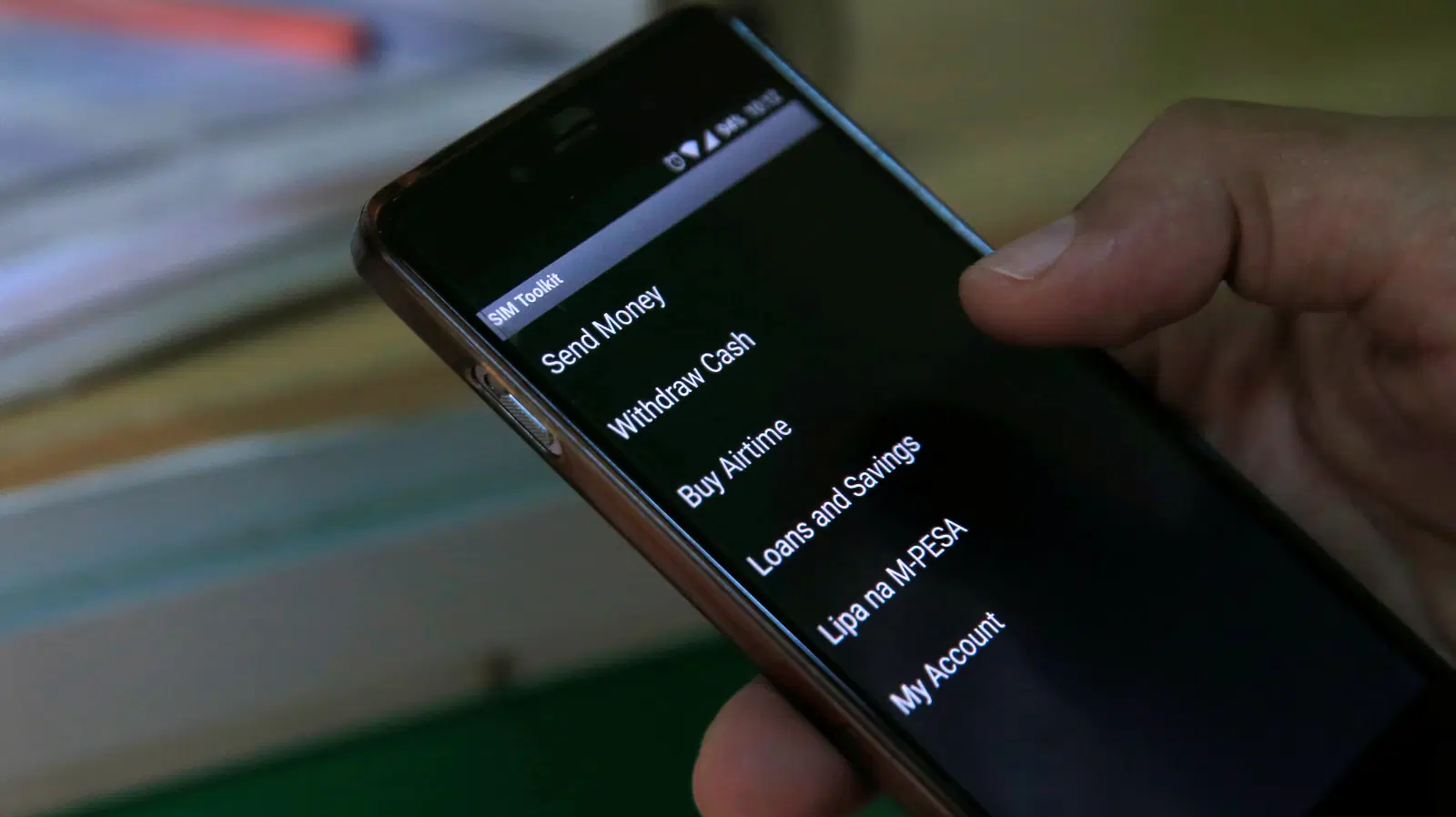

The most prevalent start-up business models are no doubt Fintech start-ups, as they continue to provide solutions to payments, savings, and mobile money transfers. The Global fintech market size has been predicted to reach USD 332.5 Billion by the year 2028.

