Decentralized finance (DeFi) is tipped to be the next big thing in the cryptocurrency and blockchain technology arenas.

Most of these DeFi coins are expected to blow up in the next foreseeable future. And this has caught the attention of every future-focused investor – many of whom are actively looking for the best DeFi coins to buy at the current dip.

You too should consider stacking up a few of these highly promising crypto assets. And to help you get started, we will tell you about the 10 best DeFi crypto coins to buy today and where to buy them. We will also provide you with a step-by-step guide to buying them on the all-popular eToro exchange.

Let us get right to it.

Put simply, the phenomenon refers to projects that aim to provide traditional financial services – such as loans, savings accounts, and asset exchanges, but without requiring a third-party intermediary.

In this guide, we analyze the best DeFi coins to buy today so that you can enter the decentralized finance space while it is still in its infancy.

>>>Buy DeFi Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Best DeFi Coins to Buy Right Now

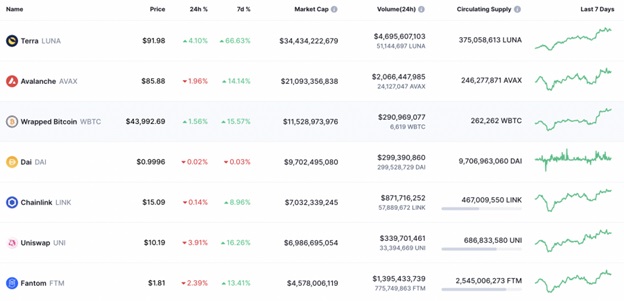

Though relatively new, the DeFi niche is home to hundreds of well-performing DeFi altcoins. We reviewed the majority of these and identified 10 best DeFi coins of what we believe to be the most promising.

- Uniswap (UNI) – Overall Best DeFi Coin To Buy

- Aave (AAVE) – Best Multi-Chain DeFi Project To Buy And HODL

- Maker (MKR) – Best Eth-Based Lending DeFi To Invest in

- Compound (COMP) – Best Staking and Lending DeFi Protocol

- Loopring (LRC) – Decentralized Exchanges Protocol With A Popular Promising Crypto

- SushiSwap (SUSHI) – Popular DEX With A Promising And High Performing DeFi Coin

- Finance (YFI) – Best DeFi Aggregator Platform With Low Token Supply

- Curve Finance (CRV) – Popular DeFi Marketplace For Stablecoins With A Massively Popular Coin

- Kyber Network (KNC) – Best Liquidity Aggregation And Provision Platform

- Bancor (BNT) – Pioneer DeFi Protocol With Ultra-Competitive APRs

Want to know what makes these DeFi coins unique and why they made it to our list of best DeFi coins to invest in? Read on.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk

A Closer Look At The 10 Best DeFi Tokens To Invest in

When vetting the different DeFi cryptos and coming up with the index for top DeFi coins to buy today, we looked at more than just their past price action.

We looked at the sustainability of their platforms, their mission, support from the crypto community, their resilience, and their potential for future value gains.

Ultimately, we settled on the following 10 DeFi coins. Read on to discover why you too should consider adding them to your list of top DeFi crypto.

1. Uniswap (UNI) – Overall Best DeFi coin to buy

Uniswap is the most popular decentralized exchange. It has attracted more than 3 million users and has processed trades worth more than $1 Trillion in the last three years. It is also one of the most valuable DeFi protocols with a market cap of $4 Billion and more than $7 Billion in total value locked. And we consider it the overall best DeFi coin to buy right now not only because it has strong fundamentals but also because it has a massively promising future.

Our analysis of the larger crypto-verse indicates a growing interest in DEXs and a need to diversify incomes among long-term crypto investors. The privacy crusaders no longer want to be associated with centralized crypto exchanges that can withhold their crypto assets or share their trading information with authorities. The rest want to earn passive incomes by staking and providing liquidity.

