Shiba Inu is the most popular meme coin in the world today. The Dogecoin killer has proven to be much more than just some joke coin. As it attracts investors, many are trying to decipher the Shiba Inu coin price prediction and the prospects for the asset going forward.

Below, you’ll get to find some expert opinions on the Shiba Inu price prediction and where the market sees the asset going in the next few years

Asking yourself big questions about Shiba Inu (SHIB) price forecasts? Like, ‘is Shiba Inu worth buying’?

>>>Buy Shiba Inu Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Shiba Inu Price Prediction – Overview

Listed below are forecasts on the Shiba Inu Price for the foreseeable future. We discuss the following points:

- End of 2022: Shiba Inu remains one of the most undervalued coins on the market today, and its growing community is still an asset. With SHIB growing as a payment method, we expect to see it push for the $0.000035 price level.

- End of 2023: Investors should see more functionality for Shiba Inu. The digital asset will be a critical part of both the Shibverse and ShibaSwap, and these use cases could help drive it to $0.000060.

- End of 2025: The rise of ShibaSwap and its metaverse in 2025 will massively increase the demand for Shiba Inu taking the SHIB asset to a new top price of $0.000850.

- End of 2030: The expanding Shiba Inu ecosystem can push SHIB to further highs of up to $0.00290 in 2030.

>>>Buy Shiba Inu Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Shiba Inu Price History

Historical Shiba Inu (SHIB) Price Movements

Analyzing the past performance of a cryptocurrency is one of the most important steps to take if you’re looking for the top cryptos to invest in, so let’s take a look at how the price of Shiba Inu SHIBA Inu has changed in the past. CoinMarketCap first started tracking the price of Shiba Inu on the 2nd of August 2020.

What price did Shiba Inu start?: The earliest confirmed price of Shiba Inu was $0.00000000051 on the 2nd of August 2020.

What is Shiba Inu’s highest price?: $0.00008845, reached on the 28th of October 2021.

What is Shiba Inu’s lowest price?: On the 1st of September 2020, SHIB reached its all-time low of $0.000000000082.

In 2021, Shiba Inu started the year at $0.000000000168 and ended 2021 at $0.00003341. Though these prices are incredibly low, the amount in which SHIB increased is enormous.

Shiba Inu Price Chart

Technical Analysis Of Shiba Inu (SHIB)

The past performance of a cryptocurrency is always one of the most crucial factors to consider when attempting to make valid cryptocurrency predictions. As we can see from the graph above, Shiba Inu has had a wild couple of years.

You could be forgiven for thinking that the almost flatline from SHIB’s creation to between March and May 2021 was a boring time. Actually, a lot was going on — though the price of SHIB was puny, it was highly volatile and a terrific way to make a quick profit.

Shiba Inu’s first spike took place in May 2021. It was big news and was arguably the first time traders started paying attention to the asset. Yes, Shiba Inu fell dramatically following this high, but noticeably, its new lows were not as low as its previous prices before the spike.

Several months later, in October, following the price of BTC, Shiba Inu had another enormous price spike, and after a moment of consolidation, leapt once more to its current all-time high towards the end of the month.

Again, SHIB couldn’t maintain such a high, but just like last time, its lows were much higher than before the spike. This suggests that there is an underlying positive trend in the long term.

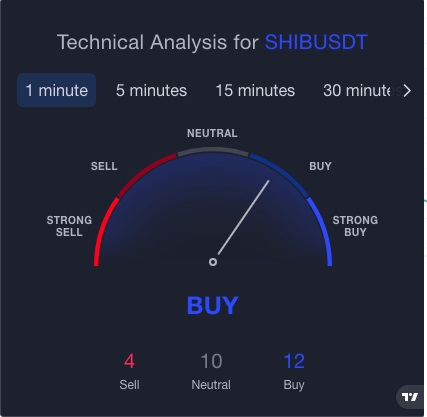

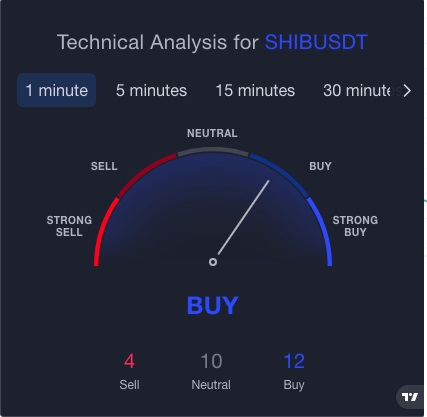

Shiba Inu is the second largest meme cryptocurrency by market capitalization. The growth is mainly due to the boost in the utility. Now the SHIB price predictions are a center of interest for many investors. The overall recommendation is Buy! Here’s a current time technical analysis for Shiba Inu.

>>>Buy Shiba Inu Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Shiba Inu Price Predictions Long Term Outlook

As a long-term investment, it is projected that Shiba Inu could perform very well. According to predictions, the value of the SHIB token could rise to $0.0000350 by the end of 2022, $0.000065 in 2023, and achieve a mean price of $0.000859, by 2025.

