Polygon stole headlines several times recently and reached some incredible highs. And now investors are asking what is Polygon expected to reach? Before we reveal our top Polygon MATIC price predictions, Will Polygon crypto go up in value? Is MATIC a good investment?

According to Polygon price prediction, the price of Polygon will reach $1.66 by the end of 2022, rising to $4.40 by the end of 2023 and $10.11 by the end of 2025. Polygon will then rise to $31.20 in 2027, and $50.45 in 2030.

>>>Buy Polygon Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Polygon price predictions – Overview

- End of 2022: Becoming the top Ethereum scaling solution in 2022 will take MATIC to a high of $1.87.

- End of 2025: Aiding Ethereum’s transition to proof-of-stake in 2025 will see Polygon MATIC appreciate to $15.13.

- End of 2030: Providing scaling solutions to a variety of other blockchains in 2030 will see Polygon hit $54.85 in 2030.

>>>Buy Polygon Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Polygon Price History

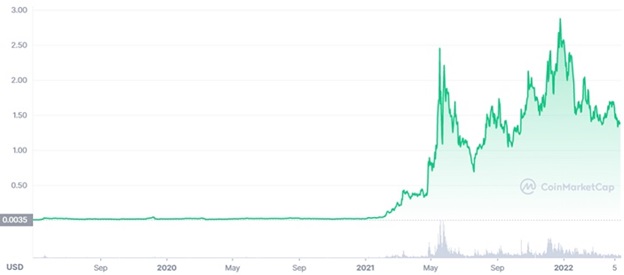

Historical Polygon (MATIC) Price Movements

Analyzing MATIC’s price history is the No. 1 thing you should do when considering making an investment in Polygon. By utilizing Polygon’s historical data, you can get a glimpse at what the asset is capable of in the future.

What was Polygon’s starting price?: Polygon was first available to investors between the 25th and 26th of April 2019 via an ICO (initial coin offering) at $1 MATIC to $0.00263.

What was Polygon’s highest price?: Polygon’s all-time high is $2.92, reached on the 27th of December 2021.

What was Polygon’s lowest price?: Polygon’s all-time low is $0.003012, recorded on the 9th of May 2019.

In 2021, Polygon began the year at $0.01781, hit its current all-time high mentioned above, and ended the year at $2.5271 per MATIC. Polygon’s current 52-week low is $0.2985.

Polygon MATIC/USD Chart

Polygon MATIC/USD price chart. Source: Coinmarketcap

Technical Analysis Of Polygon (MATIC)

Conducting MATIC price analysis is an absolute must. Armed with in-depth analysis, you’ll be better able to make precise Polygon price predictions.

From the Polygon MATIC price graph above, you can very quickly see that Polygon has not been on the market for very long — only slightly more than two years. This can make any technical analysis very limiting. Furthermore, the 2021 bull run can make it harder to truly figure out MATIC’s proper price potential.

Nevertheless, there are some observations that we can make. Firstly, from its creation until the beginning of 2021, MATIC sold for $0.01 to $0.02, and so reaching prices of $1 to $2 was an enormous leap.

Secondly, most obviously, Polygon is affected by the price of Bitcoin and any bullish sentiment in the market. Just like many other cryptocurrencies, it exploded in May 2021 and then in October and November 2021.

Polygon Price Predictions Long Term Outlook

Based on our Polygon MATIC price prediction, from 2022 to 2030 a long-term increase in the price of MATIC is expected, suggesting that investors could potentially profit more in the long-term than the short-term. According to these predictions, the value of the Polygon token could rise to $2.66 by the end of 2022, $4.40 in 2023, and achieve a mean price of $10.11 by 2025 — an increase of 632%.

Now that we know a bit more about Polygon’s historical prices, we can start to identify what primary factors could influence its price in the coming years. By combining fundamental and technical analysis, we can find an informed answer to the question ‘should I invest in Polygon?’

The price of any asset is determined by the relationship between supply and demand. When the demand exceeds the supply, the price goes up to reflect the scarcity. When the supply is greater than the demand, the price will fall.

As we mentioned earlier, there is a total supply of 10,000,000,000 MATIC tokens. (Compare this to the total supply of Bitcoin tokens, which is capped at ‘just’ 21 million.) This staggering supply makes the crypto much more scalable than others on the market. Considering the total supply is yet to enter circulation, we could see the price of MATIC start to increase as the relationship between supply and demand changes.