Uniswap provides real answers to both these challenges, which explains its blowing popularity. This is especially evidenced by the growing number of traders registering accounts with the DEX. The number of digital wallets holding UNI tokens has also been on the rise. But more significantly, Uniswap is now integrated into 300+ crypto-based programs.

We expect Uniswap’s popularity to continue rising in the foreseeable future. A move that will most certainly catapult UNI token prices to new heights – as high as $250 by 2030 (representing a 5000% value gain) – further confirms why UNI is the best DeFi coin to buy today.

>>>Buy UNI Now<<<

Virtual currencies are highly volatile. Your capital is at risk

2. Aave (AAVE) – Best Multi-Chain DeFi Project To Invest in

Started as ETHLend in 2017, Aave is one of the oldest DeFi platforms around. It was born out of the need for a decentralized and highly flexible savings and lending platform in the crypto-verse. It was the first crypto lending platform to support non-collateralized crypto loans. The platform’s popularity among crypto investors has also been on the rise. But so has investor interest in AAVE, especially after the tokens rallied by 3000%+ in early 2021.

But these aren’t the only reasons why we consider Aave the DeFi token to invest in. We feature it here because it has a massively promising future. Given the rising global inflation and contracting interest on savings, we expect to see more individuals flocking the platform in search of higher interest on savings and flexible loan terms. And given its squeezed supply of only 16 million AAVE tokens against this growing investor interest in both the lending platform and the altcoins, we expect it to report a sizable value gain in the future.

We also observe that Aave has the third-largest total value locked – in excess of $5 Billion – and that it is a multi-chain protocol. It has already deployed on such large blockchains as Fantom and Avalanche and is expected to launch on more in the foreseeable future.

And all these, plus a recovering crypto market, a revived DeFi craze, and AAVE’s resilience are expected to help catapult the token prices to inconceivable heights by the turn of the decade. Optimists are, for instance, confident that AAVE token prices could rally by more than 6000% to top $3500 – which is yet another confirmation that Aave is the best DeFi crypto to buy in the current dip.

>>>Buy AAVE Now<<<

Virtual currencies are highly volatile. Your capital is at risk

3. Maker (MKR) – Best Eth-Based Lending DeFi to Invest in

Maker is one of the oldest and most popular and one of the most valuable DeFi lending protocols. It is also home to the all-popular DAI stable coin and was among the first decentralized platforms to embrace DAO oversight.

MKR, on the other hand, is the utility and governance token for the platform that currently has the highest total value locked – more than $8 Billion. We feature it among the best DeFi coins to buy because of its proven resilience and promising future.

For starters, it has been around since 2017. This implies that it survived the longest crypto winter yet – between 2018 and 2020. It also survived some of the most turbulent crypto market crashes in 2021. And it also looks poised to overcome the contracting crypto market and escape current dips.

Maker’s massive popularity and wild acceptance by the crypto community are expected to catapult its token prices. By the turn of the decade, analysts are confident that it could rally by more than 4000% to break above $40,000.

Other factors that we believe will help Maker’s value gain include its limited supply of 1 million MKR tokens against an undying demand, a recovering crypto market, and a revived DeFi Craze. And they all add to the reasons why you too should consider adding MKR to your list of best DeFi coins to buy today.

>>>Buy MKR Now<<<

Virtual currencies are highly volatile. Your capital is at risk

4. Compound (COMP) – Best Staking and Lending DeFi Protocol

Compound is a leading crypto ending and stalking platform that lets you earn interest on staked ETH and ERC tokens. It also lets you take out loans against the staked crypto at a highly competitive rate and with flexible repayment periods. It has received massive reception from the community.

This has helped keep COMP altcoins on a sustained uptrend even in the current market dip. It has also helped it grow its market cap to peak at $4.4 Billion and expand the total value locked on the platform past $3 Billion – making it the 6th Most valuable DeFi protocol on DeFi pulse. And we rank it this high among the best DeFi coins to buy because we are confident that Compound will continue advancing these gains in the future.

