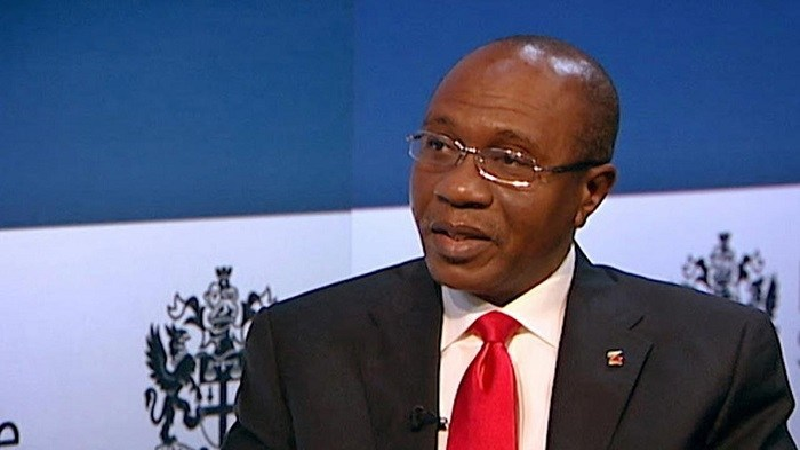

The Central Bank of Nigeria (CBN) noted: “the Global Standing Instruction (GSI) started with personal accounts but we are expanding to corporate accounts and microfinance banks. We understand that an individual can take a loan with commercial banks and choose not to fund his account and take his money to OFI [Other Financial Institutions]. Microfinance banks are going to be part of the Global Standing Instruction (GSI) policy but that phase would come gradually”.

Simply, the apex bank of Nigeria will expand GSI to corporate accounts and microfinance banks in the country: “Standing Instruction (GSI) policy is meant to facilitate improved credit repayment culture in the country; reduce non-performing loans (NPLs), and promote watch-listing of chronic loan defaulters in the Nigerian Banking System”.

In other words, your company cannot borrow from Bank A and intentionally refuses to fund the account therein while doing banking with Bank B. With this new playbook, Bank A can go after your balance in Bank B. This is good policy in a trust-challenged ecosystem.

But it opens risks to company directors. In Nigeria, corporate accounts are largely tracked in banks by the BVNs of the directors, and not necessarily by the Corporate Affairs registration (CAC) numbers. So, if you are a director in any company with your BVN in the bank account, this is the time to ask questions even if you are not actively running that business!

-

The Financial Policy and Regulation Department of the Central Bank of Nigeria (CBN) announced the operational guidelines for the new policy for individual bank customers in the country in circular No. FPRD/DIR/GEN/CIR/07/056 to all banks and other financial institutions on July 13, 2020.

-

The CBN released recommendations for all banks and other financial institutions on August 28, 2019, to ensure successful implementation of the GSI process, including eligible loans given by banks.

-

Under the GSI, a bank client will no longer be able to accept a loan or credit from one bank and refuse to pay it back while maintaining many other bank accounts with sufficient credit balances to pay off the amount owed to the first bank.