Another factor that can hugely affect the price of any cryptocurrency is the prevalence of influential investors (just look at how much control Elon Musk — who is largely credited for the rise of Dogecoin (DOGE) — wields over the market). Billionaire Mark Cuban is a major fan of MATIC, and this celebrity endorsement has undoubtedly been beneficial for the asset.

Cuban’s website proclaims: “Polygon is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development”. At a recent DeFi summit, he also claimed that Polygon is “destroying everybody else” in the world of crypto. Although Cuban reportedly owns 100 altcoins, it’s clear that Polygon has risen to the top of the pack. This could lend further legitimacy to the Polygon network, boosting its profile and encouraging more people to invest.

As an ERC-20 token and based on the Ethereum blockchain, the success (and therefore) price of Polygon is always going to be closely tied to that of ETH. With the completion of Ethereum 2.0 still hotly anticipated, we could see the price of Polygon increase once finished.

Ethereum 2.0 is a series of upgrades that will attempt to solve many of the same issues that Polygon currently navigates on the Ethereum blockchain. These include the platform’s slow transaction speed, high fees, and potentially lax security. It’s expected that the upgrade will cause interest in ETH to increase — and if that’s the case, we could see the price of MATIC follow suit.

Overall, it looks like there’s little standing in Polygon’s way to the top. Our Polygon price prediction analysis strongly suggests that MATIC is an excellent short-term investment (one year) or long-term investment (five to 10 years). Here are our Polygon price predictions for 2022 to 2030.

>>>Buy Polygon Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Polygon Price Prediction 2022

2022 will see Polygon become the No. 1 scaling solution for Ethereum. The MATIC price is expected to rise to a yearly high of $1.87, hit a yearly low of $1.18, and end 2022 at $2.66, as per our short-term Polygon price prediction forecast. By 2022, the Polygon price prediction will accomplish an average of $2.59.

Polygon Price Prediction 2023

DeFi projects seeking to scale faster on the Ethereum blockchain will crowd over to Polygon in 2023. Starting 2023 at $2.67, MATIC will hit a maximum of $5.26 and end the year at $4.40. Our short-term Polygon price prediction also estimates a minimum of $2.58 and a yearly average of $3.79.

>>>Buy Polygon Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Polygon Price Prediction 2024

With Ethereum completing its transition to proof-of-stake, Polygon will explore different ways it can support the network. Securing a median price of $6.12 in 2024, Polygon will not be worth less than $5.42 and can reach a top price of $9.28. An end of year price of $8.09 is also anticipated by our 2024 Polygon MATIC price prediction.

If you’re wondering should I invest in Polygon in the short-term, it does look like a good option with MATIC expected to rise from a 2022 low of $1.18 to a 2024 high of $9.28. However, long-term price predictions suggest bigger gains could be made towards the end of the 2020s. So, what could we expect to see in the long-term?

Polygon Price Prediction 2025 and Beyond

Ethereum finishing its transitioning to proof-of-stake in 2025 will have a knock-on effect on Polygon and take it to new highs. Crossing the $10.00 barrier early on in 2025, based on our forecasts MATIC/USD will reach an all-time high of $15.13. For the rest of 2025, MATIC will be worth $7.63 at the lowest and close the year at an average of $10.11 — a 330% increase since the beginning of 2022.

As the DeFi projects continue to balloon into 2026, MATIC stands to gain the most out of the entire Ethereum ecosystem. Refusing to sell lower than $8.47, our 2026 long-term MATIC price prediction has determined that Polygon will reach a record high of $24.17. The average expected price for 2026 will be $17.46 and MATIC will be worth $23.25 by the end of December.

2027 stands to be the year institutional money rains in on Polygon as investors from all backgrounds acknowledge its performance. Climbing to the $30.00 barrier, MATIC will hit a high of $33.84 towards the end of 2027 and decline to a closing price of $31.20. Our five-year Polygon MATIC price prediction puts the asset at an average of $28.92 for 2027 and estimates a low of $21.43.

Having built several bridges to some of the top smart contract platforms, Polygon will become the most used scaling solution for the crypto market. As per our 2028 Polygon price forecast, the price of MATIC is expected to reach $40.00 at the beginning of the year. MATIC’s expected high is $42.09 and the low will be $35.88. The average MATIC price prediction for the end of 2028 is $38.69.