We also feature it here because we believe such factors as a growing number of Compound platform users, a recovering crypto market, a revived DeFi craze, and increased investor interest in COMP tokens to help ignite the token’s next price run. Not forgetting that COMP tokens have already proved their resilience and that they already are listed with virtually all the most popular crypto trading platforms.

If you add it to your index of best DeFi crypto to buy and invest in the token today, you stand to potentially grow this investment by 5500%+ when COMP token prices eventually break above $2500.

>>>Buy COMP Now<<<

Virtual currencies are highly volatile. Your capital is at risk

5. Loopring (LRC) – Decentralized Exchanges Protocol With a Popular Promising Crypto

Loopring is an open-sourced and hybrid decentralized exchange protocol. It makes it to our list of best DeFi coins to watch primarily because it bridges the gap between centralized and decentralized exchanges – hastening the adoption of DEXs.

It is a decentralized platform that promises to marry the efficiency of centralized exchanges and the transparency of decentralized exchanges, effectively knocking down the biggest barrier to the adoption of DEX exchanges yet.

Three other factors informed our decision to include Loopring here; first, it appeals to a growing trend in the crypto community and hastens the adoption of DEXs. Secondly, Loopring is multi-chain and can be hosted on Ethereum, NEO, and QUANT blockchains.

Lastly, Loopring is more than a DEX, it is a protocol on which other – equally powerful – DEXs can be built. And all these are geared toward increasing their usefulness and the use cases for the LRP tokens – which is important if they are to sustain their current value gain.

You too may consider adding LRP tokens to your list of best DeFi cryptos to buy in the current dip because its popularity has been on the rise. Furthermore, it has proved its resilience, and a recovering crypto market, as well as growing adoption of crypto technology, are all expected to continue fueling its value gains.

>>>Buy LCR Now<<<

Virtual currencies are highly volatile. Your capital is at risk

6. SushiSwap (SUSHI) – Popular DEX With a Promising and High Performing DeFi Coin

SushiSwap was the first and most successful Uniswap hard fork. It too has grown in popularity owing to its innovative approach to the decentralized exchange world – characterized by deep liquidity, fast order execution, and competitive earnings on continued liquidity.

Its fork received a massive welcome from the crypto community, evidenced by the fact that more than $1 Billion worth of crypto was moved to its liquidity pools in the first few days of launch. This launch even forced Uniswap to hurriedly launch the UNI tokens. Further, there is a massive interest in the DEX protocol and it was the best DeFi crypto to buy at the time.

But while everything seemed to work for the DEX, its pseudonymous founder – Chef Nomi – cashed out his SUSHI tokens in what was interpreted by the crypto community to be an exit scam. It rocked Sushiswap’s boat, the total value locked here shrunk, and SUSHI token prices crashed.

So why should you consider adding the SUSHI token to your list of top DeFi coins to buy right now?

For starters, Chef Nomi has since returned these assets and surrendered leadership of the DEX protocol to the level-headed Sam Bankman-Fried – the founder and CEO of the FTX exchange. Additionally, liquidity is moving back to the DEX, SUSHI token prices have begun recovering, and community interest in the brand is also on a steady recovery.

You would, therefore, want to be part of this Sushiswap rebirth. In fact, some optimists estimate that current SUSHI token hodlers will most likely grow their portfolio by 6000%+ when the DeFi coin prices tear above $60 by 2030.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk

7. Yearn.Finance (YFI) – Best DeFi Aggregator Platform With Low Token Supply

We include Yearn.Finance among the best DeFi coins to buy in the current dip for two reasons. First, it is a popular and revolutionary cryptocurrency with a history of stellar performance. It has sustained an overall positive ROI since its launch – having peaked more than 10000% above its introductory price during the early 2021 market rally. Secondly, it has one of the lowest maximum token supply – capped at 36,666 YFI – which based on its growing popularity will help keep its token prices on an uptrend.

In addition to these, we have identified three more reasons why you too should consider Yearn.Finance a top DeFi coin to buy today. First, it let you earn passively via competitive interest rates when you stake your coins on this platform. Secondly, you get to borrow against your staked crypto in a seamless process, at competitive interest rates and with flexible repayment periods.

