Our Tekedia Live today….ongoing

Source: Tekedia Institute

Let me wish the new Inspector General of Police good luck. Usman Alkali Baba needs to do better than his predecessor who was more occupied in court on how he could rule till 2024 than how he could maintain law and order in Nigeria. What happened in Owerri (Imo state), over the weekend, was one of the lowest points in Nigeria since 1970.

They took down the prisons, took down the Force Headquarters, and for 2-3 hours, commanded the city. And to explain that Nigeria is fading, the men began at the Government House, announcing their presence, and sang to the execution points. The Police were largely nonexistent!

In Ovim while we are in Abia state with Umuahia as the capital, Owerri remains our de facto capital because Owerri remains special to Ovim. Our sons were governors in the state. So, whenever Owerri has an issue, it is always painful because up till today, Ovim people retire to Owerri, from Lagos, New York and London, not Umuahia.

As I wish Baba good luck, I wish Mr. President a faster return to his nation. The Supreme Court is largely shut down due to the striking judiciary. The doctors are on strike and today, university lecturers are planning to re-restart. FCT is down on strike. And from north to south, state workers are unpaid!

I have said it before: if Mr. President comes out and says, “Fellow Nigerians, I need help in a more practical way, many Nigerians will rise”. Sam Mbakwe did that and Imolites responded.

We need a new playbook in the nation. A new IGP is a welcome development but it changes nothing if you cannot inspire the citizens to believe!

Last month, I spoke in a Silicon Valley-based VC fund. They have brought me to drive home the message of fintechnolization. I have postulated that all digital platforms have one thing in common: they will mature to offer financial services to ecosystem players and participants. So, irrespective of whatever Tencent, Alibaba, Google, Facebook, and anyone do, at the end, they will become a quasi-fintech company.

Today, we are reading that Clubhouse is joining that construct very fast: the ‘one-year-old social audio app reportedly valued at $1 billion, will now allow users to send money to their favorite creators — or speakers — on the platform. In a blog post, the startup announced the new monetization feature, Clubhouse Payments, as the “the first of many features that allow creators to get paid directly on Clubhouse.”’ Simply, fintechnolization is working at Clubhouse and they want to use that to deepen the ecosystem.

Today, we’re thrilled to begin rolling out Payments—our first monetization feature for creators on Clubhouse. All users will be able to send payments today, and we’ll be rolling out the ability to receive payments in waves, starting with a small test group today. Our hope is to collect feedback, fine-tune the feature, and roll it out to everyone soon.

If you are building a digital ecosystem, thinking within the construct of fintechnolization is strategic because sooner rather than later, you will be forced to make that call. This connects to the one oasis strategy and how empires of the future are those with demand, not just supply.

This video – from Tekedia Live – explains the construct.

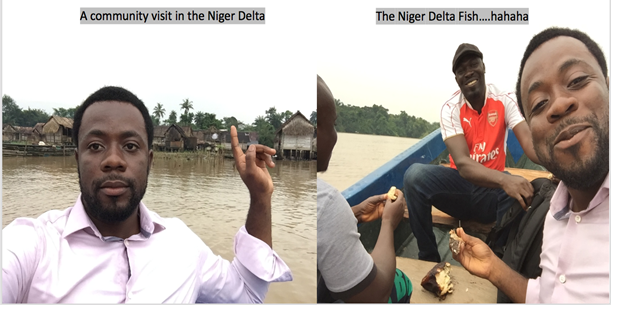

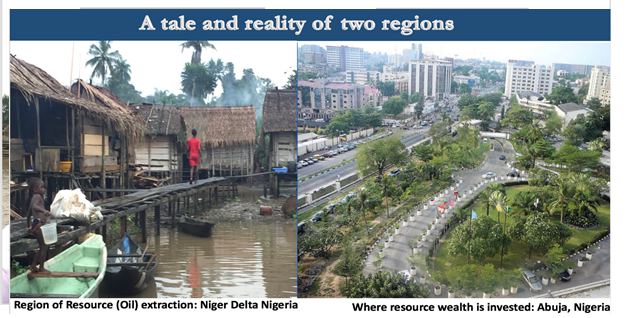

From Niger Delta Nigeria to Chaco Region of Bolivia; from Cabinda and Soyo regions of Angola to the mine hill adjacent to Lake Malo in DR Congo. They have one thing in common. Naturel Resources!