By 2029, Polygon is now seen as more important than Ethereum or any of the other blockchains it helps scale as DeFi projects choose to MATIC over ETH. 2029 will begin with Polygon MATIC at $39.03 and see it rise to an acceptable $45.18. From this point, our long-term Polygon price prediction puts MATIC at a max price of $49.90 but also suggests that a low of $39.39 is possible. The expected average at the end of 2029 is $46.85.

>>>Buy Polygon Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Polygon Price Prediction 2030

Under Polygon, the biggest blockchains will be interoperable by 2030 making them much faster and more practical to use, dramatically speeding up adoption by large companies. Our long-term MATIC/USD price prediction forecast calculates that at the very highest, we can see Polygon reach $54.85 per MATIC token. MATIC can also form a level of support at a low of $43.68 and accomplish an average price of $50.45 by the end of 2030, which would equate to a gigantic 1,918,151% increase since its ICO in 2019.

Is Polygon Crypto A Good Investment?

Polygon MATIC definitely appears to be a good investment. Becoming a vital part of the Ethereum ecosystem, MATIC went from $0.017 to $2.92 between January and December 2021 — a humongous increase.

Polygon is still reasonably priced or depending on who you talk to, undervalued. Polygon will likely only increase in price as more of the Ethereum network comes to depend on it.

For an asset that only launched in 2019, it has accumulated an ROI (return on investment) of 30,745.47%. That’s an extremely high rate of return.

The trajectory that Polygon MATIC is expected to take, according to our MATIC/USD price prediction and technical analysis indicates that Polygon can make a good future investment. The potential long-term gains far outstrip the potential short-term gains.

The riskiest aspects to consider when investing in Polygon are that Ethereum’s transition could make it less useful and the highly competitive field it operates in. Those aside, it is a relatively safe investment in comparison to other crypto assets.

Polygon could be one of the most profitable coins on the crypto market at the moment. This is because Polygon is already delivering on what it promised to do (improve Ethereum’s scalability), while many other cryptos are yet to prove their worth with goals that may take years to achieve.

>>Buy Polygon Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Polygon Price Predictions – Conclusion

Polygon is making the Ethereum network a practical reality today by squashing its scalability issues — issues that many felt would take years of development to solve.

By making Ethereum faster, Polygon paves the way for big companies to move into building blockchain projects on Ethereum and prevents congestion issues — as we saw in February 2021 — where ETH transactions slowed dramatically, and fees soared.

If you’ve been dying to find out what Polygon MATIC could be worth in 2022 and 2025 and beyond, we hope this article has helped. Undeniably, investing in Polygon — or any cryptocurrency — is tricky. It’s still a new asset class and there’s a lot of uncertainty and risk. Despite this, the current trend we have identified for MATIC seems to be telling us that the value of Polygon could rise by around 630% by the year 2025.

To summarize our Polygon MATIC price predictions, it certainly looks like a better option to hold your MATIC for the long run. Investors who are most comfortable with long-term positions could gain the most out of MATIC.

>>>Buy Polygon Now<<<

Virtual currencies are highly volatile. Your capital is at risk

Will Polygon (MATIC) Hit $100?

For the time being, with Polygon’s current trajectory $100 per MATIC is not attainable. Our MATIC prediction suggests that it’s much wiser to aim for $40 to $50 per coin by the end of 2030.

Will Polygon (MATIC) Reach $1,000?

It is extremely unlikely that we will see Polygon’s MATIC token rise to $1,000. Even if MATIC performs exceptionally well in the next seven to eight years, $1k per MATIC probably won’t happen.

What Will Polygon MATIC Be Worth In Five Years?

In five years, Polygon MATIC is predicted to increase by 2,352% to an all-time high of $33.84, as per our MATIC/USD price prediction in five years.

Will Polygon (MATIC) Go Up?

It certainly appears that Polygon is on the up given our highly positive price prediction. Though, do note that while we expect prices to potentially hit $2.87 in 2022, they can also decline to $1.18. Based on the price forecast we have developed for Polygon, it can be a profitable investment for both long- and short-term investors, with MATIC expected to hit new highs from 2023 to 2030.

What Price Could Polygon Reach?

In 2022, Polygon will reach $2.87, then hit $5.26 in 2023, $15.13 in 2025, $33.84 in 2027, and then $54.85 in 2030, as calculated by our Polygon price prediction algorithm.

Polygon Price Prediction 2040

If we stretch our current Polygon MATIC price forecast to 2040 and there is no change in its projection, we foresee the asset trading between $500 and $2,000 per coin.

>>>Buy Polygon Now<<<

Virtual currencies are highly volatile. Your capital is at risk