Out of 166 global currencies ranked by Xe, the world’s favourite currency site, in terms of popularity, Nigeria is in 58th. The Africa’s most populous country’s currency is behind Kenyan Shillings, Egyptian Pounds, Tunisian Dinars and Moroccan Dirhams. Over the years, Naira performance against the most popular currencies such as US Dollar, Euro and Great Britain Pounds has been a game of ups and downs. However, being popular does not mean being valuable in the world. World Data notes that between January 2015 and September 2021, the exchange rate for 1000 NGN developed from USD 5.03 to USD 2.43, indicating that for 81 months it fell by 51.7%.

During the challenging periods [days, months and years], the Central Bank of Nigeria made and still making a number of strategic decisions to salvage the currency total collapse. In spite of this, it appears that the decisions have not really yielded desired results as the currency continue to dwindle every day.

From the stakeholders in the banking and financial sectors, and citizens to the government, there are have been counter and alternative arguments on how the stakeholders are sabotaging various policy measures of the apex bank. It has reached a stage that if necessary steps are not taken, manufacturing sector and other essential sectors of the economy would suffer greatly, when it becomes practically impossible to access forex for importation of essential raw materials and manufactured goods.

In its efforts of making the currency strong, the CBN recently outlawed operators of the Bureau De Change across the country. This yields little or no results as the currency refuses to bounce back and be valuable among other currencies in the world. Some days ago, the apex bank after its Monthly Meeting figured Aboki FX, a platform that provides foreign exchange information to the public using gathered data from the BDC, as “manipulator” that contributes to the dwindling of the currency.

As the CBN and the platform exchange statements on the issue, our analyst examines the CBN’s position through the public information seeking behaviour in relation to foreign exchange features. The submission from the CBN and national newspapers has been that the reportage of Aboki FX’s daily information and application by the public [buyers and sellers] facilitate the fall of Naira every day. Our analyst verified this proposition and analysis reveals a number of surprising results and insights.

Aboki FX’s Presence on the Internet

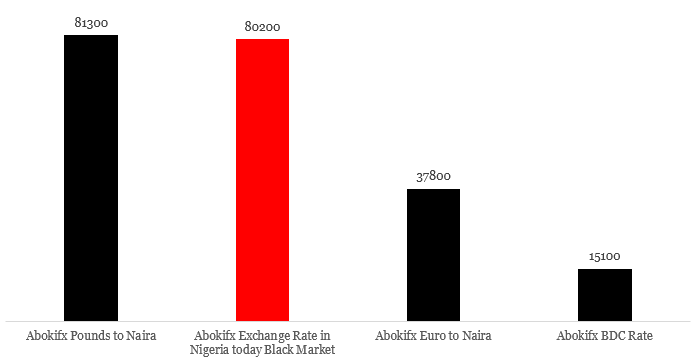

In the first instance, there is a quite volume of publications about activities of Aboki FX on the Google Search Engine. Our check reveals that in relation to Aboki FX, people are also searching Abokifx BDC Rate, Abokifx Euro to Naira, Abokifx Pounds to Naira, Abokifx Exchange Rate in Nigeria today Black Market and CBN Exchange Rate. While over 200,000 publications are available for understanding Abokifx, there are over 2 million publications for the public to understand foreign exchange rate within the context of the Central Bank of Nigeria in line with other sources.

Exhibit 1: Aboki FX on Google Search Engine

With these, our analyst notes that there is no way the apex bank would not have issues with Aboki FX because of the huge volume of existing information regarding exchange rate understanding via Black Market, which indicates that people are getting relevant information through the platform. This position is further reinforced with the rate at which the public sought information between January 1 and September 18, 2021 [see Exhibit 2 and Exhibit 3].

