As we do in Tekedia Institute where we add special sessions on moving topics to educate our members, a special Tekedia Live will hold tomorrow to discuss the evolution and potential implications of Zugacoin, which Africa’s largest indigenous auto manufacturer, Innoson Motors, now accepts as a form of payment, for its vehicles.

Zugacoin is a unique brainchild that aims to rebuild Africa’s dying economy by becoming Africa’s first coin in equity and investment funding for Africa’s government instead of China. Starting a business in Africa can often be a gargantuan task, especially since the prospects of obtaining a loan are few and far between, we will give out loans to aid businesses and encourage investors.

Zugacoin is the first cryptocurrency in the world that owns physical offices Across 15 African countries and 32 states in nigeria.

Zugacoin offers a safe and secure platform to easily send and receive crypto from anyone in the world. Your transactions are not limited by geographical boundaries.

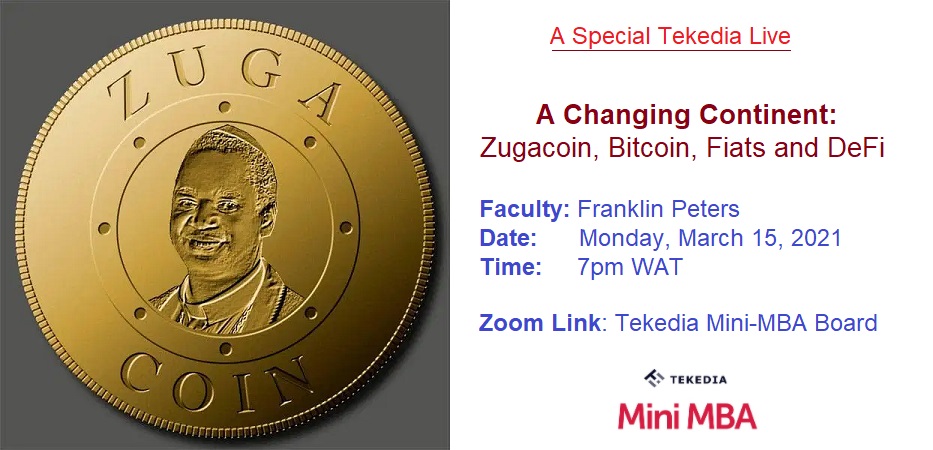

Franklin Peters Odoemenam, the CEO of Bitfxt, a crypto exchange, which used to employ many people in Lagos, but has since relocated his company to Dubai, after the Central Bank of Nigeria (CBN) restricted crypto exchanges within the Nigerian banking system, will anchor the conversation. Franklin is also working to make Zugacoin available within his exchange. Franklin is a Tekedia Institute Faculty.

- Topic: A Changing Continent: Zugacoin, Bitcoin, Fiats and DeFi

- Faculty: Franklin Peters Odoemenam

- Date: Monday, March 15, 2021

- Time: 7pm WAT

- Zoom: Tekedia Mini-MBA Board

NB: If you have registered for Tekedia Mini-MBA edition 5 (June 7 – Sept 1, 2021) and want to join, please ask Admin to give you access. If you have not, please pay and ask Admin to send you Zoom link to join.

|

Code |

Description |

Cost |

|

MINI |

Tekedia Mini-MBA. And WhatsApp School |

US$170 or N120,000 naira |

|

MINF |

Annual Package: 3 consecutive MINI, and 2 optional capstones. |

$340 or N180,000 |

|

MINR |

(optional) Homework review; faculty will review your homework with feedback. |

$30 or N10,000 |

|

CAPS |

(optional) Tekedia capstone is a research paper, analogous to final college project. |

$60 or N20,000 per track |

Use options to pay for Tekedia and Fasmicro services.

- Bank transfer (Nigerian naira) options:

- GTBank 0114016493

- UBA 1019195493

- Name: First Atlantic Semiconductors and Microelectronics.

- Flutterwave: follow this link to use Verve, Visa, Mastercard, etc in Naira, USD, Ksh, Cedi, etc.

- PayPal: follow this link and pay in US dollars with global debit/credit cards

- Stripe: follow this link and pay in US dollars with global debit/credit cards

- Zelle (USD): use tekedia@fasmicro.com

After payment, email info@tekedia.com

Note: We have spoken with the personal assistant of the creator of Zugacoin, Archbishop Sam Zuga. We are doing everything we can to get him to also join us. Personally, I want to ask him “Why Zugacoin when there is Naira”? As an archbishop, he is certainly a busy man to be brought in within short notice but we will keep trying. The PA is helping.

Then, most importantly, everything on Zugacoin, BTC, etc is for academic purposes. So, no endorsement. We run a school and not an investment house. So, all is for educating innovators and professionals to understand the changing markets and economics. We have that obligation to do that if we want to be relevant as a school.

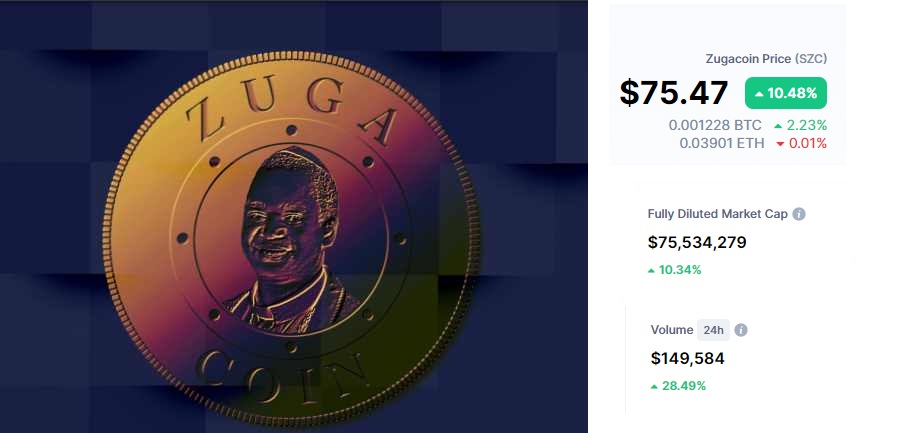

Like Tesla for BTC, Innoson Motors Will Accept Nigeria’s Cryto Zugacoin

Question on LinkedIn Feed

Comment: Prof do you think a product like a crypto coin is sustainable and safe when it is founded around a personality?

My Response: It is not every product that thrives in markets. Many banks came and went. Many soap making firms came and went. My job in Tekedia Institute is to expand the mindset of our members to become knowledgeable decision makers. Last week, we ran a course on Singularity – things that may happen say in 100 years. I know the outcome and people are thinking BIGGER. So, whether coin is sustainable or not should not stop a school teaching it. We are not an investment house. On personality, there is no problem with that. You start with what you have to get leverage and then transition to institutionalize.

Update: Innoson Motors is disputing this but Vanguard Newspapers which broke the news is yet to remove it from its website (see below). We have updated our articles accordingly. This is largely expected as I wrote in my original piece: “This is not going to be the end of this story – I expect the Central Bank of Nigeria to be concerned.” Certainly, Innoson Motors would not like to score an own-goal here. Yet, why it took it more than 100 hours to respond is another story. As always, we see our platform as an education arena – and that does not mean endorsement. Tekedia is a school and teaching something does not mean endorsing it. We will continue to share emerging technologies even if we do not endorse them. Shine your eyes.