Even more importantly, you can consider it the best DeFi crypto to buy. It is estimated that it will grow your portfolio by unbelievable rates in the future. The majority of analysts in the crypto market have, for instance, said that they expect YFI token prices to top $400,000 by the turn of the decade, which would mean close to 7000% value gains for you if you buy the token today.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk

8. Curve Finance (CRV) – Popular DeFi Marketplace for Stablecoins With a Massively Popular Coin

Curve Finance is a unique decentralized exchange given that it specializes in the trade of stablecoins. At the time of writing, it is selling at a 95% discount (from its all-time high) and well below its introductory price. But we still feature it among the best DeFi coins to add because of its immensely promising future.

After losing more than 90% of its introductory price within its first two months of launch, for instance, Curve proved its resilience and recovered much of this during the 2021 market rally. And this tells us that it is only trading at these lows because of the ongoing market contraction. That it will bounce back at the first chance of market recovery.

We must also observe that investor interest in the DeFi platform hasn’t dwindled, even with the beaten-down CRV token prices. It still has the 5th largest volume of cryptos locked to its platform – according to DeFi pulse. And continues to partner with both on- and off-chain brands – with the most recent being the partnership with Compound Finance to launch a DeFi lending platform.

All of these have us convinced that CRV token prices will have a fast rebound with analysts expecting them to rally by 4000%+ and hit $40 by 2030.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk

9. Kyber Network (KNC) – Best Liquidity Aggregation and Provision Platform

Kyber Network addresses the biggest challenge facing the DeFi sector – fragmentation. Now that every developer seeks to set up their own DeFi protocol, liquidity for the majority of DeFi coins has been spread thinly across multiple protocols – which forces most active traders and large volume traders to a centralized exchange.

Kyber Network, however, addresses this by coming up with a decentralized protocol that aggregates liquidity from different DeFi protocols. This gives traders access to deep liquidity at the most competitive rates. This has already endeared Kyber Network to a majority of crypto traders and investors whose interaction with the platform and the KNC token have helped it sustain the current uptrend.

We consider it the best DeFi coin to buy today because we expect it to continue drawing in users who continue driving its token prices up. In addition to users, other factors that we believe will help drive KNC token prices up include the rising adoption of crypto technology, its proven resilience, and a revived DeFi craze. And in the next 10 years, these all are expected to have helped KNC token prices rally by more than 6500% to break above $90.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk

10. Bancor (BNT) – Pioneer DeFi Protocol With Ultra-Competitive APRs

Bancor is a top 10 DeFi protocol with close to $2 Billion in total value locked according to DeFi Pulse. Started in 2017, it is one of the longest-running DeFi technologies and some have christened it the pioneer DeFi protocol.

Bancor is also massively popular within the crypto community and the confidence that it will most likely leverage popularity to turn its fortunes around is one of the reasons we consider it the best DeFi coin to buy today.

You too should add to your list of top DeFi coins to invest in today because; first – it promises higher than average returns on staked coins (as much as 60% interest on select coins). Secondly, it is the only DeFi protocol that protects its investors against impermanent losses. Lastly, it helps grow your portfolio.

Between now and the turn of the decade, for example, analysts are confident that BNT tokens have whatever they need to rally their current prices up by more than 10000% to break above $50.

>>>Buy BNT Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Are DeFi Coins Good Investments?

DeFi coins are great investments today because they are a relatively new niche in the ever-expanding cryptoverse. Both technical and fundamental analysts are massively optimistic about the future of the niche and individual cryptocurrencies securing different protocols here.

They are expected to blow up during the next market rally and sustain this uptrend in to the future – especially if the heightened global political tensions, contracting economies, and rising inflation persist.

Here are more reasons why our analysts and the majority in the crypto community believe DeFi coins are great investments:

- Many are low priced: The majority of DeFi coins available today are competitively priced – often selling for pennies. They, therefore, present you with an excellent entry point to crypto investing and portfolio diversification.

