When information and communication technology experts sneeze and release new products, people and organizations must catch the ‘cold’ by incorporating the products into their value creation and capturing processes. Emerging technologies have continued to shape how media companies create and distribute value over time. The concept of carrying a radio box in order to listen to radio stations has been rendered obsolete by the introduction of various smart devices with radio capabilities.

The emergence of similar devices has effectively ended the era of viewing a television box as a “collective box” for viewers. Going to vendors’ stands in neighborhoods or waiting for them to deliver a copy of one’s favorite newspaper brand has completely changed because one only needs access to the Internet to read the content of various newspapers.

These scenarios can be found all over the world. Africa, also known as the emerging continent, is catching up in all aspects of integrating new media with traditional media systems. Media entrepreneurs and professionals from the continent’s east, west, north, and south are constantly innovating in terms of using emerging technologies for value creation and delivery.

In this piece, our analyst examines the media convergence patterns of 63 African media organizations. According to several independent research sources, these organizations have been the leading brands in South Africa, Nigeria, Kenya, and Egypt since 2019. The brands are Mail and Guardian, Time Live, News24, Daily Maverick, IOL, The South African, Citizen, The Punch, Premium Times, The Guardian, The Nation, ThisDay, Daily Trust, Leadership, The Star, The Standard, Nation, The East African, Egypt Today, Araham Online, Egypt Independent, NTA, Channels TV, TVC, Arise TV, ONTV, LTV, OGTV, Sound City TV, Kenya Broadcasting Corporation, Citizen TV, Family TV, NTV, South African Broadcasting Corporation, CNBC Africa, Ezekiel TV, Cape Town TV, Soweto TV, M-Net, MY TV, RSG, Metro FM, Radio 702, Umhlobo Wenene FM, Ukhozi FM, Lesedi FM, Radio Citizen, Classic 105, Radio Maisha, Kiss FM, Milele FM, Nile FM, Egyptian Radio, Robinson FM, Nogoum FM, Goal FM, Rehab FM, Wazobia FM, Nigeria Info, Raypower FM 100.5, Brila FM, FRCN FM and Freedom FM.

The majority of the top media outlets, from Egypt to Kenya, Nigeria, and South Africa, are combining social media with their current traditional or conventional methods of reaching audiences in their local areas and beyond. Our analyst found that the main reason media organizations use social networking sites like Facebook, Twitter, Instagram, and YouTube is to get around the limited radio and television frequencies that relevant local and international organizations have given them permission to use. Analyzed African traditional newspapers are also using the sites to expand their readership beyond their immediate area and increase their revenue from online advertising.

Despite their close use of social media, these organizations differ in how they display the platform icons (Facebook, Twitter, Instagram, and YouTube) on their websites. According to our data, many of them have the icons at the top of the home page, while others have them at the bottom. This has a number of implications for gaining an audience through social media. Our analyst notes that brands with icons at the top of the page have a better chance of attracting audience than those with icons at the bottom of the page. This is because online readers usually pay attention to the top of a website before considering the bottom.

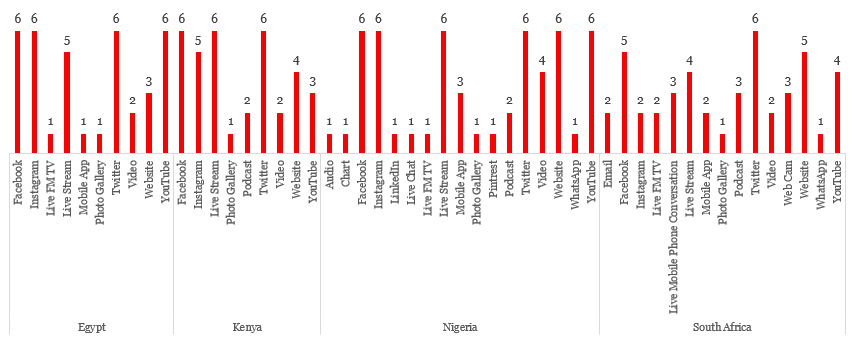

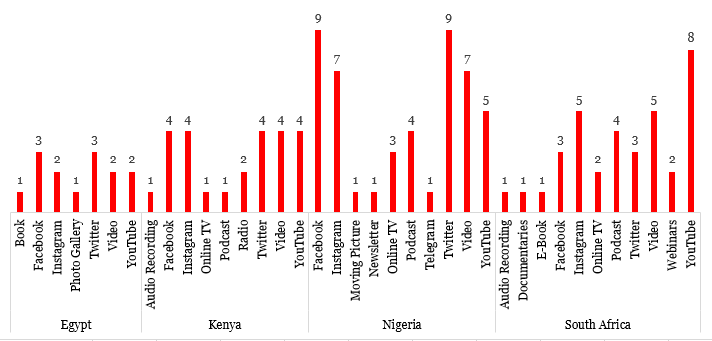

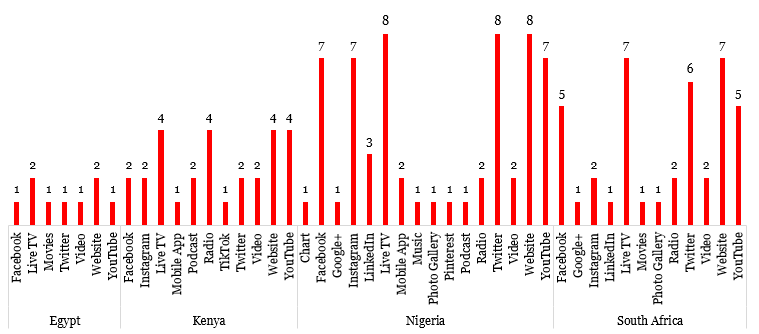

According to a country-by-country analysis, media brands in Nigeria, South Africa, and Kenya fare better in terms of incorporating many emerging technologies than those in Egypt (see Exhibit 1 to Exhibit 3). Egyptian brands, on the other hand, are better at integrating books and movies. The use of Live FM Television Channel on radio station websites is one of the most surprising insights from the selected brands’ convergence with new media. In this regard, one Egyptian radio station was successful in establishing a Live FM Television Channel on its website. This also applies to one Nigerian station and two South African stations. With the strategic placement of podcast and Live TV on websites, radio and television stations are embracing the duo.

Exhibit 1: Select African Countries and Categories of New Media Newspapers Are Converging With

Exhibit 2: Select African Countries and Categories of New Media Television Stations Are Converging With

Exhibit 3: Select African Countries and Categories of New Media Radio Stations Are Converging With