Good People, this a pre-event alert to block the date/time for the 5th edition of First Bank Fintech Summit. Yours truly will keynote this year’s one and I will be speaking on Open Banking and the grand unification of financial services across many dimensions. The Summit is an event geared towards bringing together the finest and most innovative subject matter experts who are at the forefront of digital innovation both locally and on the global stage. The schedule is here.

Vedantu, Indian Edtech Startup, Raises $100m to Become A Unicorn

As China’s crackdown on its tech industry extends to edtech, spooked investors appear to be turning attention to another huge market for online education – India.

Vedantu, an edtech platform has raised $100 million in a Series E round, making it the latest Indian startup to become a unicorn. The fund also marks another milestone for India’s online learning industry.

The round, which pushed its value to $1 billion up from $275 million early last year, was led by Singapore-headquartered — and Temasek-backed — private equity firm ABC World Asia. The startup said the new round was “strongly” supported by existing investors Coatue Management, Tiger Global, GGV Capital and WestBridge.

Based in Bangalore, Vedantu offers live and interactive courses for students in grades six through 12. Through partnerships with Airtel and Tata Sky that enables it to offer its courses on their respective satellite cable TVs, the startup offers a large library of lessons at no cost to students.

In July, China extended its tech sector reforms to edtech, asking companies in the industry to go non-profit. The move has wiped over $100 billion in China’s online learning industry and forced investors to turn their attention to other places.

India, with a booming digital market that has been enthusiastically spearheaded by Prime Minister Nerandra Modi, has become a favorite destination for investors looking for edtech markets to put their money. The effects of COVID-19 in the country has also spurred the number of students who have switched to online learning, pumping the growth potentials of the edtech sector.

India has over 250 million school-age population, the largest in the world. The country’s edtech user base saw a sharp spike due to COVID: total users grew 2x, from 45 million in 2019 to 90 million in April 2020, analysts at Bernstein wrote in a report to clients earlier this month.

Vedantu says it has amassed over 35 million monthly active users, and as of last year, had 200,000 paying customers. Vamsi Krishna, co-founder and chief executive of Vedantu, told TechCrunch in an interview that paying subscriber figures is expected to more than double this year. The startup’s revenue has also grown more than 4x in the past one year, and the current annual run rate is around $65 million, he said.

While India booms with millions of students, the quality of education and its affordability have become two major challenges. Online tutors are now working to fix the challenges.

Besides Vedantu, India is home to other online learning platforms such as Unacademy and Byju’s, which operates an eponymous digital reading platform for kids aged 12 or younger. The company, which in July, acquired Epic in a $500 million deal, holds the country’s most valuable startup status.

Krishna said Vedantu‘s goal is to fill the vacuum in India’s education sector not marketing, (explaining why the startup isn’t funded regularly) and it will keep innovating in its own pace to achieve that.

“You have to look at our genesis. We were already running a successful education venture. The reason why we started Vedantu was to solve the challenges teachers and students were facing. Having spent 16 years now in the education space, we know that creating a significant impact takes time. So our orientation has always been long-term,” he said.

Vedantu has organically amassed some users in over 47 additional countries, and has been looking for opportunities either in merger or acquisition, to expand its services.

“As long as you are able to innovate for students and deliver value, nothing can prevent you from creating a long-term sustainable company. You can’t afford to keep getting distracted with what others are doing and how their revenue or valuation is growing. This is what we have been telling our team from the beginning,” he said.

Per TechCrunch, analysts at Bernstein estimate India’s edtech market to be worth $126 billion by next year, up from $63 billion in 2016. Spending on the K12 education market is expected to jump to $55 billion by 2022 and the post-K12 education market is projected to hit $71 billion.

In a statement, Sugandhi Matta, chief impact officer at ABC World Asia, said, “Vedantu embodies our investment themes of providing better access to quality education and using digital technology to improve lives and livelihoods. In India, online education has the potential to extend the scope of ‘right to education’ to students in the underserved community and capture the ‘next half billion’ income group, representing over half of the country’s student population.

