After a considerable drop in cryptocurrency valuations, the odds are that the market has hit bottom. This means it is an excellent time to start buying cryptocurrencies in anticipation of a price pump in 2023.

This article looks at some of the top 10 cryptocurrencies with the most upside in 2023. The list is a mix of cryptocurrency blue chips and low-cost growth cryptocurrencies.

The Top 10 Cryptocurrencies with the most upside in 2023

To get started, let’s first do a quick overview of the ten high-potential cryptocurrencies to keep an eye on going into 2023.

- Cardano – Ethereum Competitor that is Scalable and has a Growing Ecosystem

- Terra Classic – Penny Cryptocurrency with a Passionate Community

- Cosmos – Top Web 3.0 Cryptocurrency that is Gaining Traction in Adoption

- Chainlink – Undervalued Decentralized Oracles Cryptocurrency

- Bitcoin – The number one Cryptocurrency is Now Trading at a discount

- Ethereum – Top Smart Contracts Cryptocurrencies that Now Run on PoS

- Dogecoin – Top Meme Coin with the Highest Potential in the Bullish Market

- Quint – High Potential Cryptocurrency with Staking Opportunities

- Shiba Inu – High Potential Meme Coin that is Making Inroads into the Metaverse

- ApeCoin – One of the Most Popular NFT Crypto In the market

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

An In-Depth Analysis of the Best Cryptocurrencies with the Most Upside in 2023

The decision to invest in cryptocurrency is no mean feat. With over 20k digital currencies out there and all with varying levels of risks, it can be difficult for investors who don’t know what they’re doing to get started

A lot depends on your choice when buying a cryptocurrency with high upside potential. To ensure that investors have an opportunity with reasonable risk-reward potential, we have narrowed down these 10 cryptocurrencies with high upside potential and a diverse risk profile.

Without further ado, let’s take an in-depth look at the top 10 cryptocurrencies with the most upside potential in 2023.

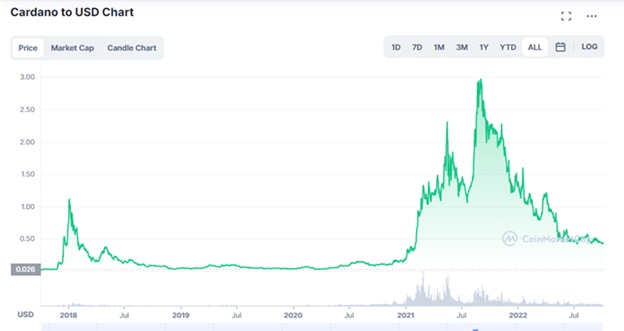

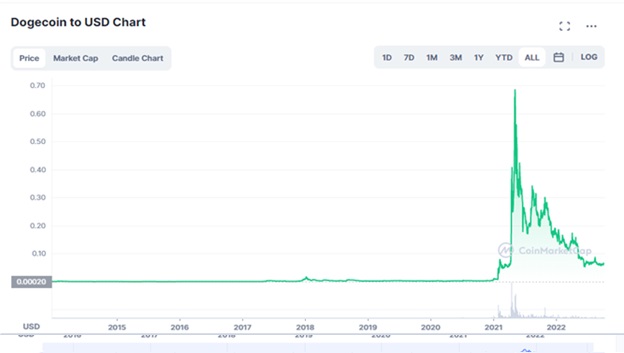

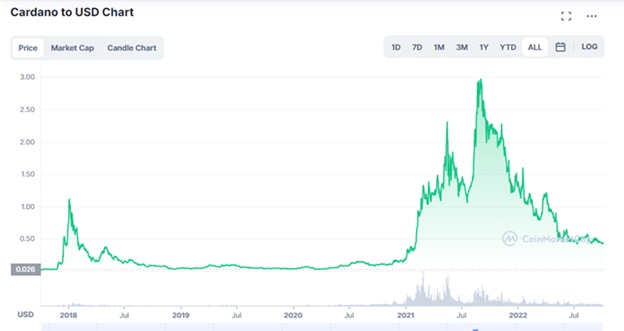

1. Cardano

Cardano easily stands out among the best cryptocurrencies with the most upside in 2023. That’s because it is one of the most fundamentally strong cryptocurrencies in the market today. It is a platform blockchain that is scalable, secure, and, most importantly, decentralized. This makes Cardano one of the most credible Ethereum competitors in the smart contract space.

On top of that, Cardano is currently trading at a significant discount. From highs of over $2 back in 2021, Cardano is currently trading at $0.42. This means it is trading at a discount of over 80% from its most recent highs.

Going by the old investment analogy of buy low and sell high, Cardano is a cryptocurrency worth keeping an eye on in 2023. The best part is that, per the Cardano roadmap, there is much to look forward to between now and 2023.

This and Cardano’s strong community gives ADA the potential to 2x in the medium term. The odds are in its favor.

>>>Buy Cardano Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

2. Terra Classic

Terra Classic is one of those cryptocurrencies that have made headlines throughout 2022. That’s because of the unexpected collapse that saw LUNA drop from a top 10 cryptocurrency to a penny coin.

While it was easy to write off Terra after its highly publicized collapse, the community has proven to be one of the most resilient in the cryptocurrency market. The strength of the Terra Classic ecosystem is most evident in the way they have introduced an accelerated toke burn. This has seen it emerge as one of the best-performing cryptocurrencies in recent months.

Going into 2023, there is every indication that Terra Classic is one of the cryptocurrencies with the most upside potential. That’s because of the recently introduced tax that aims to help accelerate the token burn. The fact that most top cryptocurrency exchanges support the burn gives Terra Classic even better prospects going into 2023.

This coupled with the fact that Terra Classic is still a respectable layer-1 for launching Dapps, makes it a top cryptocurrency to buy and hold for 2023.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

3. Cosmos

Cosmos is one of the most fundamentally strong cryptocurrencies with strong upside potential for 2023. That’s because it has one of the cryptocurrencies that will be at the center stage if blockchain technology ever achieves mass adoption.

Cosmos aims to help Dapps from multiple blockchains create a network rivaling the centralized internet. So far, Cosmos has gained traction, and the number of projects using Cosmos is rising.

At the same time, Cosmos is getting more attractive to investors looking to earn a passive income from cryptocurrencies. Staking Cosmos is pretty easy, and anyone can do it. Thanks to Cosmos’ strong fundamentals, the number of long-term Cosmos stakers is on the rise. This has helped keep the price stable even as most other cryptocurrencies continue to see new lows.

This coupled with the fact that Cosmos is trading at an over 70% discount, means that it is quite attractive to investors as buying momentum starts returning to the market. With all these factors in ATOM’s favor, it is easy to see why it is a top cryptocurrency with strong upside potential in 2023.

>>>Buy Cosmos Crypto Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

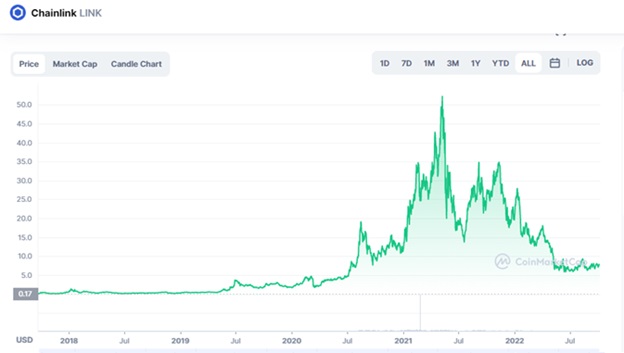

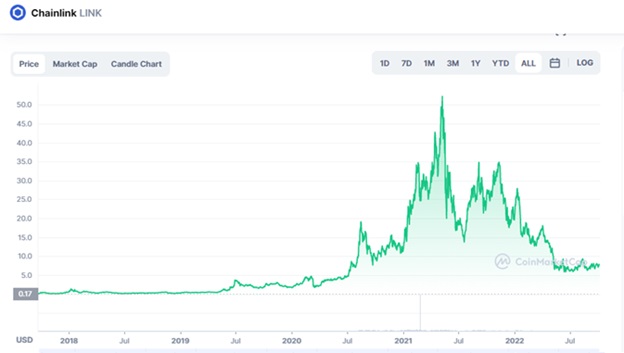

4. Chainlink

Chainlink is the number one decentralized oracle cryptocurrency in the market. So dominant is Chainlink in this market that it accounts for more than 65% of the market. More than $20 billion in assets within the cryptocurrency market rely on Chainlink for data.

Despite this dominance and the growing importance of Chainlink in the crypto market, LINK’s price has remained highly depressed for a long time. Even in the rallies that have taken place during the bear market, LINK hasn’t moved much.

Chainlink’s mismatch of price and fundamentals makes it a highly undervalued cryptocurrency. Now that it is trading at more than 70% off its most recent highs, the odds are that LINK will attract investor attention going into 2023. That’s why an investor is looking for a cryptocurrency that has significant upside potential going into 2023.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

5. Bitcoin

Bitcoin is an obvious inclusion in our list of top cryptocurrencies with high upside potential in 2023. Like many other cryptocurrencies, Bitcoin has recently seen its valuation decline. Bitcoin’s current market capitalization stands at $386 billion, a significant drop from its peak market capitalization of over $1 trillion. This means it could be trading at a point of maximum pain, giving it a considerable upside potential if the market turns in 2023.

That’s because the cryptocurrency market moves in cycles, with periods of rapid gains and steep price drops. The opportunity to profit is there for those who take advantage of these cycles. For instance, in 2018, Bitcoin dropped from a high of $20k to a low of $3k. However, in the follow-up bull market that started in April 2020, Bitcoin gained significant upside traction, and by the end of 2021, Bitcoin hit a high of $69k.

Similarly, from the last peak of $69k, Bitcoin is now trading at a 70% loss. However, someone looking to buy Bitcoin in anticipation of another cycle is potentially buying BTC at a 70% discount, which is admirable for any investment out there. If past Bitcoin cycles are anything to go by, the odds are that Bitcoin could be 2X from its current price in the short term.

That’s because being the largest cryptocurrency by market capitalization and trading at a discount, BTC is now highly attractive to institutional investors.

>>>Buy Bitcoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

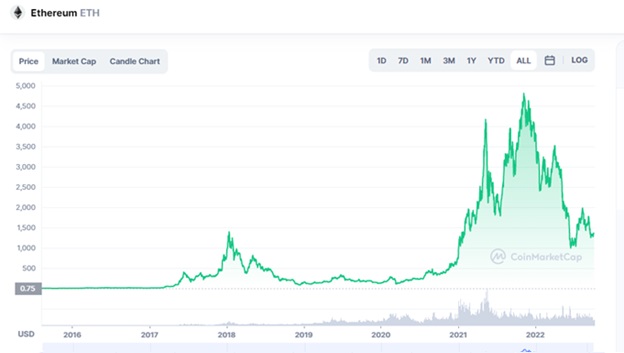

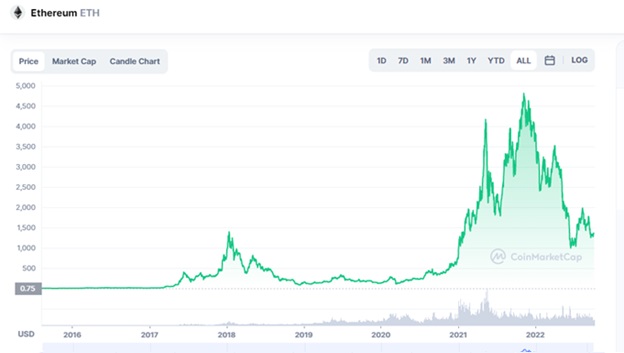

6. Ethereum

Ethereum is a crypto project that has been around since 2015. It’s one of the most popular cryptocurrencies and is only second to Bitcoin on key metrics, such as adoption. Recently, it has rivaled Bitcoin, with the number of Ethereum addresses now outpacing those of Bitcoin.

Ethereum blockchain is the most popular digital ledger for supporting smart contract technology. It’s been used by thousands of different cryptocurrencies to operate their own networks, many with unique features or values relating thematically together as part of a metaverse, where users can interact within virtual worlds without actually being there physically. While there are many other platform blockchains in the market today, most developers choose Ethereum for its security and decentralization.

The Ethereum blockchain and ERC-20 framework have been a major success for many projects, including Shiba Inu, Chainlink, and pretty much all the large DeFi and Metaverse cryptocurrencies.

Now that Ethereum has shifted from a Proof-of-Work algorithm to Proof-of-Stake, Ethereum gas fees will likely go down over time. This will also mean a bigger incentive for Dapps developers. For investors, it means an even higher potential for value growth going into the future.

Despite all these developments, Ethereum is trading at record lows from its most recent highs of $4800. If you invest in Ethereum today, you will get in at a massive discount. It’s, without a doubt, one of the best cryptocurrencies to buy during the current market crash.

>>>Buy Ethereum Crypto Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

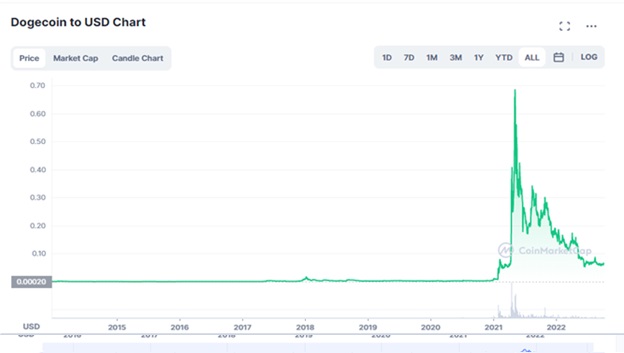

7. Dogecoin

Dogecoin has always been a joke, but it seems the cryptocurrency is finally taking itself seriously. Since 2020 when Elon Musk started talking about it, Dogecoin has become a serious cryptocurrency to many investors.

The momentum that Dogecoin gained in 2020 saw it become one of the best-performing cryptocurrencies in 2021, rallying by over 12,000%.

While Elon Musk was the key trigger for Dogecoin’s price rally, Dogecoin has gained traction in its own right. For instance, Dogecoin has been used over the last two years by multiple large organizations for payments. As more of these organizations use Doge for payments, so will investor interest in DOGE. This makes it one of the top cryptocurrencies with significant upside potential in 2023 and beyond.

>>>Buy Dogecoin Crypto Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

8. Quint

For investors looking for exponential gains in a short time, Quint is one of the best cryptocurrencies with significant upside potential in 2023. So, what exactly is Quint?

With a world of possibilities at their fingertips, Quint wants to make it easier for people to transition seamlessly between the real world and the Metaverse. To do so, they have created super staking pools that allow users exciting income opportunities.

When it comes to earning passive income, there’s no better way than with the new Quint. With just one deposit of 500 QNT, an investor receives an entry ticket into their prize competitions. The investments are guaranteed to return your initial investment and provide monthly wins.

Among the wins that Quint investors get to enjoy are top NFTs like the Bored Ape Yacht Club NFTs. Quint is currently offering a super staking pool with the chance to win an NFT from the BAYC collection. They also have a host of luxury items that investors can win. This makes Quint a highly attractive cryptocurrency for passive income in 2023. That’s because some of the prices they offer, such as NFTs, are also potentially good long-term cryptocurrency investments and can give investors a significant ROI in 2023. Besides, Quint is a relatively new cryptocurrency, and if you invest in Quint today, the potential for long-term exponential growth is high.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

9. Shiba Inu

Some might think Shiba Inu is just another Dogecoin, but the similarities between these two coins end there. For one thing, it offers real-world utility to its holders with plans for future products and services that entrepreneurs within the community will create.

Imagine a world where you can buy your own piece of virtual land with Shiba Inu tokens. The Shiba Inu Metaverse is up and running, and though it is still in its initial stages, it is drawing a lot of investor interest.

At the same time, Shiba Inu is on the radar of cryptocurrency speculators, especially now that the broader market is trading at the bottom. That’s because Shiba Inu was one of the best-performing cryptocurrencies in the last bull run. At the time, anyone brave enough to buy Shiba Inu for as low as $100 was a millionaire by November 2021.

If the cryptocurrency market gains traction again in 2023, Shiba Inu could have strong upside potential. It is not surprising that Shiba Inu is one of the most searched cryptocurrencies today.

>>>Buy Shiba Inu Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

10. ApeCoin

ApeCoin entered the market in Q1 of 2022 in the middle of the cryptocurrency bear market. Despite the bearish trend across the market, ApeCoin became one of the best-performing cryptocurrencies at the time. That’s because it was the creation of the same people that created the trendy Bored Ape Yacht Club line of NFTs.

ApeCoin has also been gaining traction due to its potentially high utility in the Metaverse. That’s because ApeCoin is the currency for trade within the Otherside Metaverse. Given how fast Otherside and the Metaverse space, in general, are growing, it is not hard to see why ApeCoin is one of the best top cryptocurrencies with the most upside potential in 2023. To give you an idea of how much potential the Otherside Metaverse has, consider that top rappers like Eminem already have virtual concerts on the Other Side Metaverse.

