Nigeria has to really do more for us to build a promising future. In population, the United States has about 120 million more people than Nigeria. That is where any metric breaks down. I was just going through the profits of major US banks and I became intrigued: largely the profit of one American bank in mere 3 months can buy all the banks traded in the Nigerian Stock Exchange.

Bank of America’s profit rose 58% to $7.7 billion; Wells Fargo’s profit increased 59% to $5.12 billion; Morgan Stanley notched a $3.7 billion profit and Citibank posted a $4.6 billion profit for the three-month period that ended in September, IN News summarized.

Nigeria’s most valued bank, GTBank*, has a market cap of about $1.6 billion. If you combine all of the banks, you will not get up to $6 billion which is well below the market cap of South Africa’s Standard Bank Group.

Sure, you cannot compare a $21 trillion economy with a sub-$500 billion economy. But we need to pay attention to these numbers to be motivated to do the needful. And that “needful” must include a fundamental redesign on how we deploy state resources. For all the entrepreneurial festivals happening in Nigeria, without foreign capital, we will not have these growing startups. If that is the case, do we need to change our tax code to make those who have money to invest in productive things in Nigeria?

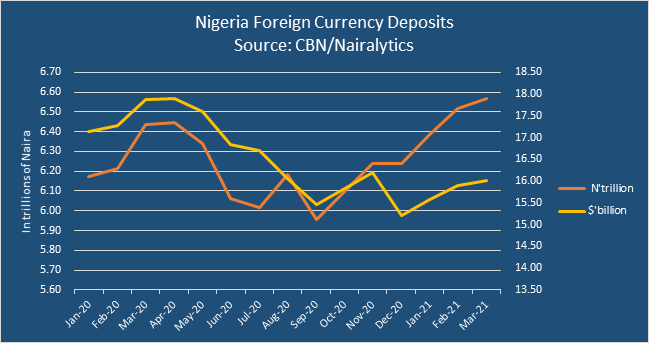

Why am I writing this? The news is that Nigeria has $16 billion in domiciliary accounts (about $4.3 billion are retail deposits) in our banking system. That tells you that Nigeria has capacity but we are not deploying productive assets to ramp up growth: “Nigeria has an estimated $16 billion in domiciliary accounts of commercial and merchant banks, data from the Central Bank of Nigeria reveals. We assumed an official exchange rate of N410/$ based on NAFEX rate used at the Investor and Exporter window. According to data contained in the apex bank’s statistical bulletin, Nigeria had a total domiciliary account balance of N6.566 trillion as of March 2021 which when converted to dollars at the official rate of N410/$1, translates to about $16 billion.”

I am very confident that a tax system that rewards productive investment will release capital in the economy and in the process build up the economy. When people prefer to put their money in the bank instead of investing, we can assume that our system is not working optimally.