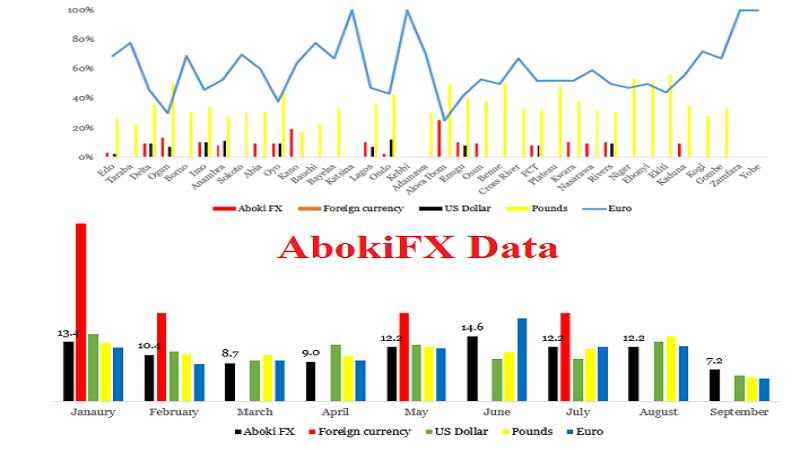

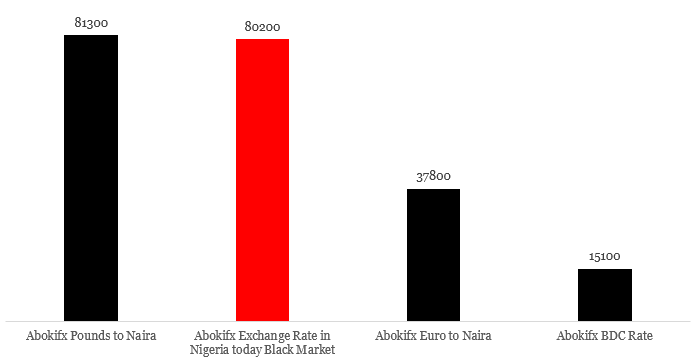

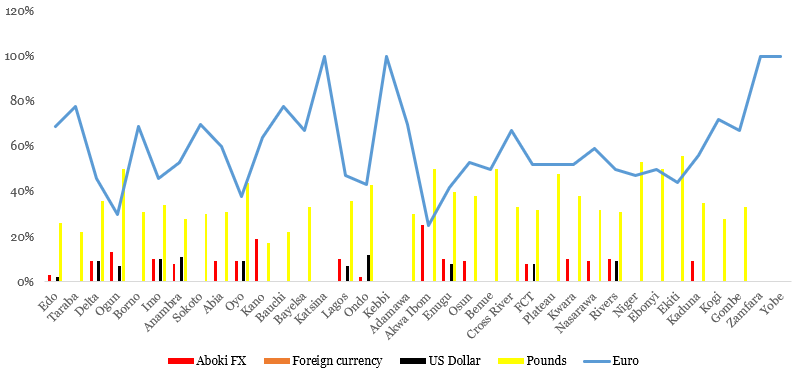

Since the Central Bank of Nigeria announced its intention of probing the activities of the Aboki FX, a platform that provides foreign exchange information, based on the perceived influence the information had on Naira valuation in recent times, Nigerians across the world have been expressing mixed reactions.

Professionals in the country believe that the decision of the apex bank is not appropriate considering the fact that there are other fundamental issues that the bank and other stakeholders need to address, not tackling the currency spectators or operators of the Bureau De Change.

One of the professionals said in a recent conversation with a local newspaper that “AbokiFX might be influencing the forex market, depending on the size of the forex transactions it conducts, the operations of the platform was not the major driver of forex scarcity and Naira devaluation. As a general principle, I disagree with that approach. Of course, markets need to be regulated and have boundaries, but I think that it is too easy to blame markets when sometimes the problem might be from within.”

In another engagement with a local newspaper, another revered professional walked the stakeholders through stages employed by currency spectators to attack and affect Naira value. Some hours ago, our analyst had to the conversation on the appropriateness of the apex bank’s decision, exploring the possible influence of the Aboki FX’s activities on the currency.

The piece has received a number of great counter and alternative reactions from Nigerian. Like previous and ongoing national issues, two schools of thought have emerged. There is a school which believes the fundamental issues should be addressed not following a particular organisation, using it as a scapegoat. In this regard, the Central Bank and concerned political leaders should do the needful by concentrating on fixing macro and micro economic problems that enhance the dwindling of Naira every day.

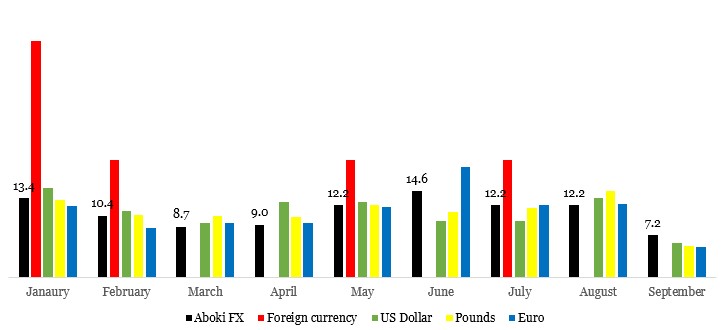

The second school believes that Aboki FX cannot be totally exonerated from the fall of the currency. This is hinged on the fact that buyers and sellers access the platform before making decision. It is also possible, according to some members of this school, because national newspapers use the platform in their reportage of the currency depreciation and appreciation daily.

It is interesting to note that from the two schools, the counter and alternative comments have deepened the ongoing discourse on the currency performance. However, it is imperative that members of the schools embrace constructive and restorative narratives in their comments. There is a need to address issues instead of personalities as we continue to have great conversations on the issues of national importance towards sustainable development in Nigeria. The big questions that need the big answers from concerned stakeholders asked in some of the reactions are reproduced below.

The Big Questions from the Public

- Why don’t other countries ban FX arbitrageurs who similarly publish black market rates?

- Our needs and problems are many, but who can take up the challenge?

- How many of us here can actually say we value the naira as a unit of value storage?

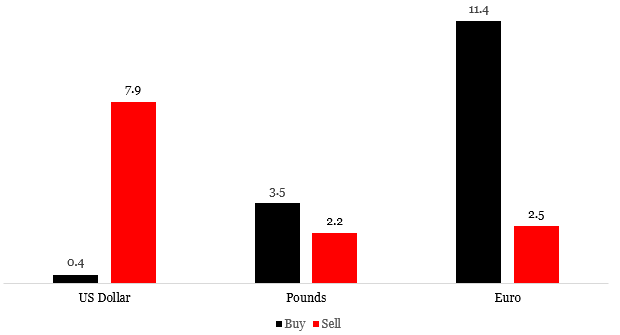

- Do BDCs (share of total matters) visit the Abokifx website to get their rates before they sell FX to their customers?

- Do customers visit Abokifx before or after they contact their BDCs (reference rate or as a second check)?

- What system does Abokifx use to update its rates? Does its use differ between Nigerians in Nigeria and Nigerians in the diasporas?

- Is Aboki FX Naira problem?

- How many Nigerian graduate are employable?

- Where’s the electricity?

- Are there hospitals? Where are the leaders?