- Lucrative to early adopters: The majority of DeFi coins are also relatively new or simply having their popularity blow. They have sustainable protocols that promise to be massively lucrative for early adopters when they eventually blow.

- Promising future: Everyone is confident that DeFi token prices will continue rising and that the niche has a promising future, which makes them even more appealing to long-term crypto investors.

- >>>Buy Cryptos Now<<<

- Virtual currencies are highly volatile. Your capital is at risk

Where To Buy DeFi Investments

The majority of these DeFi coins have blown in popularity. As a result, they have been listed in virtually all the most popular crypto trading platforms. But if you are looking for the best places to buy DeFi Coins today, we recommend going for one of the following crypto exchanges:

- eToro – Best for beginners. eToro has a straightforward account registration process, a seamless buy process, and even integrates social and copy trading tools.

- Coinbase – Best place to buy DeFi coins instantly. Coinbase is deeply liquid, operates an intuitive trading interface, and lists a wide range of DeFi coins.

- Binance – Best place to buy DeFi coins at low trading fees. Binance lists the widest range of DeFi coins and their trading pairs, its massively liquid, and insures the client’s digital assets held in its vaults.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk

How To Buy DeFi Coins Today – Step-by-Step Guide

Want to just buy DeFi coins but aren’t sure where to start? We recommend following this step-by-step guide that teaches you how to buy the best and cheapest cryptos today including DeFi coins on the all-popular eToro crypto exchange.

Step 1: Register a crypto trader account with eToro

Start by opening the official eToro website and hitting the “Join Now” button. A user registration form will pop up. Complete it by entering your basic personal information and telling the exchange of your income sources and level of trading experience.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Step 2: Verify identity

To complete the registration process, the multi-regulated broker will ask that you verify your identity by uploading a copy of your government-issued identification document.

Step 3: Fund the account

Proceed to log i-n to the now-approved eToro trader account and on the user dashboard, press “Deposit.” This will reveal a funding tab that lists all the payment options available to you based on your country of residence. Choose one and follow the prompts to complete the deposit – noting that the minimum you can deposit into eToro is $10.

Step 4: Search for the DeFi coins

Once the deposit reflects in your trader account, hit the “Discover” button on the user dashboard. Choose “Crypto” from the list of supported asset classes and look up the DeFi coin to buy from the list of cryptocurrencies supported on the platform.

Step 5: Buy DeFi coins

Click the “Buy” option against the preferred DeFi coin to bring up the trading menu. Use it to customize the trade by indicating the number of tokens you wish to buy or the amount of cash you wish to spend on the trade. Then click on the “Open Trade” button to complete the purchase.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Conclusion – Best DeFi Coins to Invest in

DeFi coins are promising to be the best big thing. Their niche is relatively new and the majority of analysts expect it and the associated crypto coins to post galactic gains in the foreseeable future.

To help you take advantage of these portfolio-bulging gains, we have come up with what we consider to be the 10 best DeFi coins. We have even gone over why they stand out and how high up they are expected to reach over the next few years.

But more importantly, we have told you of the best places to buy these DeFi coins. And concluded by providing you with a step-by-step guide on how to buy DeFi coins on the all-popular eToro trading platform.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk

FAQs

What is a DeFi coin?

DeFi coins refer to all the cryptocurrencies linked to the Decentralized Finance niche. Most are the native tokens for the many DeFi protocols and programs around.

Which is the best DeFi coin to buy today?

Our analysis indicates that Uniswap could be the best DeFi coin to buy right now. But we also provide you with a list of nine other equally promising DeFi coins that we believe will perform exemplarily well in the future.

Are DeFi coins a good investment?

Yes, DeFi coins are a good investment because the niche is currently in its infancy stage and still enjoying massive hype from the crypto community. All these are expected to help rally DeFi coin prices.

How do I buy DeFi coins today?

Start by registering a crypto trader account with a reputable crypto exchange that lists DeFi coins – like eToro. Deposit funds herein, choose the DeFi coins you would like to buy, and initiate the buying process.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk