PICK A TOOL FOR A JOB, NOT A JOB FOR A TOOL

I had been thinking about another post I needed to make on the topic of Web 3 domains, how I had been serially examining that sector and the sources of Web 3 domains, and how I had consistently been finding ‘Unstoppable Domains’ as the leading vendor…

Following some months, UD got a Series A injection from Pantera Capital, which put the total value at close to a billion USD.

When I started writing about it… everyone was like ‘What’s a Web 3 domain?’… that was around November last year, and roll on 9 months we have a $1 billion Category King.

But as always, I start with a simple idea that should take ten minutes of my time to write, and I discover other things relevant which add on… I end with Tekedia piece resembling a Masters Thesis. 20+ minutes reads are too long for some people.

Such it was when I discovered Victor Akujuo‘s post about ‘2022 being a brutal year for the crypto market’. So I am resisting the temptation to make it a section in the imminent ‘Unstoppable Domains’ Pantera Capital Series A piece, and, instead, just share my ideas topical to the great piece by Victor separately,

Cryptocurrency was birthed to give an alternative to FIAT as a ‘value instrument’ with which to trade. To this day, many in the US celebrate May 22 as ‘Bitcoin Pizza Day’, to commemorate in May 22 2010, Laszlo Hanyecz from Florida spent 10,000 BTC on two pizzas. It was never intended as an investment vehicle.

Digital Art creations were birthed to be a collectible and attract a collectors following. Collectible items are of subjective value, as their aesthetics is in the eye of the collector, and whoever else chooses to agree with them. People have built collections of all sorts of things, and some of us share this urge with some far less intelligent forms of life. The Satin Bowerbird ‘makes structures out of sticks…furnish it with shiny objects, like gumwrappers, plastic straws ,pens…’ (learningbirdwatching.com), but there is no evidence that this collecting behaviour is helpful to wildlife’s survival, and sometimes can be a hindrance. As a species, we have kept collections of postage stamps, coins, beer mats, bottle tops, and celebrity memorabilia. One of the strangest I have found online is a ‘Navel Fluff Collection’ by one Graham Barker (25 Strangest Collections on the Web).

The value of collectibles vary with the times. For example, as the notoriety of a celebrity fades, so will memorabilia associated with him or her. Again, the primary force behind collecting isn’t as a good investment to profit from in the future.

Web 3, aka decentralized or blockchain domains, were intended as a universal identity in Web 3, to develop a Web 3 website, anchor a Web 3 ecosystem, and be a proxy for long alphanumeric blockchain IDs hard to remember and easy to make a transcription mistake. (Similar to how Web 2 domains replace an IP identity in Web 2 through DNS)

