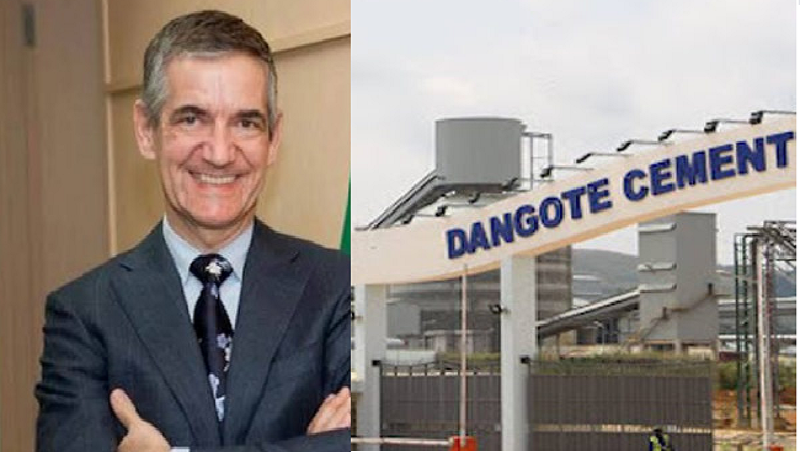

Michel Puchercos Takes Dangote Cement To The Big Party with MTN Nigeria

Mr. Cement, Michel Puchercos, CEO of Dangote Cement, has done it – Dangote Cement joins MTN Nigeria as two companies which have broken the N1 trillion revenue mark. This was how I introduced him when he joined Dangote Cement from Lafarge – “Dangote hired Michel Puchercos from Larfarge to keep in-house a man who seems to be the best talent in the cement industry in Nigeria. Michel had performed wonders in Lafarge, transforming the company in many ways, and positioning it to battle Dangote Cement….

“Find ways to build the best team: nothing else matters than having the right person to manage all your factors of production. This man is a real Mr. Cement and he is rocking it in Nigeria. Yes, in the Forum a few months ago, I noted how he grew profits 1,284% in Lafarge while reducing CEO compensation by 10%!”

Today, he has put Dangote Cement in the history books: “Total sales came to N1.034 trillion, N142.525 billion higher than the figure for the year before, the income statement of the cement-maker obtained by Premium Times showed.”

Nigeria’s biggest company Dangote Cement Plc Tuesday reported a 16 per cent surge in revenue for 2020, culminating in its biggest annual sales ever, Premium Times has the report.

Total sales came to N1.034 trillion, N142.525 billion higher than the figure for the year before, the income statement of the cement-maker obtained by Premium Times showed.

It is an astounding run in the face of the pandemic that has plummeted economies, limiting building and construction activities.

The group’s quarterly profit before tax (PBT) during the H1 2020, was N109.11 billion compared to the N42.19 billion reported at the same period the previous year. The quarterly revenue was N284.59 billion compared to the N212.06 billion reported the same period the previous year.

Defying the Pandemic, Dangote Cement Posts N276bn 2020 Profit

Defying the Pandemic, Dangote Cement Posts N276bn 2020 Profit

Nigeria’s biggest company Dangote Cement Plc Tuesday reported a 16 per cent surge in revenue for 2020, culminating in its biggest annual sales ever, Premium Times has the report.

Total sales came to N1.034 trillion, N142.525 billion higher than the figure for the year before, the income statement of the cement-maker obtained by Premium Times showed.

It is an astounding run in the face of the pandemic that has plummeted economies, limiting building and construction activities.

The group’s quarterly profit before tax (PBT) during the H1 2020, was N109.11 billion compared to the N42.19 billion reported at the same period the previous year. The quarterly revenue was N284.59 billion compared to the N212.06 billion reported the same period the previous year.

The Nigerian government in the third quarter of last year excluded Dangote Cement from its blockade on exports to other countries through land borders especially to West African neighbors Niger and Togo, thereby helping the group to ramp up sales, Chief Executive Officer Michel Puchercos said on an investor call, according to Bloomberg.

