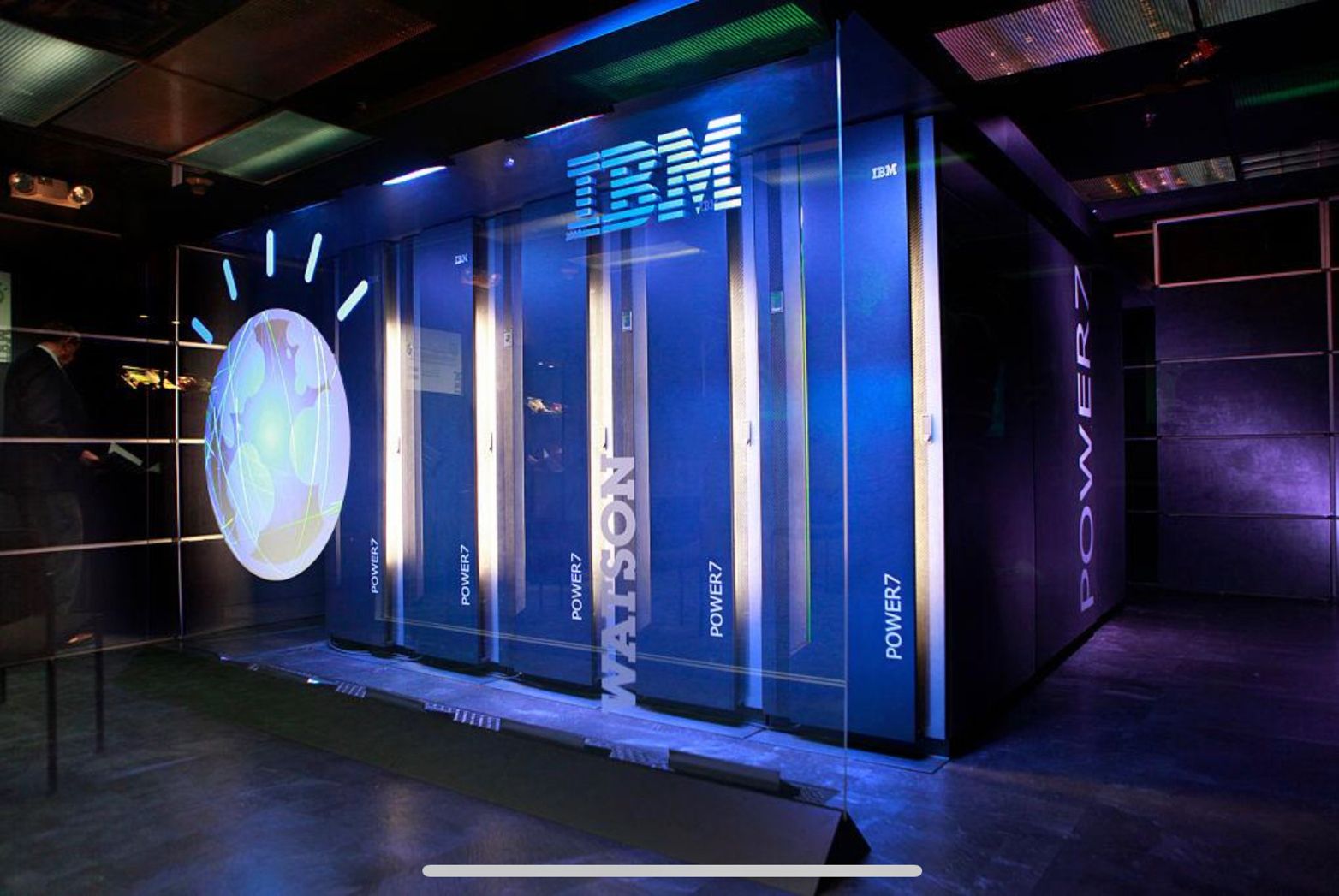

IBM Watson Health is dead – the unit will move to the hands of Francisco Partners, a private equity company. In Tekedia Mini-MBA, I had used IBM as a case study on how NOT to build a modern technology company. Sure, who is this village boy complaining over one of America’s finest companies? Fair question!

:”IBM’s Watson Health is being sold for parts. The technology giant has agreed to sell the division’s data and analytics assets to private equity firm Francisco Partners. Terms weren’t disclosed, although Bloomberg values the deal at more than $1 billion. Launched in 2015, Watson Health’s goal was to revolutionize medicine through AI. After years of pricey expansion — it spent more than $4 billion on acquisitions, per Axios — and reports of ineffectiveness, the unit scaled back its ambitions under CEO Arvind Krishna.”