Vedantu said it plans to use the newly raised funds to expand its offerings aimed at students in grade one to five.

The Unicorns And Wealth of Africa

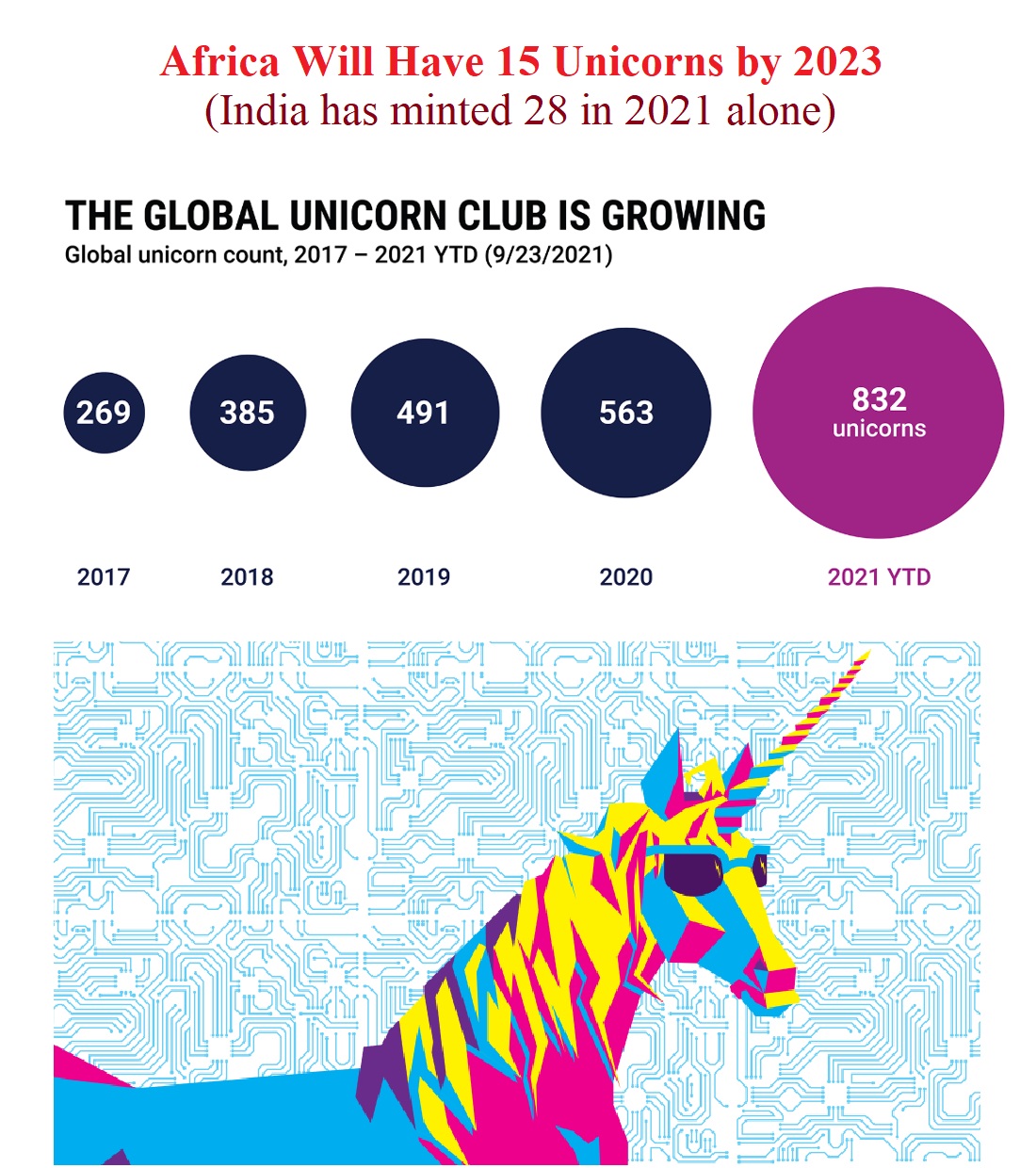

This is the global roll call and the reason why we started Tekedia Capital. Technology is the accelerant that will advance all industrial sectors because every business is increasingly a technology business. Africa* has five unicorns as I write: Interswitch, Andela, Flutterwave, OPay, and Wave.