In addition to analyzing Shiba Inu’s historical prices, it’s important to identify the key factors that could affect its price in the future. This will make it easier for you to make your own predictions based on current cryptocurrency trends and find an informed answer to the question ‘should I invest in Shiba Inu?’

Shiba Inu predictions must be taken with a pinch of salt. Though there is a lot of good stuff potentially on the way, we also need to think about potential negatives too. Taken together, we can get a clear picture of what Shiba Inu could be worth.

Shiba Inu is very susceptible to crypto whales. A ‘crypto whale’ is an investor, typically a financial institution, which holds enormous reserves of different digital assets. Because they have so much of the market at their disposal, it’s generally accepted that these investors have the power to make or break a particular asset — all they have to do is buy or sell and an asset can leap forwards or sink. This could certainly be a risk when it comes to the price of Shiba Inu. Crypto whales could become less of a crucial factor to Shiba Inu price predictions as more people take up the coin.

Shiba Inu Price Prediction 2022

It’s wise to get an idea of Shiba inu’s prospects over the short and long term before you invest. As noted above, the Shiba price today is around $0.000010, down 45% since the beginning of 2022. However, given this start, what sort of performance can we expect from Shiba Inu in the remainder of the year?

It’s very important to remember that Shiba Inu has strong community support from both retail and high net worth individual investors. The launch of the Shiba DAO in 2022 will make Shiba Inu more democratic and could help draw in many more users.

Due to this, our Shiba Inu price prediction for 2022 estimates that the meme coin could reach $0.0000350 by the end of the year – a 250% rise from today’s levels.

Through the year end, SHIB/USD could hit $0.000045 and rally as per experts’ short-term Shiba Inu price forecasts. The lowest Shiba Inu price for the year-end is $0.000005 and SHIB is predicted to achieve an average of $0.0000270 by the end of the year.

>>>Buy Shiba Inu Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Shiba Inu Price Prediction 2023

Shiba is one of the most potential crypto to explode next year due to the technical improvements such as layer 2 solutions will improve Shiba Inu’s performance in 2023 and make it cheaper to use than most other cryptos.

Overall, if this happens, we would expect more demand for SHIB from retail and institutional investors. As such, Shiba Inu price prediction for 2023 estimates that the coin could reach $0.0000635 – an increase of 550% from today’s price.

Shiba Inu Price Prediction 2024

By 2024, the crypto community will have almost forgotten about weak meme coins and Shiba Inu continues to grow in popularity. This adds another major reason for investors to buy and hold SHIB, which is good news for Shiba inu price potential. Overall, if Shiba can capitalize on this momentum and partner with more entities it’ll boost the coin’ appeal to investors looking to generate an income stream.

The calculated max SHIB/USD prediction is $0.000189, and the lowest prediction is $0.0000113. Shiba Inu price forecasts then determine that the coin will end 2024 at an average price of $0.0000377.

If you’re wondering ‘should I invest in Shiba Inu?’, short-term cryptocurrency predictions aren’t particularly conclusive. The predictions for 2022 and 2023 are varied, ranging from under $0.00002 to around $0.00020. If you favor a long-term investing strategy, let’s take a look at the Shiba Inu price forecasts for 2025 and beyond. What could we expect to see in the long-term?

>>>Buy Shiba Inu Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Shiba Inu Price Prediction 2025 And Beyond

Further improvements to ShibaSwap could make it the go-to DEX in 2025 and increase demand for Shiba Inu and its other tokens.

When making a Shiba Inu forecast for the long term, it’s essential to understand that SHIB is underpinned by Ethereum blockchain technology. Due to this, investors will need to monitor the price movements of ETH as well as other major blockchain crypto assets.

Assuming this is the case, our Shiba Inu price prediction for 2025 estimates that the coin could reach a new-time highs of $0.000852, and potential beyond that level.

The average 2025 price forecast equates to a 2,094% increase since today’s level.

New developments could see Shiba Inu become increasingly advanced by 2027, likely taking advantage of smart contracts and dApps. In five years, we will see Shiba Inu trade at an average price of $0.00125 after passing the $0.001 barrier in 2027 for good. Our 2027 SHIB prediction also sees a top price of $0.00168 and a minimum of $0.00112.

2028 will see Shiba Inu likely become one of the most desired cryptocurrencies built on top of the Ethereum blockchain. Securing a low of $0.00141 early on in 2028, our Shiba Inu price prediction anticipates a record price of $0.00209. Bullish momentum will take SHIB to an average of $0.00172 and the asset will then wrap up the year at $0.00197.

Shiba Inu will become one of the biggest driving forces of cryptocurrency adoption by 2029 and could become many new investors’ first taste of crypto. Shiba Inu is expected to reach the $0.0025 milestone by 2029 before hitting a yearly high of $0.002578, according to the SHIB price prediction. Shiba will also build support around a low of $0.00155 and can maintain an average of $0.00211. The end of year price for Shiba Inu is calculated at $0.00234, according to our 2029 forecasts.