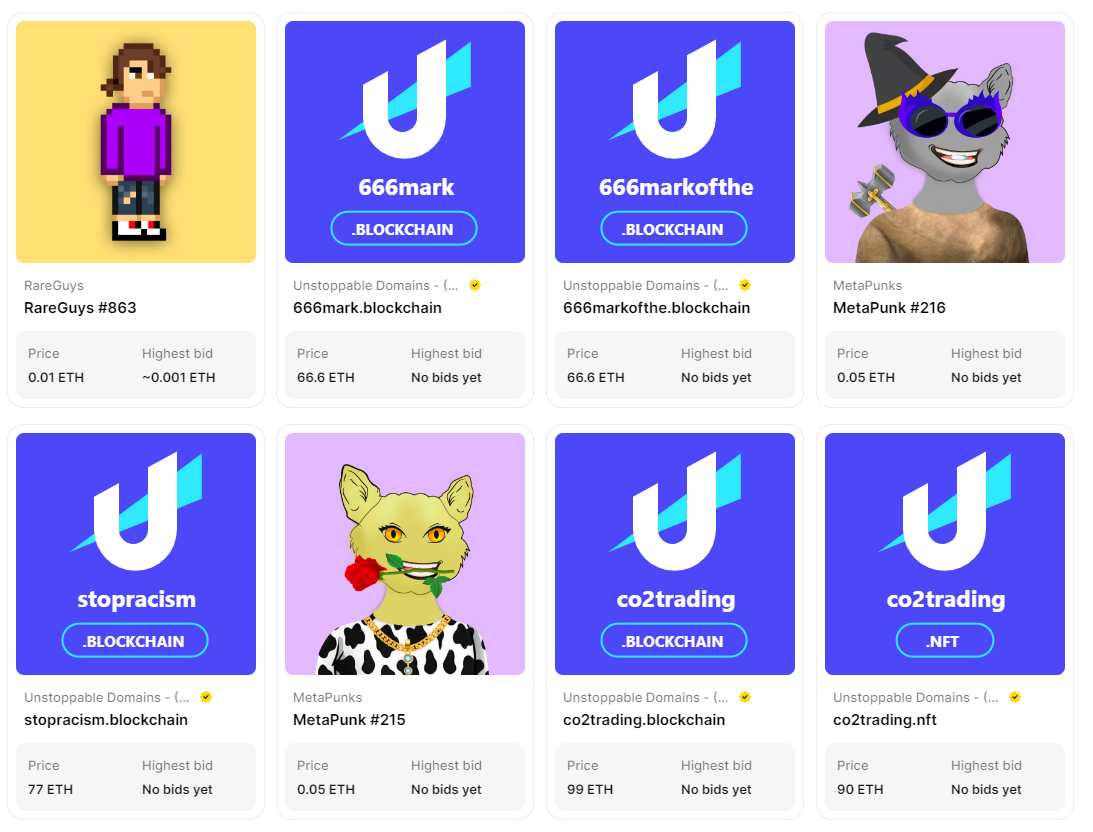

Now, even though most people can’t even cite a Web 3 address where they visited or interacted with virtual content, we already have people ‘domain flipping’ Web 3 domains (buying them up through either Web3 domain vendors or the blockchain system, and offering them for sale at an increased cost). Web 1/2 websites and the domain names that represent them (through DNS), were already very much a thing when domain flipping started in the legacy domain market.

However if anybody is hell bent in getting into domain flipping, I have included an interesting article on common mistakes. It has been written initially for Web1/2 domains but the principles apply to Web 3 as well. Web 1/2 started around 1995, and with Web 3 fairly new, catchy short domains will still be much easier to find.

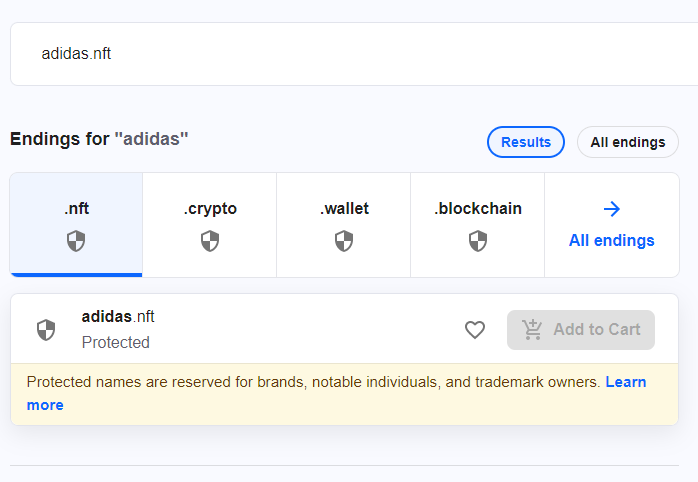

Would advise strongly against ‘domain squatting’ (Buying up a domain related to a known company and then trying to sell to them (blackmail them into taking it at an an inflated price), or cyber squatting, buying a domain, or a slightly different domain (typo squatting) and carrying on dishonest activities pretending to be the genuine company online. The World Intellectual Property Organization made this illegal in 1999, though interpretation and implementation may differ depending on country.