I expect this number to hit 15 by the end of 2023 (India has minted 28 so far in 2021). Andela is another non-fintech in that list after Jumia, an ecommerce, until it exited the private club. MENA’s Careem which Uber acquired was also in that club. Largely, by 2030, some of these founders will become the new $100 million club owners just as the people on this list.

Learn what we are doing at Tekedia Capital here.

Tekedia Capital offers a specialty investment vehicle (or investment syndicate) which makes it possible for citizens, groups and organizations to co-invest in innovative startups and young companies in Africa and around the world. Capital from these investing entities are pooled together and then invested in a specific company or companies.

We invest in mainly technology-anchored companies and are sector-agnostic which means those companies could be operating in any industry, including finance, real estate, education, health, logistics, etc. The opportunity is open for individuals in Africa, Africans in diasporas, global citizens in any place in the world, investment groups and organizations around the world.

The Message from ex-Central Bank Governor on Nigeria’s Economic Readiness

The ex-governor of the Central Bank of Nigeria, Alhaji Muhammad Sanusi, delivered this message during the closing ceremony of the Kaduna Investment Summit, according to Daily Trust.

Only eight of every 100 Nigerians who start primary school complete university.

“Globally, work is being redefined; 30 to 40 per cent of workers in developed economies will need to significantly upgrade their skills by 2030. And what are the major drivers of this redefinition? ICT and remote working, which we have seen even here with COVID-19.

“There is increased automation and artificial intelligence. Very soon, robot will take over work in most countries and those who would have job are those who operate the robots, manufacture the robots or service the robots.”

Alternative energy sources

“A few months ago, Germany was able to produce enough renewable energy for the entire country’s need. Today, we are having difficulties selling Nigerian oil. So, not only are we having problems producing, even when we produce, the market is not there.

“So, this is forcing a change, and for us a country that depends on oil, things need to change.”

Skill creation for the young people

“Data is one of the most crucial support that can be given to entrepreneurs for innovation,”

While calling on government to encourage market access, he said, “If Kaduna state government continues with its e-government plan, it will be a big market itself and it will encourage investment which are all knowledge economy aspiration and a shift in government spending to match the priority.”

Solving Electronic Frauds In The Nigeria’s Banking Sector

Penultimate week, I rigorously engaged one of my experienced colleagues in an all-inclusive talk as regards the banks, financial institutions generally.

It’s noteworthy that, as tech experts, we were more concerned about how much and far the key players of the said sector had thus far fared while trying to inculcate tech-driven measures into their extant policies. As a policy analyst, I took time to x-ray the banking policies.

As some individuals in a certain quarter would – albeit ignorantly – strongly dispute the ‘goodness’ and remarkable activity of the banking sector, some others will ceaselessly defend the ‘inevitable role’ of the industry even with the last drop of their blood.

The above argument was the basis of my discussion with the colleague. In our individual understandings, we tried to examine the merits and demerits of the financial institutions at large, especially with the advent of the digital age.

Bank as an institution has indeed tremendously enabled mankind to jettison the archaic pattern of saving money and other valuables, thereby averting a whole lot of troubles usually characterized by the said method.

The bank as a sector has in recent times obviously contributed to countless economic growth recorded by both individuals and entities, particularly a given country or bloc as might be the case.

Regarding savings, the bank creates an unquantifiable opportunity for the human race, businessmen and traders in particular, to on a daily basis safe-keep their monies and assets towards experiencing a better ease of doing business or trading.

The bank has thus far arguably saved people from a lot of tensions, because it has created and maintained an avenue where anyone, regardless of status, can easily deposit his/her money without exercising any element of fear concerning safety.

