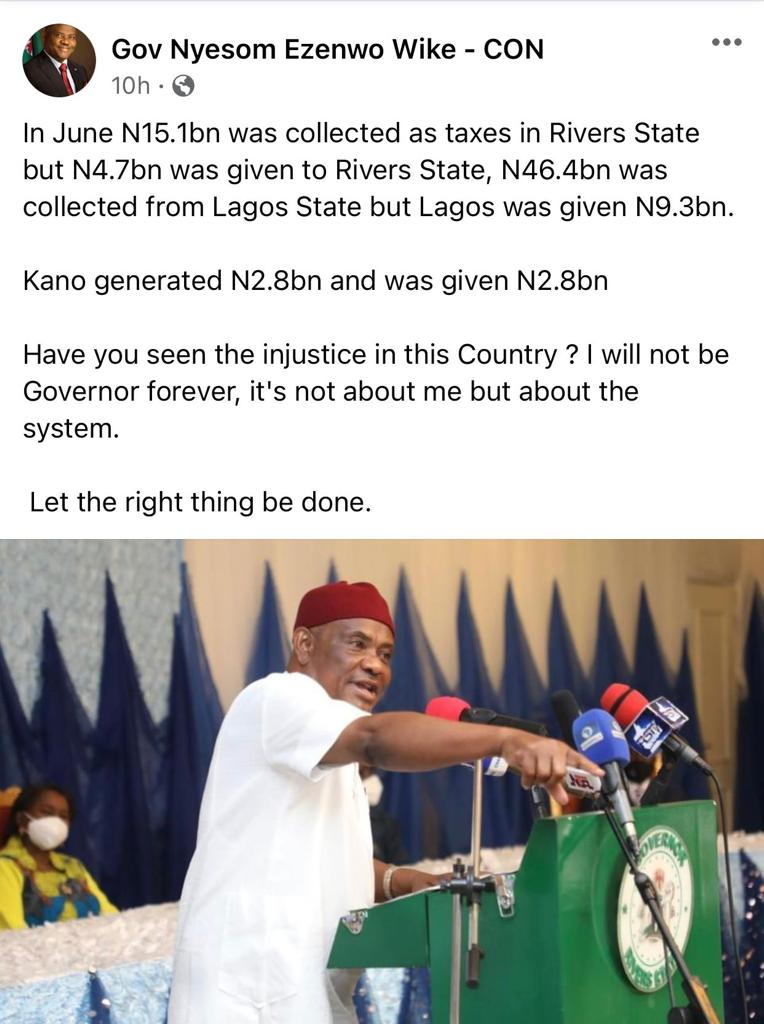

Read this Facebook post by Rivers State governor, Governor Wike, as the battle for who collects VAT in Rivers state rages.

In a stakeholders meeting, the governor noted that he would go after the Federal Inland Revenue Service (FIRS) if they do not cease from attempting to collect VAT in Rivers State.

He said, “People say that let heaven not fall but sometimes I believe that heaven should come down so that everybody will rest…When we do the right thing, heaven is at peace. So, the right thing must be done at all times.

“Rivers State is challenging FIRS from collecting VAT in Rivers State. I am not challenging FIRS from collecting VAT in Abuja. Let it be understood. But the law says Rivers must collect VAT in the state.”

“The Federal Government surreptitiously lobbied to amend the constitution to place VAT collection under the exclusive legislative list. We have challenged it and we have no apologies to anybody.

“I don’t want to be in the good book of anybody but in the good book of God. You don’t bully a state like us. FIRS should be very careful. I have the political will to do a lot of things. If they continue to bully us, I will take all their offices in the state.’’

Lagos State Joins Rivers State

Lagos state has joined this fray passing a bill to also be in charge of its own VAT collection. The governor has signed it into law: “Governor Babajide Sanwo-Olu of Lagos State has signed into law the State Value-Added Tax Bill as passed by the House of Assembly days after Rivers State government took the same route.”

“The governor signed the ‘bill for a law to impose and charge VAT on certain goods and services’ at about 11.45 a.m. on Friday after returning from an official trip in Abuja,” Gbenga Omotoso, the commissioner for Information and Strategy, said in a statement.

“By this act, the bill has now become a law,” he added.

The Lagos State House of Assembly transmitted a clean copyof the VAT Bill to Mr Sanwo-Olu on September 9, through the acting clerk of the House, Olalekan Onafeko.

Appeal Court Rules on River State

The Court has ruled that Rivers State and FIRS should pause this VAT battle until the court concludes. FIRS appealed the ruling or High Court which said that Rivers State has the right to collect VAT in the state. FIRS pushed for a state of execution which was not granted. Now, the appeal court wants all the parties to pause until it finishes its works.

The Court of Appeal in Abuja, on Friday, ordered the Rivers and Lagos state governments to stay action on their bids to collect Value Added Tax (VAT) pending the resolution of the legal dispute on the matter.

A three-man panel of the appellate court ordered that the enforcement of the judgment of the Federal High Court, Port Harcourt, latched on to by the state governments be put on hold.

Haruna Tsanami, the judge who delivered the lead ruling of the panel, also suspended the operation of the law passed by the Rivers State House of Assembly and assented to by Governor Nyesom Wike, for the collection of VAT by the State government.

Value added tax (VAT) is a consumption tax paid when goods are purchased and services are rendered, and it is currently set at 7.5 per cent in Nigeria.