In Tekedia Capital, I push our founders NEVER to ignore a web strategy in Nigeria and broad Africa. Despite the broad slogan which posits that Africa is mobile-first (yes, build mobile apps before anything) and in extended case mobile-only, if you look at the real data without the US-influenced slogan, Africa is not mobile-first when you move away from social media.

From our data which drives our investment model, when your product is not Facebook, Instagram, TikTok and the like, the struggle to find space in many African smartphones becomes harder. People use social media daily and that means they can install the apps. But apart from social media, what else do we use daily that requires most Africans to budget storage spaces in their limited storage-capacity-phones?

If you use it once a week, why must it be installed as a mobile app when you can use the web app (i.e. browser-based) and get the same thing done? For most Nigerians and Africans, once Facebook and Instagram have taken their positions, the phone has limited spaces to accommodate other apps. What happens is clear: even the bank apps lose out because social media apps have taken their positions!

And the big one, for companies, who want to run a company with mobile-only fintech solutions? Would the app be installed in the accountant’s mobile phone or the CEO’s or who? But in Nigeria, you have many fintechs which do not offer web apps.

Those companies are making big mistakes since most companies will NEVER allow company financial assets to be accessed via personal mobile phones (or company-issued mobile phones). What they do is to have dongles which are locked to dedicated laptops or desktops for security. If you do not have web apps, those companies cannot be your customers.

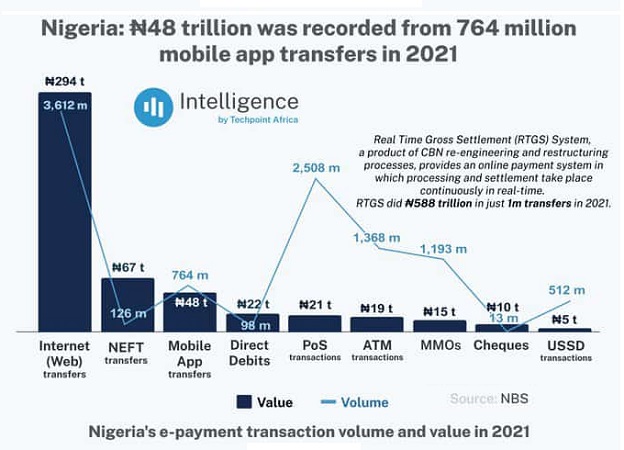

Yes, when you see those startups which offer only mobile apps without web apps, run away from them because they do not understand what moves markets. According to government data, the total value of web apps transfers was N294 trillion naira (against mobile apps’ N48 trillion) over 3.6 billion (mobile did 764 million) transactions in 2021. This shows clearly that a web app strategy will deliver great value and under no account must you be fixated on mobile apps, neglecting the most important channel which drives growth.

Feedback On Feed

Comment #1: Valid points Prof , Ndubuisi Ekekwe. I’m curious about the breakdown of the Web data. It seems that most of the merchant transactions which are routed through processors ( Flutterwave, Paystack, etc.) bind to that data point even if it’s mobile web. And then the transactions through banking apps bind to the Mobile app data point.

I was looking at the NBS sheet earlier today, it didn’t give any other details on how the data were categorized.

My Response: certainly, a mobile web transaction is web (both are done via browsers). And most of those web transfers are done via smartphones. But mobile web transactions are different from mobile-app transactions. My point is that most startups do not even give you the option to use your browser (web-based) to access their products unless you install their mobile apps.

… A browser based transaction on your phone is web-based (not mobile app). So, most of those web transactions are done with smartphones. NBS did not say smartphone transactions. You can do web transactions on phone, desktop and laptop. But you can only do mobile-app transactions on phone.

Comment 1b: This is true, and the fact that most Startups track the Number of downloads as their most important metric adds to the pitfall.

Comment #2: True that Prof ![]() When one wants to make heavier transactions and a call for more security – some Apps will prompt that you finish the setup/transaction over the web. And because people still go on web to search, research and review, such people could easily be asked via digitally tracking and mapping of their interests, and suggestively made to take a decisive action immediately on the web

When one wants to make heavier transactions and a call for more security – some Apps will prompt that you finish the setup/transaction over the web. And because people still go on web to search, research and review, such people could easily be asked via digitally tracking and mapping of their interests, and suggestively made to take a decisive action immediately on the web