Big corporation interest in Web 3 hasn’t heated up yet, and as well can see, Adidas still has several available Web 3 domain names unsecured, although the vendor in this case, Unstoppable Domains, has had the good sense to restrict them and tag them as ‘protected’, to avoid liability should they sell it to a customer.

Unstoppable Domains are the current market leader in Web 3 domains. The second biggest player is Handshake Domains, who operate through distributors of which Namecheap seems to have the strongest visibility. Unlike Web1/2, regulated by IANA/ICANN, anybody can come along at any time, start their own blockchain, (or partner with one) and create their own Web 3 domain service offering new TLDs (Third Level Domains). This has the potential to deflate the Web 3 domain reselling market in the same way as the explosion in AI generated artwork is in danger of impacting virtual art collectibles.

SUMMARY:

Look at what you want to do in the BoT (Blockchain of Things) space. Try to spend on only what can deliver you a function.

I buy MATIC, the native crypto on Polygon chain, because I have functional things going on with that chain, and if I have to get smart contracts, or dApps or some other services, I will have to pay for them in MATIC. I don’t hold much, but equally, as it is a chain that more and more things are being built on, and my UD domain is there… activity is ramping up, so its value isn’t going to crash. DeSo is worth looking at as well. (Credit Albert Baldwin)

You can also buy cryptocurrency just to pay for other things, if using FIAT is less practical for you for some reason. Best to not buy more than you need to transact.

Stay clear of Collectibles unless you can appreciate them aesthetically, and you can afford the money.

If you have reached a level of financial independence that allows you to be indulgent, then by all means build your own collection of Virtual Collectibles if they make you ‘feel good’. But bear in mind this requires a mentality that dismisses the investment cost as ‘past tense’, and moving forward, views them from the subjective value you place on them because of the ‘feelgood factor’ and not because they will make money if you sell them. Don’t spend your children’s future school fees on them, thinking there will be money for them when they reach the age.

Avoid accumulating collections of Web 3 domains.

If you have been around for a while in related business, and you are familiar as a customer with the processes of using domain registration and hosting services, then you will be familiar with this. You think of what seems to be a great domain name, and you register it. This happens a few times a year, renewal costs mount up. You never seem to be able to get purpose clarified, and then content consistent with purpose, at the same pace as the accumulation of domain names.

We are really in BoT and some way off Web 3 becoming a working reality. Accumulating ‘collections’ of Web 3 domain names is probably not a good idea. There is no point in having a lot of blockchain assets sitting down doing nothing. Again, it depends on level of Financial Independence. If someone can afford to be indulgent, there are worse things to spend money on than Web 3 domains. I would suggest 1-3 domains. One for business. One for personal identity, a third for some stand alone activity that is best kept separate from 1 and 2. But any number smaller than 3 works!

The bottom line is to pick the tool for the job, not the job for the tool!

All online references accessed 21-08-22:

en.wikipedia.org/wiki/World_Intellectual_Property_Organization

smartchoicedomains.com/2019/04/29/domain-flipping-3-common-mistakes-of-domain-flippers-and-how-to-avoid-them

unstoppabledomains.com

moneyhaat.com/technology/unstoppable-domains-which-offers-nft-domains-as-a-personal-identifier-across-web3-apps-raised-a-65m-series-a-led-by-pantera-capital-at-a-1b-valuation-mk-manoylov-the-block/

namecheap.com

deso.org

learnbirdwatching.com/birds-that-are-attracted-to-shiny-objects

moneycrashers.com/most-valuable-expensive-types-collectibles

linkedin.com/posts/john-mc-keown-nigeria-expert_beyond-crypto-fintech-and-defiis-africa-activity-6909476843259576320-2vqO?

neatorama.com/2008/05/14/neatoramas-guide-to-25-of-the-strangest-collections-on-the-web/

linkedin.com/in/johnkraski/

linkedin.com/in/victor-akujuo/

linkedin.com/in/albert-baldwin-83bb7aa/