SoftBank, the Japanese rainmaker and investor, is having one of the greatest moments in its history. Just recently, the world mocked the company for its aggressive investment model. But today, the sun has risen in Softbank’s headquarters in Japan.

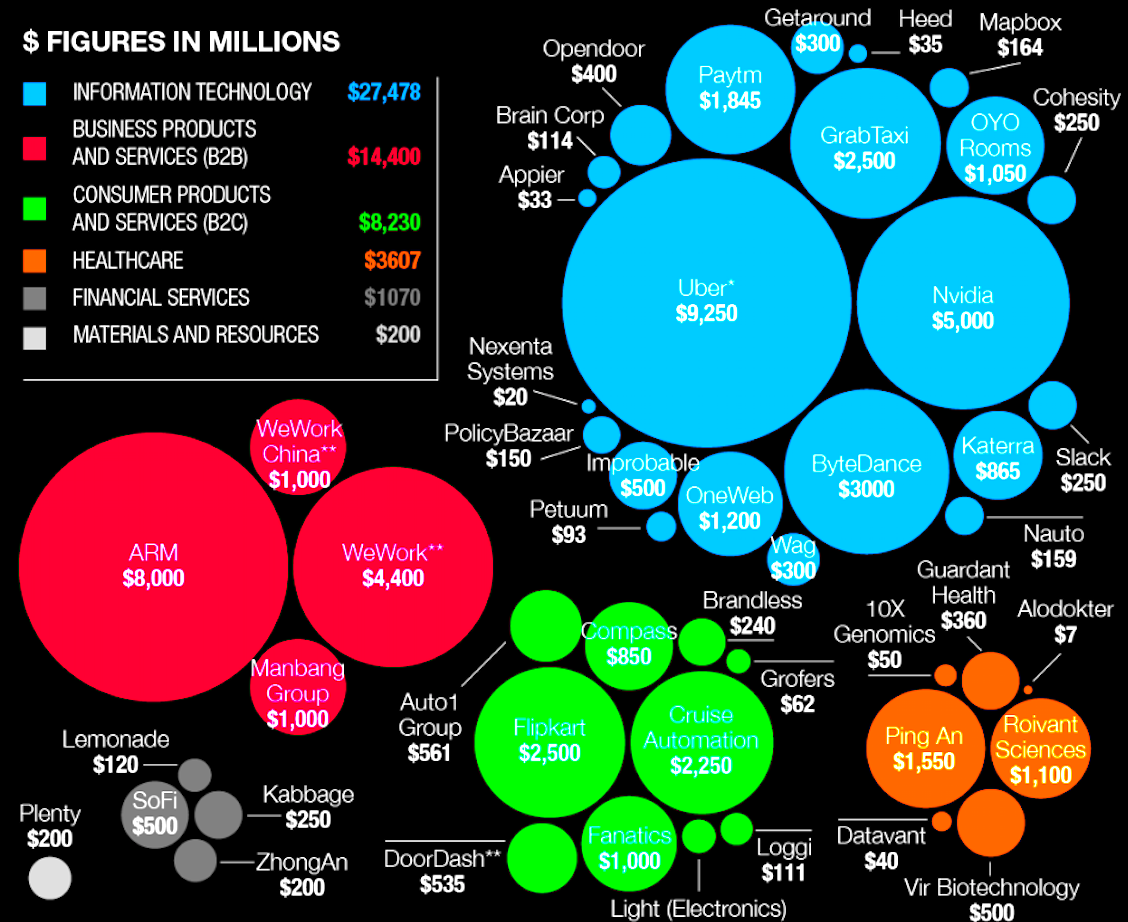

Yes, the IPOs within SoftBank’s assets are some of the world’s most anticipated: China’s ByteDance and Didi Chuxing, Singapore’s Grab, Indonesia’s Tokopedia, and India’s Paytm and PolicyBazaar. People, is there really any risk in these technology companies when they hit the inflection market cap of $2 billion which typically triggers SoftBank to pump capital?

Masayoshi Son’s SoftBank Group has reaped $45.8 billion net income for the fiscal year ended March 31, 2021, the highest of any Japanese company—ever. Its fourth quarter alone saw $17.7 billion in profit. The annual sum, fueled by a global tech rally, represents a spectacular rebound from its record $8.8 billion loss in the previous year that was compounded by investment hits from the pandemic and holdings in the troubled WeWork.

As that happens, the Nigeria Sovereign Investment Authority is letting the nation know that it recorded “a total of N160.06 billion in comprehensive income in 2020, representing a 343% growth compared to N36.15 billion recorded in 2019”. That is a commendable number; Nigeria can bring alpha.

The growth was attributed to strong performance from its investments in international capital markets, improved contribution from subsidiaries and affiliates and exchange rate gain from foreign currency positions despite challenges of the coronavirus pandemic.

This disclosure was made by the Managing Director of NSIA, Mr Uche Orji, at a virtual media conference on the presentation of the NSIA’s 2020 Audited Financial Statements and Performance Review on Tuesday in Abuja.

Orji said that the authority achieved 33% growth in Net Assets amounting to N772.75 billion as against N579.54 billion in the previous year.

More so, the Nigerian Customs Service (NCS) Apapa Area Command was not left out as it reported a revenue of N65.4 billion for the month of April—an increase of N25.6 billion compared to the same period last year. You may wonder: money everywhere but none for the common man! Why is that so?