for compensation for loss and damages (as distinct from adaptation and mitigation funding), that demand has mostly been met with silence in the West.

Amid this simmering acrimony, I offer a few words of advice to Western negotiators at this year’s COP27. They should help the West avoid exacerbating what the U.N. secretary general has called “a climate of mistrust” enveloping our world. Some of the global south’s demands seem obvious. But experience of the recent past suggests they need to be reiterated.

First, rich countries should direct a greater share of funding to developing nations’ adaptation to the effects of climate change. Most financing currently flows toward mitigation projects, such as renewable energy projects, that reduce emissions. While such projects have their uses, far more money needs to go to helping Africa adapt to the effects of climate change — which seems only fair for a continent that produces less than 3 percent of global emissions.

Africa urgently needs investment in adaptation infrastructure — such as flood prevention systems — to stave off the disasters that destroy communities and cripple economies.

Second, don’t tell Africans they can’t use their own resources. If Africa were to use all its known reserves of natural gas — the cleanest transitional fossil fuel — its share of global emissions would rise from a mere 3 percent to 3.5 percent.

We are not the problem. Yet the continent needs a reliable source of power if it is to pull millions of citizens out of poverty and create jobs for its burgeoning youth population. Africa’s future must be carbon-free. But current energy demands cannot yet be met solely through weather-dependent solar and wind power.

Don’t tell Africa that the world cannot afford the climate cost of its hydrocarbons — and then fire up coal stations whenever Europe feels an energy pinch. Don’t tell the poorest in the world that their marginal energy use will break the carbon budget — only to sign off on new domestic permits for oil and gas exploration. It gives the impression your citizens have more of a right to energy than Africans.

Third, when you realize you need Africa’s reserves, don’t cut its citizens out of the benefits. In the wake of the Ukraine war, there has been a resurgence of interest in Africa’s gas. But this impulse is coming from Western companies — backed by their governments — who are interested only in extracting these resources and then exporting them to Europe.

Funding for gas that benefits Africa as well as the West is conspicuously lacking. At last year’s COP, Western governments and multilateral lenders pledged to stop all funding for overseas fossil fuel projects. Without these pools of capital, Africa will struggle to tap the gas needed to boost its own domestic power supply. Consequently, its development and industrialization will suffer. Donor countries don’t believe in the developing world exploiting its own hydrocarbons even as they pursue new oil and gas projects within their own borders.

Western development has unleashed climate catastrophe on my continent. Now, the rich countries’ green policies dictate that Africans should remain poor for the greater good. To compound the injustice, Africa’s hydrocarbons will be exploited after all — just not for Africans.

Fourth, follow your own logic. Africa is told that the falling cost of renewables means that it must leapfrog carbon-emitting industries. At the same time, Western governments are effectively paying their citizens to burn more hydrocarbons: Lavish subsidy packages have been drawn up to offset spiraling energy bills. Meanwhile, Africa is the continent closest to being carbon-neutral. It reserves the right to plug holes in its energy mix with the resources in its ground — especially when they will make almost no difference to global emissions.

The Western countries are unable to take politically difficult decisions that hurt domestically. Instead, they move the problem offshore, essentially dictating that the developing world must swallow the pill too bitter for their own voters’ palates. Africa didn’t cause the mess, yet we pay the price. At this year’s COP, that should be the starting point for all negotiations.

Like this:

Like Loading...