The first attack was on September 13th, 2017. The second was on December 15th, 2021. On the first occasion, my sin was that I checked email messages from clients and colleagues. Before my very eyes, all the files and programmes in the operating system were damaged with the Lukitus. Hackers brought ‘Operation Lukitus Dance’ to my comfort zone. Lukitus formed from Lukko, a Finnish word danced with me for over 7 days.

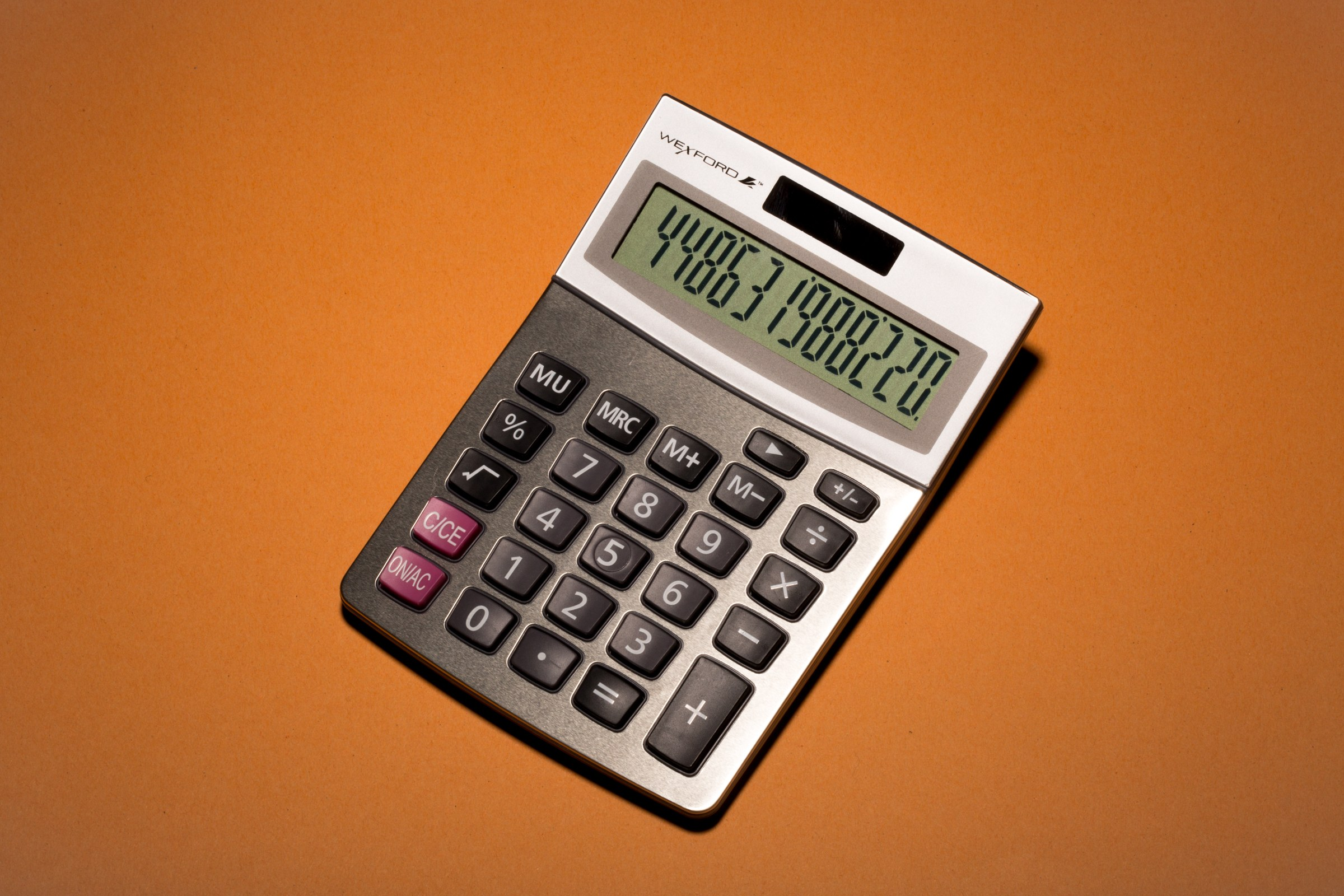

The developers of the Lukitus felt that the best they could do to me is to hold on to my over 7,000 files created in the last 4 years through encryption and generated 352 threats on the PC. To decrypt all the files, developers requested $3,000 ransom!

Shgv is the name of the second virus. After several reviews of my system using a number of tools, I discovered 819 threats with the severity level at 70%. The people behind this want $980 before they could decrypt my over 100, 000 files created since 2017. Within few minutes I lost files worth over N10,000,000. Over 20 book manuscripts and hundreds of academic and applied research documents were lost.

It is ridiculous that your single action will deny a number of people and businesses from drawing significant insights from data-driven articles [with over 200,000 words] prepared for Tekedia.

As local and foreign engineers continue working on the system with possible solutions, I want to state it again what I said in 2017, you hackers can only encrypt my documents not my brain because God knows how He wired it and how it will be used.

By His grace, I will bounce back!