Profit before tax swelled by 49 per cent, rising from N250.479 billion to N373.310 billion.

Profit for the year advanced from N200.521 billion to N276.068 billion, translating to a 37.7 per cent jump. That lifted earnings per share from N11.79 to N16.14.

Earnings were limited by a N188 million provision for impaired assets as well as a surge in income tax expense from N49.958 billion to N97.242 billion, implying a 94.6 percent growth.

Shareholders fund dipped 0.8 per cent from N897.937 billion to N890.970 billion, following Dangote Cement’s buyback of 40.2 million units of its shares in December at the cost of N9.8 billion.

The company’s board on Friday proposed a N16 per share dividend totaling N272.648 billion for shareholders for 2020, the same amount it has paid shareholders every year in the past three years.

“I am delighted to report that Dangote Cement experienced its strongest year in terms of EBITDA and strongest year in terms of volumes. Despite a challenging environment, Group volumes for the year were up per cent and Group EBITDA was up 20.9 per cent,” Mr Puchercos said.

“Looking ahead, we have strengthened our Alternative Fuel initiative which focuses on leveraging the circular economy business model and reducing exposure of our cost base to foreign currencies fluctuations.”

Shares in Dangote Cement closed in Lagos on Tuesday at N220 per unit, trading up by 3.09%.

The growth is also attributed to the ingenuity of Mr. Puchercos, who joined Dangote Cement from rival company Lafarge last year, and has since turned the numbers up for the Nigerian cement giant.

Mr. Puchercos said: “Dangote Cement’s strategy to offer high quality products at competitive prices is meeting customers’ expectations in Nigeria and across the continent, where we continue to deploy excellent marketing initiatives and operational excellence.”

Brazil Fines Apple $2m, Heightening Its Consumer and Regulator Troubles

Apple has been slapped with a $2 million fine in Brazil for selling iPhones without a charger, adding to its many problems with watchdogs.

In addition to levying a hefty fine (10,546,442.48 Brazilian real), São Paulo-based consumer protection foundation Procon on Friday also accused Apple of misleading advertising, selling defective products, maintaining unfair contract terms, and not repairing a product still under warranty.

“Apple needs to understand that in Brazil there are solid laws and institutions for consumer protection,” Procon executive director Fernando Capez said in a statement. “It needs to respect these laws and these institutions.”

The iPhone 12 launched last year with a Lightning-to-USB-C cable, but no power adapter or earbuds as used to be typical. According to Apple, excluding the power adapter reduces the box size, allowing it to ship more at one time. Smaller packaging also helps reduce annual carbon emissions.

When Procon reportedly contacted Cupertino last year, asking for clarification, the company “never offered a convincing explanation,” according to Brazilian news site Tilt. Apple can still appeal the decision, ask Procon to reevaluate, or settle it in court.

Official 20W USB-C chargers are currently sold separately by Apple for 219 Brazilian real ($40). It’s not inconceivable, though, that the company could ship the products together. France, for instance, insists that every mobile phone include some form of hands-free kit or headset in a bid to protect children under the age of 14 from exposure to electromagnetic waves. A 75,000 euro ($89,000) criminal fine was enough to convince Apple to ship its hardware with EarPods and a Lightning-to-USB-C cable.

High demand for the iPhone 12 allowed Apple to one-up Samsung in Q4 2020 smartphone sales, giving the Cupertino-based manufacturer its first leadership position since Q4 2016. Samsung still kept its position as the largest manufacturer based on full-year results, shipping 253 million smartphones against Apple’s 199.8 million devices.

In December, Italy’s Competition Authority (AGCM) fined Apple €10 million ($12 million) for “aggressive and misleading iphone commercial activities”.

The regulator said the tech company failed to clarify that it’s under certain circumstances, when it advertised several iphone models as water resistant.

