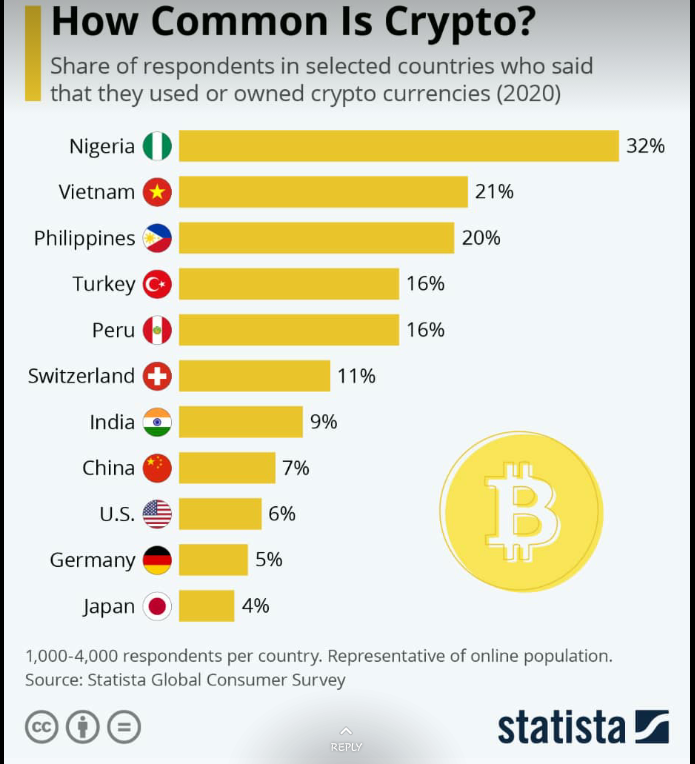

Senator Warren, the data is wrong: 32% of Nigerians do NOT own Bitcoin. It is absolute fake data they made up. Do not put any power on the open letter because the premise is invalidated by the fake data. Get me right, I am not against Bitcoin or cryptocurrency but I am against a fact-free economics. Look at this:

- Nigeria has a population of 210 million. The 32% will give you 67.2 million people.

- To have Bitcoin, you need to have a bank account, most of the time, since you need to fund the purchase via an electronic means (cash transactions with exchanges or peers are rare). Functional bank accounts in Nigeria using bank verification numbers are less than 40 million. Because Bitcoin’s total user base is a subset of this number, it is impossible for more than 40 million to own Bitcoin in Nigeria.

- Nigeria has about 104 million internet users. If we have to believe the quote, the implication is that for every 2 online users in Nigeria, at least one has Bitcoin. That is totally nonsense. More so, I do not concede that Nigeria has 104 internet users even though I will concede that Nigeria has SIMs with internet enabled capabilities. Many here continue to use their phones to talk!

- Exchanges are running bad statistics; they over extrapolate. If in 10 young men in Lagos state, three have Bitcoin, it then means 30% of Nigerians have Bitcoin! Simply visit Bayelsa, Zamfara, Ebonyi, and Osun, you will see that the extrapolation is nebulous.

Yet, Nigerian young people are promising. America can invest $1 billion via USAID to support startups including blockchain and crypto ones, along with education, logistics, healthcare, etc. But the premise must be built on reliable data.

Wow: “32 percent of Nigerians own Bitcoin, the highest percentage in the world.” ??

Open letter to @SenWarren:https://t.co/Dl11yxRKyQ

— jack (@jack) August 14, 2021

From that letter, he pulled the 32%: “As the Nigerian naira plummets in value, Bitcoin has become a necessity. 32 percent of Nigerians own Bitcoin, the highest percentage in the world. Furthermore, remittances into Nigeria exceeded $17 billion in 2020, and a substantial proportion of this value is conveyed in Bitcoin. Lastly, Nigeria has one of the youngest populations in the world, and, on a globe basis, this progressive cohort increasingly embraces Bitcoin.”