In this article, I will step away from the ‘resource curse’ hypothesis but dwell on the inseparable environmental problem associated with natural resource extraction. Natural resource exploitation will continue as long as there are resources to extract in other for states to meet their economic needs and provide energy and stock materials for industries. The exploitation of these profitable natural resources has engendered ambivalent views because of its omnipresent environmental and socio-economic implication. Mineral extraction in itself is not a bad thing, however, the configuration surrounding its exploitation and management can be problematic and complex. Natural resources hold the promise of wealth that can fuel economic development sufficient to liberate society from economic vulnerability and the constraints of nature if responsibly managed.

Ironically, such economic liberation is often gained through environmental and social change. The transformative process of mineral and energy resource extraction raises a huge public concern with space for policy instruments to manage the complex social and environmental cost of extraction. Therefore, policies for allocation of appropriate costs and gains of mineral extraction including capturing, distributing of resource gains, and determining the conditions under which extraction should take place should be pivoted on the economic, social and environmental tripod, hence the sustainability construct.

Despite global sustainability aspiration to disembark from the diesel-driven vehicle for electric vehicles, we must ensure that one man’s sustainability is not another man’s unsustainability. I have always wondered what the sustainability catch-phrase means for Ayibaebi in Niger Delta Nigeria or for Kulomba in DR Congo in the grand scheme of things when oil, coltan or cobalt mining leads to armed conflict, environmental degradation, use of child labour, consequently short-circuiting sustainability.

Therefore, to achieve sustainable development, there is a need to discontinue the current reductionist approach which has an emphasis on conventional economic rationality and embrace a systems approach that is holistic. It is striking that a good proportion of policy discourse in the public arena on mineral extraction and sustainable development shows the implicit acceptance and lack of criticality in testing many of the assumptions of sustainability while failing to operationalise macroeconomic constructs of sustainability (ecology, equity, futurity) into tools for environmental management (Bridge 2004).

Resource-based economic development can set in motion a virtuous or vicious circle of socio-economic development or retrogression respectively depending on the framework and management approach deployed. Therefore, in addressing the complex problem associated with mineral extraction, there is an overarching need for retrospective understanding, scenario analyses and futures thinking as to understand what has been done, what is being done and what should be done to ensure the sustainability of finite mineral resources and their region of extraction.

It is equally important to acknowledge that economic processes are entropic and many regions of mineral extraction have witnessed a breach of the sustainability principles and epitomise conformance to the laws of classical thermodynamics in which energy and matter which are neither created nor destroyed are withdrawn, transformed to a different form and to a different region to stimulate and produce more complex social and economic organisation and consequently accelerate systems entropy in source region as exemplified in the socio-environmental liabilities and underdevelopment (Bunker, 1985). For many of these resource-rich regions, there is the outflow of resources without a commensurate inflow of resource benefits to the region whilst the natural resource base declines correspondingly, a pure violation of sustainability principles.

Therefore, governments which are the custodian of the natural resource must set up a vehicle through which the resource wealth can be transmitted to future generations and should craft policies to ensure the exploitation of natural resources can be leveraged to move communities from the valleys and oceans of poverty to the mountain tops of prosperity. By so doing, we can ensure development will create real improvements by meeting the needs of the present without compromising the ability of the future generations to meet their needs.

References:

Tekedia Mini-MBA focuses on three core tenets in markets: innovation, growth and execution. We begin with how firms can innovate. We then move to how growth can come via the innovations. The last phase is executing in markets by applying constructs and frameworks we have mastered.

Starting on Week 11, and from Monday to Friday, we will be using cases to take home the message of Execution; these 6 companies have been selected by the Institute. The cases come in written materials and videos. Members, in the Board, from Week 11, you will see a new section titled CaseWorks.

As always, the knowledge is most useful when applied! Let us go into our firms, and apply the things we are learning. Let us make them BETTER. If you need help on that translation, ask Admin via our Support Center, and we can speak.

To the world, register for the next edition of Tekedia Mini-MBA.