>>>Buy Shiba Inu Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Shiba Inu Price Forecast 2030

By 2030, Shiba Inu will be unstoppable and will likely host a variety of other services, many of which are likely DeFi-related.

Shiba Inu will end the decade after reaching an astounding all-time high of $0.002783, as per our Shiba Inu price prediction. The coin’s final price will be $0.00269, and it will hold strong, cementing a low of $0.00205. Shiba Inu’s expected average price for 2030 is $0.00248, according to our SHIB/USD forecast. The top price represents a 3,046% increase of today’s price.

Shiba Inu Price Forecast 2040

It is almost impossible to make a Shiba inu price prediction for the long run, However if the price continues to rise in value, we think that SHIB is likely to become more valuable in 2040 than today. The price of Shiba will continue to rise and may even reach the $1 mark in 2040.

>>>Buy Shiba Inu Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Shiba Inu Price Prediction – Conclusion

Shiba Inu price prediction undoubtedly is very volatile. But people often confuse volatility with risk — the two are not always the same. Volatility can give investors excellent opportunities to buy extremely low and sell high.

While you should be careful with Shiba Inu, it is still one of the best cryptocurrencies with the most potential upside and represents opportunities if you can be patient enough to wait for them.

Shiba Inu stands a good chance of remaining the top meme coin for years to come because of its tremendous hype and wide variety of features. In terms of market cap, Shiba Inu is highly competitive against Dogecoin.

If you’ve been looking for Shiba Inu predictions for 2022-2030, we hope you’ve found this article helpful. Cryptocurrency investing is notoriously risky and it’s vital to have a robust risk management strategy in place if you’re considering adding Shiba Inu to your portfolio — however, cryptocurrency trends suggest the value of Shiba Inu will ultimately rise by around 2,000% by the year 2025.

According to these forecasts, it seems that it’s best to invest in Shiba Inu if you’re prepared to play the long game. We may be unlikely to see a dramatic price increase, but the charts suggest it could be a smart investment for those who are happy to take long-term positions.

If you want to trade this digital asset, we recommend using the crypto broker, eToro. The social trading platform comes with many useful trading tools, a wide range of payment methods, and competitive fees.

>>>Buy Shiba Inu Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Is Shiba Inu A Good Investment?

Though SHIB has declined massively from its ATH in 2021, in the long-term Shiba Inu has increased considerably from its price at the beginning of 2021 to the end. Shiba Inu’s lows are getting higher, and SHIB is only growing in popularity. Shiba Inu can be a profitable investment if you can take advantage of its price fluctuations. So far, SHIB has an incredible ROI of 1,642,668.89%, so it can be a highly profitable investment.

>>>Buy Shiba Inu Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Is It Too Late To Buy Shiba Inu?

Based on technical analysis, Shiba inu price today is undervalued as there is an underlying upwards trend taking place that could see SHIB at $0.0027 by the end of the 2020s.

Will Shiba Inu Go Up?

Yes, according to its predictions Shiba Inu will rise in value, but it won’t go up but not forever. There will be periods where Shiba Inu falls and others where it stagnates. Do not expect Shiba Inu to continuously appreciate until the end of time.

What’s Next For Shiba Inu?

Shiba Inu is building many features such as an NFT marketplace, a metaverse, and a DEX which will all provide the token with more utility. On a technical level, the Doggy DAO and the Shibarium layer 2 solutions will improve the experience of using SHIB.

What is Shiba Inu Price Prediction 2040?

Continuing with our Shiba Inu price prediction forecast, if we stretch it to 2040, high figures between $0.005 and $0.01 may be achievable

Where Can I Buy Shiba Inu?

There are several top crypto exchanges where Shiba Inu is available to investors. We recommend buying Shiba Inu from eToro.

>>>Buy Shiba Inu Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Can Shiba Inu Make You Rich?

Shiba Inu is highly volatile and has a lot of momentum that could potentially make you rich. Don’t pay too much attention to its minuscule price — look more closely at how much that price changes. According to the latest predictions, Shiba Inu is set to increase.

Will Shiba Inu Reach 1 Cent In 2023?

Shiba Inu will not hit 1 cent in 2023. Even the highest predictions do not see SHIB hitting $0.01 by 2030. 1 cent is seen as a huge milestone for Shiba Inu to reach, a milestone many holders are waiting for.

Can Shiba Hit 10 Cents?

As per Shiba Inu price forecasts, SHIB will not hit 10 cents within the next 10 years.

Can Shiba Inu Reach $1?

By looking at its historical price momentum and experts’ Shiba Inu price forecasts, it’s highly unlikely that we will see Shiba Inu reac $1 any time soon in the next ten years.

>>>Buy Shiba Inu Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Like this:

Like Loading...