ApeCoin’s potential as a cryptocurrency that could go up in 2023 is also evident in its market cap. Despite the fast-growing nature of the Otherside Metaverse and ApeCoin’s growing utility, this cryptocurrency only has a market capitalization of $1.6 billion. This gives APE the potential to 2X or more in 2023.

>>>Buy ApeCoin Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

How to Find High-Potential Cryptocurrencies

If you want to invest in cryptocurrencies that have strong upside potential in 2023, then make use of the tips below:

1. Buy Cryptocurrency Dips

High-risk crypto trading can be an exciting but also a very risky venture. One way to reduce your risk is by buying cryptocurrencies at the depths of a bear market. That’s when cryptocurrencies are trading at 70 -90% off their most recent highs. The rationale is that you get in at a steep discount. This gives you the potential for maximum gains and the lowest risk possible.

For instance, cryptocurrency prices have been falling for the better part of 2022. Most are at 70-80% off their most recent highs. Now is an excellent time to buy cryptocurrencies with the most upside potential. Of course, you need to consider the fundamentals and not just throw money at any cryptocurrency.

2. Consider a Cryptocurrency’s Market Capitalization.

Investing in crypto with the most significant upside is like playing Russian roulette. You never know when or where your next win will come from, but if you’re looking for some good odds, then it might be worth exploring small-cap projects that carry high potential returns on investment

The idea is that even a small increase in volumes can move the price and trigger FOMO. For instance, it would take billions of dollars in volume to significantly increase the price of Bitcoin. On the other hand, for a cryptocurrency with a market cap of $20 million, a few million dollars in volumes can see the price surge to heights never seen before.

For context, back in 2020, Shiba Inu had a very low market cap, and as FOMO kicked in, SHIB rallied by over 40,000,000%. Today, Shiba Inu has a market cap of $6 billion, and it may be difficult to repeat its 2020/21 price action.

However, many small-cap cryptocurrencies are where Shiba Inu was in 2020. These give investors the best potential upside in 2023.

3. Get in at Presales

Crypto presales offer a chance for early investors to get in on the action and make money when projects go public. The idea is to get in when very few people know about a cryptocurrency, which is trading at a discount. By the time such a cryptocurrency hits major exchanges and traders FOMO in, the early investors are in significant profits.

The best thing about these cryptocurrency presales is that there is always going on at any given time. If you are looking for cryptocurrencies with a strong upside in 2023, now could be a good time to get into presales.

That said, it is important to note that the cryptocurrency presale is unregulated and is the wild west of investing. As such, before investing in cryptocurrency presales, make sure that the crypto you are eying is legit. Do as much due diligence as possible before you commit money to a cryptocurrency presale.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Conclusion – Most Potential Cryptocurrency

The cryptocurrency market has been bearish for months now. While the market may look scary right now, anyone who has been active in the cryptocurrency market for a while knows that this is the best time to buy cryptocurrencies and sell them later at a higher price. If you have read this guide, you already know of the 10 cryptocurrencies with the most upside potential in 2023. Each is in an attractive price range now that most are trading at a discount of over 70%.

While all of the cryptocurrencies discussed above have significant upside potential, we believe Chainlink has the most potential of all the 10 discussed. Chainlink has market dominance in its market and has secured more than $20 billion of value even in this bear market. This makes it highly undervalued at current prices, and it will do well in 2023.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

FAQs

Which crypto has the best upside potential in 2023?

We believe that large-cap cryptocurrencies like Bitcoin and Ethereum have a lot of potential for growth in 2023. That’s because they are currently trading at a considerable discount. We also believe that meme coins and other low-cap best altcoins that tend to do well in bull markets could rally in 2022.

What Makes for a High-Potential Cryptocurrency?

The key factors to consider before buying a cryptocurrency are its fundamentals and the prevailing price. It is best to invest when prices are their lowest for maximum returns on your investment. This gives you the potential for maximum profits once the market starts to move.

Is Buying Potential Cryptocurrencies Safe?

Yes, it is safe to buy well known cryptocurrencies. You have the most upside potential when you invest in a cryptocurrency before the next rally. That’s because you get in when most people panic and distort the price.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Like this:

Like Loading...