The Federal Reserve is likely to cut interest rates at its September 16-17, 2025, meeting, with markets pricing in an 82-88% chance of a 0.25% cut, bringing the federal funds rate to 4.00%-4.25%.

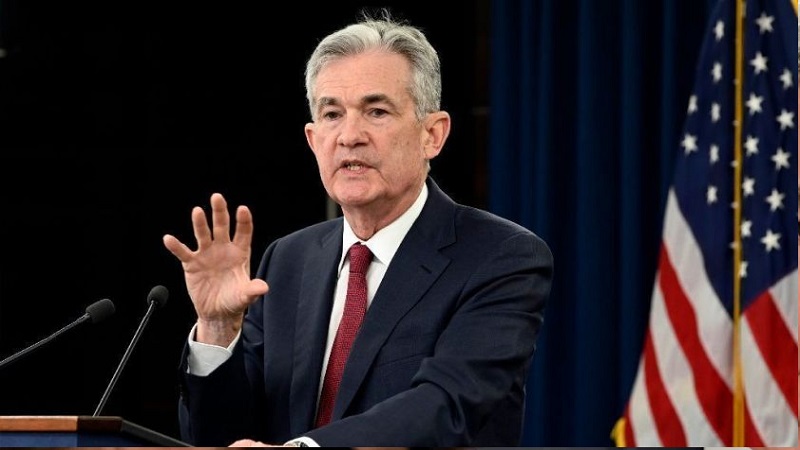

This expectation stems from Fed Chair Jerome Powell’s recent Jackson Hole speech, where he highlighted rising job market risks and a cooling economy, signaling a shift toward supporting employment over solely combating inflation. The Fed has already cut rates three times in 2024, totaling a 1% reduction, with the current rate at 4.25%-4.50%. However, experts warn of several dangers ahead.

Inflation remains above the Fed’s 2% target, with the Consumer Price Index at 2.7% in 2025. Policies like tariffs under the Trump administration could push prices higher, risking a stagflation scenario where inflation rises while economic growth slows. The Fed projects inflation won’t hit 2% until 2027, complicating further cuts.

Recent data shows job growth slowing, with July 2025 adding only 73,000 jobs against an expected 110,000, and downward revisions for prior months. A weakening labor market could force the Fed to cut rates faster, but if cuts are too late or insufficient, they may fail to prevent a broader economic slowdown.

Trump’s proposed tariffs, tax cuts, and deregulation could fuel inflation while slowing growth, creating a tricky balance for the Fed. Some experts, like those at Deutsche Bank, predict no cuts in 2025 if inflation persists, keeping borrowing costs high for consumers and businesses.

Markets reacted positively to Powell’s speech, with the Dow jumping 800 points, but a slower pace of cuts could disappoint investors expecting aggressive easing. A potential correction in stock prices looms if economic weakness impacts corporate earnings. The Fed is unsure of the “neutral” rate that neither stimulates nor restrains the economy, with estimates ranging from 2.4% to 3.8%. Cutting too far could reignite inflation, while cutting too little risks recession.

Critically, the Fed’s cautious approach reflects a tightrope walk. Some argue it’s behind the curve, as economic slowdown signs grow, while others see premature cuts as a gamble that could exacerbate inflation. The real risk is that external pressures—like tariffs or political interference—could limit the Fed’s ability to act independently, potentially destabilizing markets further.

For borrowers, a September cut may offer modest relief, but high mortgage rates (around 6.7%) and sticky inflation mean costs will likely stay elevated. Savers might benefit from sustained higher yields, but economic uncertainty could erode confidence.

A 0.25% rate cut could reduce interest rates on loans, credit cards, and adjustable-rate mortgages, offering modest relief. However, with mortgage rates still high (~6.7%), homebuyers may see limited immediate benefits. If inflation remains sticky (CPI at 2.7%) or rises due to tariffs, further cuts may be delayed, keeping borrowing costs elevated and straining households with high debt levels.

A rate cut would reduce returns on savings accounts, CDs, and bonds, impacting savers who rely on fixed-income assets. Equity markets may rally initially, as seen with the Dow’s 800-point surge after Powell’s speech, but disappointment over smaller or slower cuts could trigger volatility.

A potential stock market correction looms if corporate earnings weaken due to economic slowdown. Investors may pivot to riskier assets like stocks if yields drop, but uncertainty around inflation and tariffs could lead to cautious strategies, favoring safe-haven assets like gold.

Lower rates could reduce borrowing costs for businesses, encouraging investment and expansion. Small businesses, in particular, may benefit from cheaper loans. Tariffs and persistent inflation could raise input costs, squeezing margins, especially for import-reliant firms. A slower economy may also reduce consumer demand, offsetting the benefits of lower rates.

Rate cuts aim to support employment by stimulating economic activity. However, with job growth already weak (73,000 jobs added in July 2025 vs. 110,000 expected), delayed or insufficient cuts could exacerbate layoffs and unemployment. A tight labor market could drive wages higher, fueling inflation and complicating the Fed’s efforts to balance growth and price stability.

Lower borrowing costs could boost consumer spending, but high prices from tariffs or inflation may erode purchasing power, particularly for lower-income households. High mortgage rates and home prices may continue to deter buyers, even with a small rate cut, slowing the housing sector and related industries.

A U.S. rate cut could weaken the dollar, benefiting emerging markets with dollar-denominated debt but raising import costs for U.S. consumers. Conversely, if global growth slows, export-driven U.S. industries could suffer. If other central banks (e.g., ECB or BoJ) maintain tighter policies, capital flows and currency volatility could intensify, impacting global trade.

