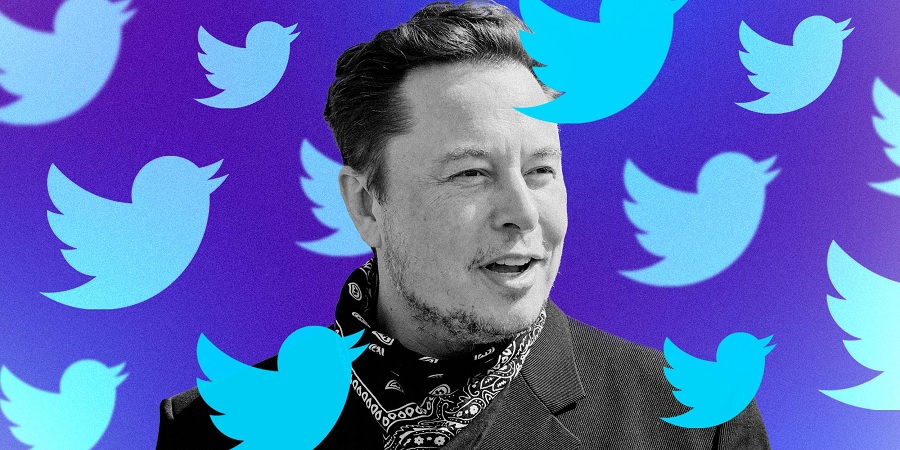

Elon Musk’s push to purchase Twitter appears to have seen a green light following mounting pressure on the company’s board by shareholders to consider his bid, Reuters reported on Sunday citing people with knowledge of the matter.

Musk made a $43 billion takeover bid for Twitter earlier this month after taking 9.2 percent stake in the company. But his bid has faced a hurdle as Twitter board adopted the ‘poison pill’ in an attempt to stop the acquisition.

Twitter co-founder and former CEO Jack Dorsey had joined Musk in criticizing the board for moving to stop the bid.

Musk had asked that Twitter shareholders be involved in the decision of whether to accept his bid or not. Now many shareholders are asking the company to consider the bid, even though they have varying views regarding what a “fair price” for a “deal would be.”

Musk had promised in a letter to Twitter’s board to turn the microblogging app’s fortune around, a message that apparently seems good to shareholders. Reuters reports that many reached out to the company after Musk outlined his acquisition financing plan on Thursday and urged it not to let the opportunity for a deal slip away.

According to the sources, Twitter’s board is expected to find that Musk’s all-cash $54.20 per share offer for the company is too low by the time it reports quarterly earnings on Thursday. Nonetheless, some shareholders who agree with that stance still want Twitter to seek a better offer from Musk.

But that would be challenging because Musk’s $43 billion bid outweighs Twitter’s current $37 billion market capitalization by $6 billion, and he made it clear that it’s his “best and final offer.” However, there is hope that he could be cajoled to add more to the figures, particularly to appease shareholders who had complained that his bid is not enough.

One option available to Twitter’s board is to open its books to Musk to try to coax him to sweeten his bid. Another would be to solicit offers from other potential bidders. While it is not yet clear which path Twitter will take, it is increasingly likely that its board will attempt to solicit a better offer from Musk even as it rebuffs the current one, the sources said.

“I wouldn’t be surprised to wake up next week and see Musk raise what he called his best and final offer to possibly $64.20 per share,” one of the fund managers who is invested in Twitter said on condition of anonymity to discuss private conversations with the company.

The possibility that Musk could win over shareholders with a tender offer had threatened whatever confidence the ‘poison pill’ had brought to the board. The sources cited by Reuters said that the board is concerned many shareholders could back Musk in a tender offer if it doesn’t negotiate with him. While the poison pill would prevent Twitter shareholders from tendering their shares, the company is worried that its negotiating hand would weaken considerably if it was shown to be going against the will of many of its investors, the sources said.

But there is another challenge. Shareholders are divided on what will be the ideal price per share. Earlier this month, Saudi Arabia’s Prince Alwaleed bin Talal, a Twitter shareholder, had tweeted: “I don’t believe that the proposed offer by Elon Musk ($54.20 per share) comes close to the intrinsic value of Twitter given its growth prospects,” in response to Musk tweets on his Twitter bid.

The sources who spoke to Reuters said the price expectations among Twitter shareholders for the deal diverge largely based on their investment strategy. Active long-term shareholders, who together with index funds hold the biggest chunk of Twitter shares, have higher price expectations, some in the $60s-per-share, the sources said. They are also more inclined to give Parag Agrawal, who became Twitter’s chief executive in November, more time to boost the value of the company’s stock, the sources added.

The disparity would be one of the most challenging issues of the deal, if the shareholders don’t quickly reach a consensus on what would be the right price.

Reuters’ sources said ‘short term-minded investors such as hedge funds want Twitter to accept Musk’s offer or ask for only a small increase’. Some of these are fretting that a recent plunge in the value of technology stocks amid concerns over inflation and an economic slowdown makes it unlikely Twitter will be able to deliver more value for itself anytime soon, the sources added.

“I would say, take the $54.20 a share and be done with it,” said Sahm Adrangi, portfolio manager at Kerrisdale Capital Management, a hedge fund that owns 1.13 million shares in Twitter, or 0.15% of the company, and has been an investor since early 2020.

But most of the issues appear to have been sorted out as new information emerges from the negotiation table.

Bloomberg reports Monday morning, citing sources, that Musk is close to sealing a deal. and if talks continue smoothly, a deal could be announced today. It is not clear yet if Musk elevated his price. Musk was reportedly ready to finance his Twitter bid with as much $15 billion of his personal fortune, and has managed to rally the support of some investors who are willing to finance the deal.

Twitter shares moved up 3.5 percent Monday, following the news that a deal could be reached soon.