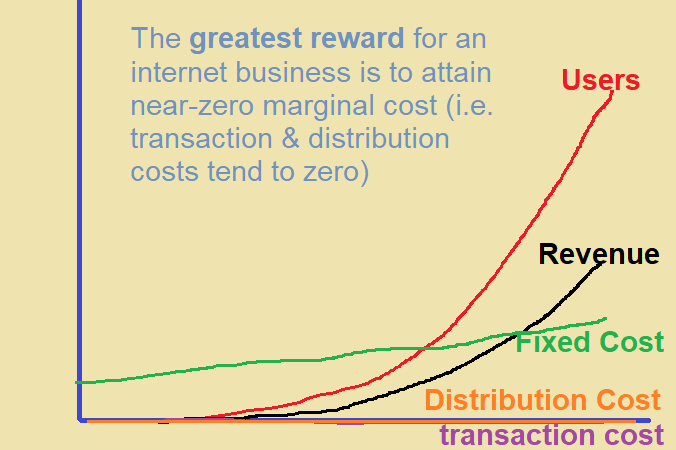

India is intensifying efforts to accelerate its digital economy plan, opening the door wider for diverse investors in the tech industry.

As part of this effort, India has thrown an investment banquet for global chipmakers with 760 billion rupees ($10.2 billion) in incentives. The pandemic ushered in a global chip shortage that has sparked a race between semiconductor companies to expand production. With the increase in semiconductor companies around the world, India, like many other countries, is setting itself up for the industry players to embrace.

The chip program, with its variety of incentives, was approved by Modi’s cabinet Dec. 15 and began accepting applicants on Jan. 1. It covers up to half the initial costs of setting up chipmaking hubs in the country, including those for front-end processes involving wafer fabrication. The Indian government will cooperate with state authorities to build high-tech industrial parks equipped with clean water, abundant power and logistics infrastructure, according to Nikkei.

It added that in addition, India will provide assistance for back-end chip facilities, which handle assembly and testing. It also will support chip-design startups and nurture more talent to build a comprehensive semiconductor industry in the country.

While the program seems attractive, and has the potential to bring chipmakers to India, Nikkei pointed out in the report below, other factors that may hinder it, given that India had been here before.

India’s attempt in the past to attract top chipmakers had only a few players expressed strong interest. One option for the country this time may be to focus first on back-end processes, so it can build a rapport with industry leaders before diving into the more technologically sophisticated front-end processes.

“The response so far has been very good,” Ashwini Vaishnaw, India’s minister of electronics and information technology, told Bloomberg TV after the package was announced. “All the big players, all the significant players, are in talks with Indian partners. Many of them are directly wanting to come and set up their units here.”

Vaishnaw predicted that in two to three years, several semiconductor plants will start production and a display panel plant will be nearing completion.

Rhandir Thakur, the head of Intel’s foundry operations, tweeted later that he was glad “to see a plan laid out for all aspects of the supply chain: talent, design, manufacturing, test, packaging & logistics.”

“Intel — welcome to India,” Vaishnaw responded. Though the exchange triggered speculation that Intel looks to form a new chipmaking hub in India, the company said it has no new plans in the country to announce at this time.

Despite the buzz, doubts exist over whether monetary incentives alone will be enough to bolster India’s chip supply. The only markets in Asia to establish a domestic chip industry that includes front-end manufacturing are Japan, Taiwan, South Korea, Singapore, Malaysia and mainland China.

India has said that securing the land, water, electricity and talent needed to operate chipmaking facilities will be a national priority. But its past attempts to attract major foreign chipmakers often fell through over one of these elements, like opposition from residents over land use, or temporary changes to state labor rules.

Labor relations can be a challenge in India. Hon Hai Precision Industry, also known as Foxconn, and Wistron — both Taiwanese assemblers of iPhones — have been mired in worker protests over labor conditions in the country.