If tariffs or policy missteps drive inflation while growth stalls, the Fed may face a no-win scenario, unable to cut rates without worsening inflation or raise them without triggering recession. Political pressures, such as Trump’s tariff plans or calls for less Fed independence, could limit the Fed’s flexibility, undermining market confidence.

If the Fed cuts too slowly, a deeper slowdown or recession could materialize, with job losses and reduced consumer confidence amplifying the downturn. The Fed’s likely cautious 0.25% cut reflects a delicate balancing act. While it may provide short-term relief, it risks being too little, too late if economic weakness accelerates.

Conversely, aggressive cuts could reignite inflation, especially with external shocks like tariffs. The uncertainty around the neutral rate and political interference adds complexity, potentially undermining the Fed’s credibility. For individuals, the implications depend on financial position—borrowers may see slight relief.

Federal Reserve Has Scheduled a Payments Innovation Conference for October 21st 2025

Meanwhile, the U.S. Federal Reserve has scheduled a Payments Innovation Conference for October 21, 2025, to explore advancements in payment systems, focusing on stablecoins, artificial intelligence (AI), and tokenization of financial products.

The event will feature panel discussions on the convergence of traditional and decentralized finance (DeFi), emerging stablecoin use cases, AI applications in payments (e.g., fraud detection and automation of international transfers), and the tokenization of assets like bonds and real estate for enhanced liquidity and traceability.

Led by Governor Christopher Waller, the conference aims to balance innovation with financial stability, emphasizing safer and more efficient payment systems. Fed Governor Michelle Bowman has also indicated ongoing work on a regulatory framework for digital assets and blockchain adoption in banking.

The event follows the passage of the GENIUS Act in July 2025, which provides regulatory clarity for stablecoins, requiring 1:1 reserve backing and compliance measures. The conference will be livestreamed on the Federal Reserve’s website, fostering public access and dialogue with regulators, industry leaders, and academics.

The Fed’s engagement with stablecoins and tokenization validates these technologies as viable components of the financial ecosystem. This reduces stigma and encourages mainstream adoption by banks, fintechs, and payment providers.

Stablecoins can facilitate faster, cheaper cross-border payments, reducing reliance on traditional intermediaries like correspondent banks. This could lower transaction costs for underserved populations and small businesses.

Tokenization of financial products (e.g., bonds, real estate) increases liquidity by enabling fractional ownership and 24/7 trading on blockchain platforms, democratizing access to investment opportunities.

AI-Driven Payment Innovations

AI applications, such as real-time fraud detection and automated compliance, can enhance security and reduce costs for payment systems. For example, machine learning models can analyze transaction patterns to flag anomalies instantly.

AI could streamline international transfers by optimizing routing and predicting liquidity needs, addressing pain points in global payments. The Fed’s involvement signals a commitment to fostering innovation while maintaining oversight to prevent systemic risks.

This is critical as tokenized assets and stablecoins scale, potentially impacting monetary policy or financial stability if mismanaged. Governor Bowman’s mention of a blockchain regulatory framework suggests the Fed is preparing to integrate decentralized technologies into existing banking systems, ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) standards.

By embracing these technologies, the U.S. aims to stay competitive with jurisdictions like the EU, which has advanced digital asset regulations (e.g., MiCA), and countries like Singapore, which are hubs for blockchain innovation.

A clear regulatory stance could attract investment and talent to the U.S., preventing the offshoring of fintech innovation. The GENIUS Act and ongoing regulatory discussions provide a predictable environment for developers and businesses. This reduces uncertainty, encouraging investment in stablecoin and tokenization projects.

Clear rules on reserve requirements and compliance for stablecoins lower entry barriers for new players while ensuring consumer protection, spurring competition and innovation. The conference fosters dialogue between regulators, industry leaders, and academics, creating a feedback loop to refine policies and technologies.

This collaboration can accelerate the development of secure, scalable payment systems. By livestreaming the event, the Fed promotes transparency and public input, potentially crowdsourcing ideas for practical applications of AI and blockchain.

The Fed’s exploration of AI and blockchain could lead to modernized payment rails, such as an upgraded FedNow system or integration with tokenized assets. This would incentivize private sector innovation to build compatible solutions.

Support for tokenization could drive development of blockchain-based platforms for trading and settling assets, with smart contracts automating processes like dividend payments or collateral management. The Fed’s focus signals to banks and fintechs that regulated experimentation is welcome.

For instance, pilot projects for tokenized securities or AI-driven payment analytics could receive regulatory sandboxes for testing. Governor Waller’s leadership suggests the Fed may explore central bank digital currencies (CBDCs) or interoperable systems with private stablecoins, spurring further research and development.

By addressing risks like fraud, cybersecurity, and systemic instability upfront, the Fed creates a safer environment for innovators to deploy new technologies without fear of abrupt regulatory crackdowns. AI’s role in compliance (e.g., real-time AML monitoring) reduces operational burdens for startups, allowing them to focus on product development.

Excessive or unclear regulations could stifle smaller innovators unable to afford compliance costs, favoring large incumbents. Rapid adoption of AI and blockchain could expose vulnerabilities, such as smart contract bugs or AI biases, requiring robust oversight.

Widespread use of stablecoins could complicate the Fed’s control over money supply, necessitating new tools for monetary policy. The Fed’s shift, exemplified by the Payments Innovation Conference and supportive legislation like the GENIUS Act, creates a fertile ground for financial innovation.

By providing regulatory clarity, fostering collaboration, and embracing technologies like AI, stablecoins, and tokenization, the Fed is positioning the U.S. financial system to be more efficient, inclusive, and competitive. However, careful management of risks and equitable policies will be crucial to ensure that innovation benefits a broad range of stakeholders without compromising stability.

Like this:

Like Loading...