Both the PEPE coin price and the Dogecoin price have shown signs of revival in the past week. Although they remain highly volatile, the altcoins are known to provide high returns to those who invest at the right time.

However, the risk associated with them is very high. This is why investors are now looking at sustainable and use-case-oriented projects that deliver actual value in the market. One such newcomer in the real estate tokenization crypto industry is Avalon X (AVLX).

Its use case as a real estate-backed cryptocurrency is undoubtedly very interesting on its own. However, what is driving viral growth to this project is its $1M crypto giveaway. Below is a detailed look at PEPE and Dogecoin price predictions, and also Avalon X’s potential as one of the top new crypto projects of 2025.

Why are PEPE and Dogecoin Prices Going Up?

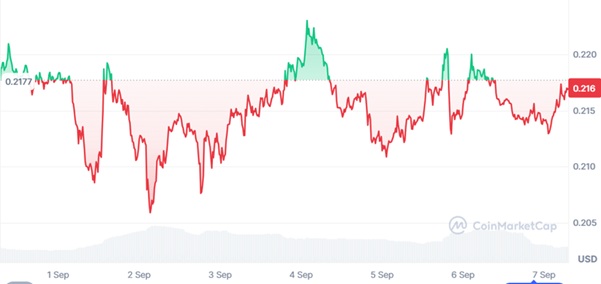

Memecoins remain as risky as ever. Recent market data shows Dogecoin price moving around the $0.21-$0.24 range. It has gone up by over 12% in the past week, and the trading volumes are also seeing a massive increase. This may reflect retail flows rather than fundamental acceptance in the market.

PEPE price has also experienced gains of over 6% in the past week. It currently trades at $0.00001039 and faces fast volatility. Making a price prediction for these memecoins is never easy. They are generally dominated by whale activity and overall market conditions.

$PEPE broke back above ..0010 and the 200 days moving average.

With bullish Q4 and rate cuts, this is likely how the price will for the rest of the year. pic.twitter.com/DzvQJ6Um7u— Plazma (@Plazma0x) September 8, 2025

This is why investors now trust crypto backed by real-world assets. The RWA industry is also growing, as its utility can generate organic demand, which in turn creates sustainability.

This creates an environment where real estate-backed cryptocurrency projects can get hold of larger and more durable investment flows.

What the $1M Avalon X Giveaway Actually Does

It is more than a marketing stunt. The Avalon X giveaway (a $1M crypto giveaway) is designed to get viral and build a community. Giveaways often encourage users to participate in the activities, which then helps the ecosystem grow.

Moreover, there is also a crypto townhouse giveaway, which just requires a minimum investment of $250 in AVLX coins. This fully deeded townhouse is located in the gated Eco Avalon development.

Moreover, investors rightly worry about presale execution. Avalon X crypto solves this big problem by putting out a formal CertiK audit report, showing security checks and ongoing monitoring. This builds practical trust for both retail and institutional buyers.

Beyond blockchain technology, the Avalon X token is directly tied to Grupo Avalon’s real properties in the Dominican Republic. That operational backing gives further credibility to the project. Investors are impressed by the fact that Avalon X real estate crypto links token utility to hospitality services, discounts, and membership perks.

What Does The Avalon X Presale Offer?

Avalon X has a capped 2 billion supply and, along with that, it has deflationary mechanisms and staged presale pricing. The presale prices start at $0.005 in Stage 1, and a 10% bonus is currently available to all. These low prices, along with the active offers, essentially reduce the cost of capital. This will help investors looking for high ROI in the RWA crypto presales market.

In a market where Dogecoin price prediction and PEPE price scenarios are primarily run on sentiment, AVLX’s problem-solving tech makes it one of the best options for those looking to invest in real estate crypto.

Join the Community

Website: https://avalonx.io

$1M Giveaway: https://avalonx.io/giveaway

Telegram: https://t.me/avlxofficial