On Friday last week, a federal jury in Marshall, Texas, ordered Apple to pay $308.5 million for infringement on technology used iTunes and App Store.

The patent has been held by Personalized Media Communications, which brought the case before court in back in 2015, alleging that Apple infringed its patent on FairPlay.

Personalized Media Communication expert explained a file encrypted on FairPlay as a piece of media content or software app, digitally encrypted and can only be decrypted by an authorized user device based on user-specific or device-specific decryption information.

The expert had set a $240 million price tag for what Apple owes Personalized Media Communication in royalties for using its technology. But the jury ordered Apple to pay a running royalty, which is the price determined by the sales of licensed products or processes.

Earlier this month, a US judge certified the class-action status of a consumer-led lawsuit over the butterfly keyboard used in Apple MacBooks, which controversy has been raging for over two years now.

Several MacBook owners in seven US states had filed class-action lawsuits against Apple in 2018 after complaints that the “Butterfly” keyboard fails. They claimed Apple knew the butterfly keyboards in certain MacBook models dating back to 2015 were prone to failure, but decided to continue selling them anyways.

The main problem with the butterfly keyboard is dust getting inside and preventing the keys from working. And replacing it costs about $400 to $700, a huge price many of the Apple users don’t want to pay.

If the class-action lawsuit is successful, affected MacBook owners may be financially compensated. However, it has become a-one-case-too-many for Apple in many of its markets around the world.

Finding Value In The Age of Perception Demand

In the last two weeks, I have been using different brands in Tekedia Growth Hour – private Tekedia Mini-MBA corporate session – to explain why brands must evolve on how they engage with markets. In the past, the mantra was this: I will just go and execute, and the numbers will do the talking. Interestingly, you can execute, but the numbers will not help you. Simply, how you make money and where you make money are more important than the actual numbers on the balance sheet and P&L.

Tesla is a car company which sells “software subscription” and emission credits, and makes all its competitors look lost, even though most are delivering “better automobile numbers”; Toyota sells more than 10 million cars than Tesla, but Tesla is valued at close to 2.5x.

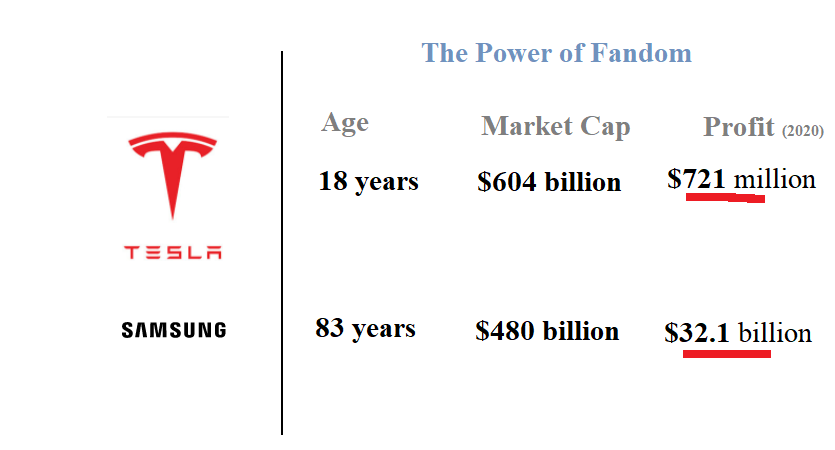

Think about it: how can you make a profit of $721 million and worth over $100 billion more than someone who made a profit of $32 billion? It is called perception demand and it is shaping everything in business.

It took Tesla 4x less years to reap a higher market cap than Samsung

Data calculated and analyzed by Finbold indicates that it took electronic vehicle manufacturer Tesla at least four times less years to amass a higher market capitalization than South Korea’s electronic giant Samsung. By March 23, 2021, Tesla was only 18 years old with a market capitalization of $643.10 billion, which is higher than 83-year old Samsung with a cap of $484.19 billion.