Democratic lawmakers are sharpening their challenge to how the largest U.S. technology companies are consolidating power in artificial intelligence, arguing that a new class of deals risks hollowing out competition while slipping through gaps in antitrust enforcement.

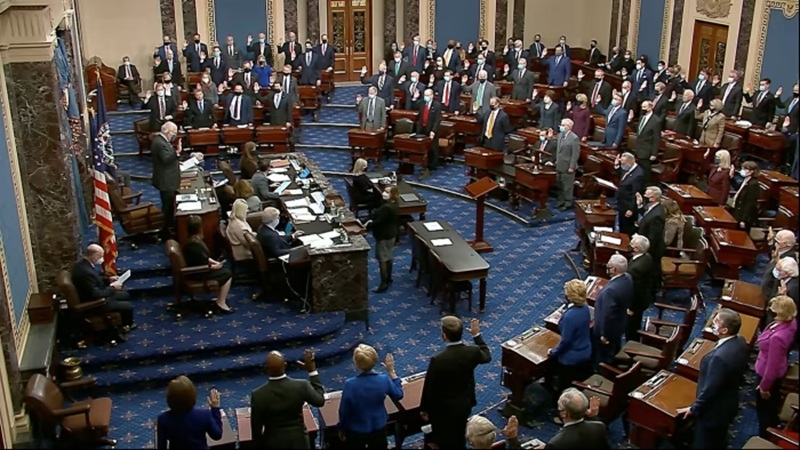

In a letter sent Wednesday to the Federal Trade Commission and the Department of Justice, Senators Elizabeth Warren, Ron Wyden, and Richard Blumenthal urged regulators to closely examine recent AI-related transactions involving Nvidia, Meta, and Google. The senators said these arrangements, which involve paying to bring top executives and engineers from startups into large companies without acquiring the startups outright, may amount to mergers in everything but name.

The lawmakers describe the practice as “reverse acqui-hiring,” a strategy they say allows dominant firms to absorb talent, institutional knowledge, and strategic advantage while avoiding the scrutiny normally triggered by acquisitions. According to the letter, these deals can weaken startups left behind, tilt emerging AI markets further toward incumbents, and narrow the path for genuine competition.

“These deals function as de facto mergers,” the senators wrote, arguing that the economic and competitive outcomes can mirror those of full acquisitions even when corporate control does not formally change hands. They called on the FTC and DOJ to block or unwind such arrangements if they violate antitrust law.

At issue is how Big Tech is adapting its deal-making playbook as regulators take a more skeptical view of large mergers. Rather than buying entire companies, firms are increasingly structuring investments, licensing agreements, or asset purchases that coincide with the recruitment of founders and senior technical leaders. The startup remains independent on paper, but its competitive core is often removed.

The senators highlighted several high-profile examples. Meta’s $14.3 billion investment in Scale AI in June brought co-founder and CEO Alexandr Wang into Meta to lead its AI strategy, giving the company access to one of the industry’s most influential figures without a traditional takeover. Google’s $2.4 billion nonexclusive licensing deal with AI coding startup Windsurf similarly resulted in key leaders joining Google. Nvidia’s $20 billion December transaction to acquire assets from AI chipmaker Groq and hire senior executives followed a comparable pattern.

In each case, the lawmakers argue, the acquiring company gained a strategic advantage while regulators were left with limited leverage to intervene. The concern is not only about market concentration today, but about how these practices could shape the next generation of AI development by starving startups of leadership and momentum.

Industry observers have raised similar alarms. Venture capital investors and startup employees have noted that reverse acqui-hiring can leave remaining teams in a weakened position, with reduced ability to execute on their original vision or attract new funding. While founders and top engineers may receive lucrative compensation packages, the broader ecosystem may see fewer viable challengers to established players.

From the perspective of Big Tech, the incentives are powerful. Competition for elite AI talent is intense, and these arrangements offer a way to secure scarce expertise quickly while minimizing regulatory risk. They also allow companies to place bets across multiple startups through investments and licenses, extracting value even if the startups themselves struggle later.

For regulators, the challenge lies in applying antitrust laws written for an earlier era to transactions that do not fit neatly into existing categories. Traditional merger reviews focus on changes in ownership and control, yet the senators argue that control over talent and knowledge can be just as consequential in AI markets, where human capital and data are central assets.

The letter follows comments in January from FTC Chairman Andrew Ferguson, who said the agency would review whether companies are using such deals to sidestep regulatory oversight. That statement suggested growing awareness within enforcement agencies that AI-driven deal structures may require closer attention.

The lawmakers’ intervention adds urgency to that review. By explicitly framing reverse acqui-hiring as a potential end run around antitrust law, Warren, Wyden, and Blumenthal are pressing regulators to expand how they assess competitive harm. The outcome could shape how aggressively the U.S. government polices AI deal-making at a moment when the technology is rapidly becoming a core driver of economic power.

If regulators move to treat these arrangements as mergers in substance rather than form, it could significantly alter how Big Tech pursues talent and partnerships in AI. If not, the senators warn, the industry may continue consolidating quietly, one executive hire at a time.