With the introduction of the ongoing Consolidation Policy of the Central Bank of Nigeria (CBN) as ably initiated during the reign of Prof. Charles Soludo, it is now certain that any amount of money/asset kept, or deposit made, in any commercial bank domiciled within the country is certainly safe.

The reliability of commercial banks are presently well guaranteed, and such can at any time be proven by any financial or policy analyst. This is the sole reason people from all walks of life can be seen currently trooping into banks to make deposits of valuables.

And with the existence of the newly introduced Cashless Policy by the apex bank, people can now make transactions from the comfort of their respective bedrooms, with ease.

The cashless policy, with the aid of tech-driven measures, has really assisted the banking sector in curtailing several inconveniences and stresses faced by their personnel as well as the clients.

The aforementioned policy has equally hitherto helped the sector to alleviate all sorts of physical social ills usually experienced by the banking industry, such but not limited to as armed robbery, to a reasonable extent.

Before now, with much cash flow in circulation, armed robbers had greater opportunity to physically invade people’s privacies, be it offices, shops, residences, or on the roads, thereby forcefully making away with their hard-earned money.

However, it’s very imperative to acknowledge that – on the contrary – the advent of the Information Technology (IT) mechanism in the banking sector has constituted tremendous unbearable non-physical ills popularly known as electronic/cyber frauds. These crimes aren’t physically perpetrated like in the case of armed robbery.

Electronic fraud, as the name implies, pertains to all kinds of ills emanating from the use of electronic gadgets or equipment to include computer and cell phones, among others.

The IT remains the major aid of the ongoing modern system of banking. It’s worthy of note that the said mode of technology cannot be possible without the use of electronic devices and mechanisms such as computer and the internet, as well as networking.

This electronic methodology, since inception in the banking sector, has profusely been characterized by countless frauds. It’s worth noting that the electronic ills can only be possible via a manipulation called hacking.

It’s only when one’s electronic belonging – including personal and bank accounts – is hacked, that the criminal would have the opportunity to perpetrate any type of intended crime that could cost the unsuspecting person a fortune. We must come into terms that anybody can fall victim of this dastardly act.

So, we can at this point wholly comprehend that though the advent and sustenance of the IT in the banking sector has majorly assisted in solving a whole lot of plights and crises, it has made millions of people victims.

In various fora and platforms, I’ve extensively analyzed several issues and ills pertaining to electronic (internet) hacking. In my candid words (analyses), I’ve taken time to advise that, for us to enjoy or appreciate the use of electronics, we must be well and aptly prepared to make, introduce and maintain sound policies, either as separate individuals or entities.

As a group of people called Nigeria, the corporate body that’s in charge of the country’s banking system in its entirety must at this digital age be more concerned on how to strategize with a view to ensuring that the existence of tech-driven measures doesn’t end up causing more harm than good to the entire system.

The above can only be duly achieved by introducing and maintaining a wholesome and reliable policy-making unit in the institution. Hence, the CBN mustn’t relent in making this happen within its jurisdiction.

As these merchants try to make profit in the lucrative banking business while helping the public safeguard their fortunes or treasures, they as an institution must equally create corporate guidelines that would help their clients avert various troubles liable to befall them.

On corporate policy, banks must be well tutored on the compelling need to create more secured online Apps or softwares by engaging reputable IT experts. Similarly, a standard IT unit ought to be maintained in their respective branches.

On individual policy, the users of the computer Apps must on the other hand be thoroughly sensitized on how best to protect their online transaction identities and details at all times. This measure must equally involve respected and reliable professionals.

The bitter fact remains that, as sophisticated technologies evolve, the criminally-minded persons or entities in the system would strive to take advantage of the development at the expense of the unsuspecting users.

This is the reason corporate bodies and individuals are regularly advised to endeavour to be wiser than the criminals just as mankind is being advised by the Holy writ to be smarter than the devil. Hence, the educational institutions, on their part, must invariably be ready to inculcate the required expertise into the IT learners or trainees.

Let’s be driven by the fact that though we are not anymore – or have left – where we used to be, we still have an enormous distance to cover towards arriving at the desired destination.