About 15 years ago, IBM, Microsoft and Apple could be seen as peers. The story was always IBM filing most patents. But as I noted in my courseware, IBM was losing the most important driver in modern markets: the right business model which any technology could cushion. Largely, having the technical quality was not enough, deploying the right business model was supreme.

The former CEO of IBM, Rometty, was grossly deficient on that business model redesign. The company lost a decade and will really work hard to thrive. Today, as Apple hits close to $3 trillion, IBM is stock in a market cap of $120 billion.

But there is hope: the new CEO is transforming the company, to align its model on what the digital age demands. I will explain these deeper in the updated courseware for the next edition of Tekedia Mini-MBA.

As IBM goes through its metamorphosis, Intel is also undergoing its own. I had written how TSMC disintermediated Intel’s business model: “Apple had taken its Mac chips from Intel, and would design and fabricate with possibly TSMC or Samsung since other players like GlobalFoundries remain weak. Other companies will do just that. As that happens, the largely closed system of Intel will begin to make way for the ARM business model. Provided there is TSMC to make the chips after circuit designs, most companies will go all the way to designing internally and sending to TMSC to fab.This was not possible in the past as TSMC was weak, but over the last few years, TSMC has evolved to be as good as Intel, if not better.”

In other words, TSMC’s business model was better than Intel’s. Interestingly, Intel has since opened its factories even to competitors under a new business model framework called “contract manufacturing”. With the new Ohio investment, it is going all the way to battle with TSMC and Samsung Electronics..

Intel will spend $20 billion to build two new chip factories outside Columbus, Ohio, boosting the company’s status as a maker of cutting-edge semiconductors along with the nation’s production capacity. Demand for chips has grown with the pandemic, exacerbating a supply shortage that began with the shift of manufacturing to lower cost markets in Asia. Intel, overtaken by South Korea’s Samsung Electronics as the biggest chip maker, has already invested almost $100 billion in European manufacturing and plans other U.S. facilities in the Southwest.

— press release

IBM (NYSE: IBM) and Francisco Partners, a leading global investment firm that specializes in partnering with technology businesses, today announced that the companies have signed a definitive agreement under which Francisco Partners will acquire healthcare data and analytics assets from IBM that are currently part of the Watson Health business. The assets acquired by Francisco Partners include extensive and diverse data sets and products, including Health Insights, MarketScan, Clinical Development, Social Program Management, Micromedex, and imaging software offerings.

The transaction is expected to close in the second quarter of this year and is subject to customary regulatory clearances. Financial terms of the transaction were not disclosed.

“Today’s agreement with Francisco Partners is a clear next step as IBM becomes even more focused on our platform-based hybrid cloud and AI strategy,” said Tom Rosamilia, Senior Vice President, IBM Software. “IBM remains committed to Watson, our broader AI business, and to the clients and partners we support in healthcare IT. Through this transaction, Francisco Partners acquires data and analytics assets that will benefit from the enhanced investment and expertise of a healthcare industry focused portfolio.”

Since its launch over 20 years ago, Francisco Partners has invested in over 400 technology companies, making it one of the most active and longstanding investors in the technology industry. Francisco Partners has extensive experience in healthcare technology and its healthcare investments have focused on companies that are leveraging technology to provide innovative products and solutions to the healthcare ecosystem including patients, providers, payers, pharma, life sciences and governments. Select current and past investments in the sector include Availity, eSolutions, Capsule, GoodRx, Landmark, QGenda, Trellis, and Zocdoc.

“We have followed IBM’s journey in healthcare data and analytics for a number of years and have a deep appreciation for its portfolio of innovative healthcare products,” said Ezra Perlman, Co-President at Francisco Partners. “IBM built a market leading team and provides its customers with mission critical products and outstanding service.”

Justin Chen, Principal at Francisco Partners, added, “Partnering with corporations to execute divisional carve-outs has been a core focus of Francisco Partners. We look forward to supporting the talented employees and management team, helping the standalone company focus on growth opportunities to realize its full potential, and delivering enhanced value to customers and partners.”

Under the terms of the agreement, the current management team will continue in similar roles in the new standalone company, serving existing clients in life sciences, provider, imaging, payer and employer, and government health and human services sectors.

Like this:

Like Loading...