Fintech company SendSprint, a money switch start-up based in the UK with operations within the US and Nigeria, has launched with a distinctive feature of a $5 flat fee for all transfers.

SendSprint enters the remittance market that is dominated by business veterans such as MoneyGram and Western Union, as well as the comparatively new fintechs like Zepz, Remitly, and Wise.

However, SendSprint’s $5 flat fee for all international money transfers might give it an edge over its rivals. The company targets three preliminary vacation international spot locations like South Africa, Kenya, and Nigeria.

SendSprint is no doubt coming big into the fintech ecosystem, as it has already partnered with Africa’s highest valued start-up, Flutterwave with the company’s valuation at $3 billion.

This partnership is indeed a strategic one as it will help SendSprint to cross-border transfers to 34 of the continent’s 54 international locations. It will also assist the company in rapidly complying with laws in its international locations of operation.

The CEO of SendSprint Damisi Busari, who has been identified as a former staff of Flutterwave, disclosed that the Fintech start-up was set up to connect Africans in the diaspora to their loved ones, by enabling fast, simple, and hassle-free International transfers. From set up to transfer confirmation within minutes of signing up for an account, transfers with Sprint are completed in minutes.

In her words, “We understand the connection that people have with their home countries and the importance of sending money and gifts home to support loved ones. SendSprint is about connecting the African diaspora to their loved ones at home by enabling fast, simple, and hassle-free international transfers as well as an innovative gifting experience.

This is a product for the African diaspora. All of us at SpendSprint understand the multiple demands that Africans living abroad need. Our service recognizes and reflects this”

The company has already launched operations in the UK as its first step, as it plans to expand into the U.S and Canada in the coming months. With SpendSprint’s $5 flat fee for money transfers, as opposed to a sliding scale from other providers, it is safe to say that Africans in the diaspora will not hesitate to try them out and possibly make them their preferred option for money transfers back home.

The company has also partnered with top companies like Jumia, Game, Shoprite, St. Nicholas Hospital, Healthplus Pharmacies, and film house cinema among others.

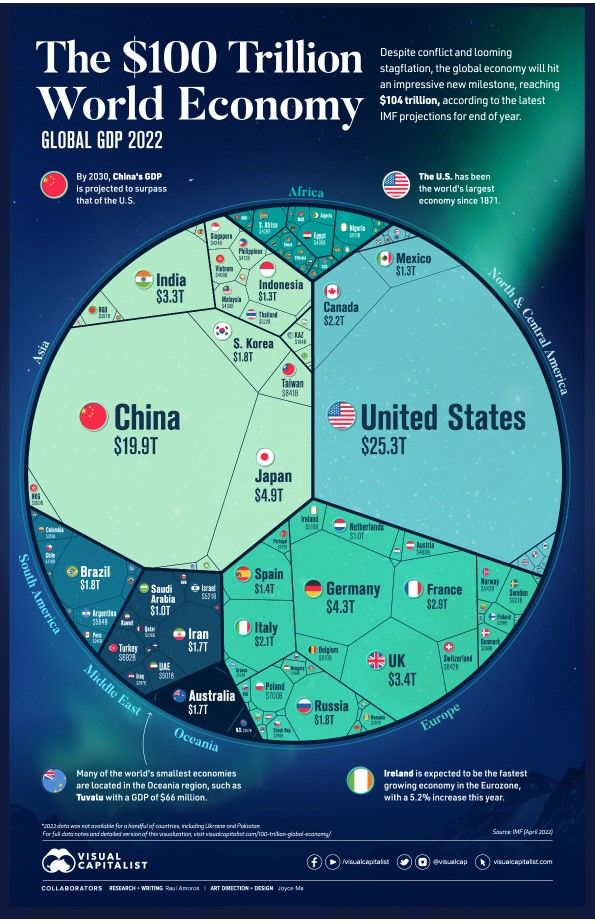

The fintech industry has continued to gain momentous significance in the past few years, as the fintech ecosystem makes up a multi-billion dollar industry, with these start-ups providing high-tech solutions to financial products and services. The fintech market is significantly growing at a fast rate and is expected to reach almost $700 billion by 2030.