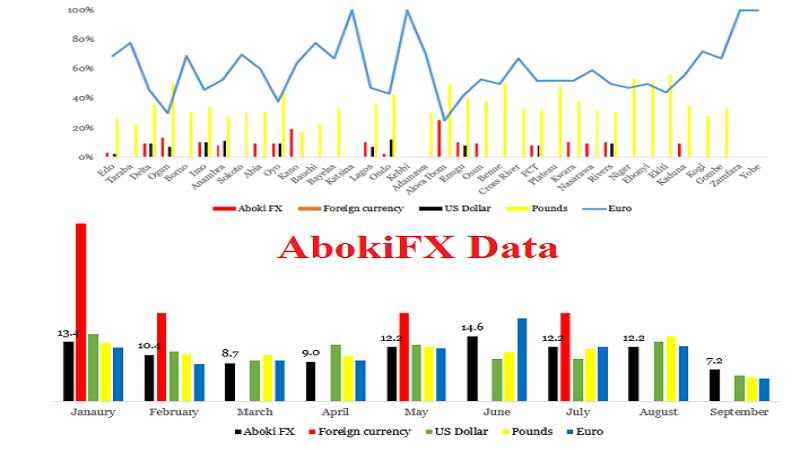

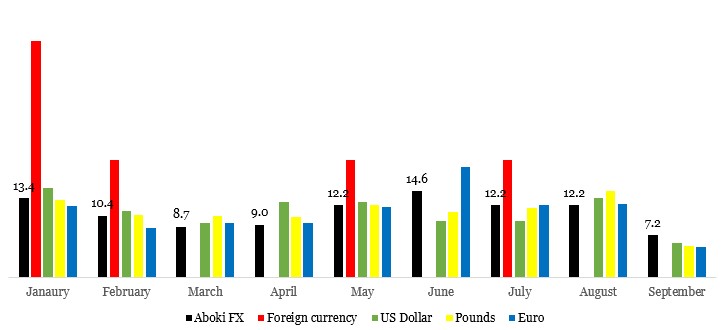

Exhibit 2: Nigerian Population Information Seeking between January 1 and September 18, 2021 Across Select Indicators

Exhibit 3: Nigerian Population Interest Across Select Indicators by Month

Naira’s Hobbling in the Midst of Public Information Seeking

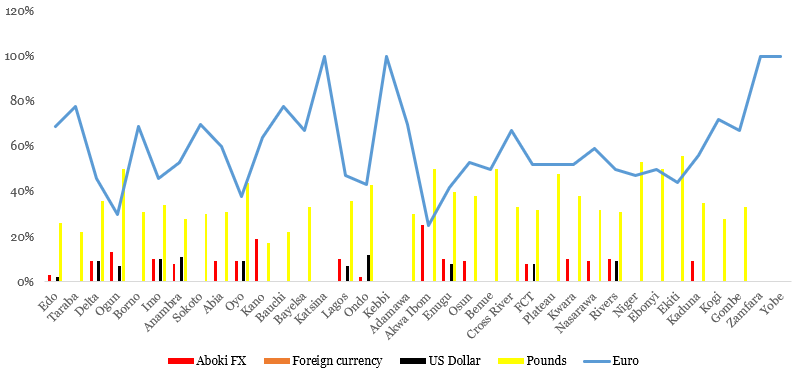

Analysis further shows strong a connection between the public interest in Aboki FX and Euro [90.9%], Pounds [73.9%] and US Dollar [52.6%]. In terms of the extent to which public information seeking using Aboki FX platform facilitates their interest in these currencies, Euro and Pounds are also better off than the US Dollar. With this, we expect Naira to react based on the information public consumed from Aboki FX and put into use. This was further verified with a Ripple Effect Analysis [REA] carried out using extrapolating approach. The Monthly Average Rate of CBN, covering January to April, 2021 and Aboki FX’s Lagos Bureau De Change Rate, spanning September 1 to September 17, 2021 were harvested for analysis.

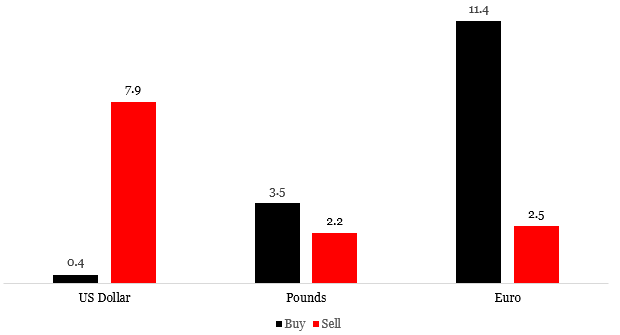

Exhibit 4: Percentage of Influence Public Interest in Knowing Foreign Exchange through Aboki FX had on Buy and Sell of the Foreign Currencies

Our analysis reveals that 67.6% connection of the public interest in Aboki FX’s and CBN’s Monthly Average Rates. However, only 45.7% of the interest could be explained from the interest in the CBN’s rate. Like the previous results, the interest in seeking information about the foreign exchange through Aboki FX partially aligned with the Lagos Bureau De Change Rate within the buy and sell categories. By 23.9%, the interest in Aboki FX and the categories are resonated within Euro, while it was 16.7% and 10.3% for Pounds and US Dollar respectively. This pattern also emerges when the extent to which the interest could be determined from the categories [buy and sell] was considered [see Exhibit 4].

Strategic Options

The emerged insights have shown that there is a need for the stakeholders to come up with sustainable solutions to the currency’s dwindling. The CBN’s decision to sanction Aboki FX could deliver certain results in the short term. It won’t address fundamental issues that fuel the poor performance of the currency locally and globally, preventing volubility of the currency in the world. Nigerian government needs to address issues of high importation of non-essential goods and help SMEs in their quest of building sustainable manufacturing sector.