The one thing you must not fail to know about is the next phase of the internet.

This new phase of internet will change everything, including you

This new phase will give you new power and influence more than the current one

If you don’t know it now, you may not know that it is already here.

I have come to agree that one of the best means of economic growth is technological breakthrough.

Imagine the invention of the internet and the combined market worth of all the businesses it supports.

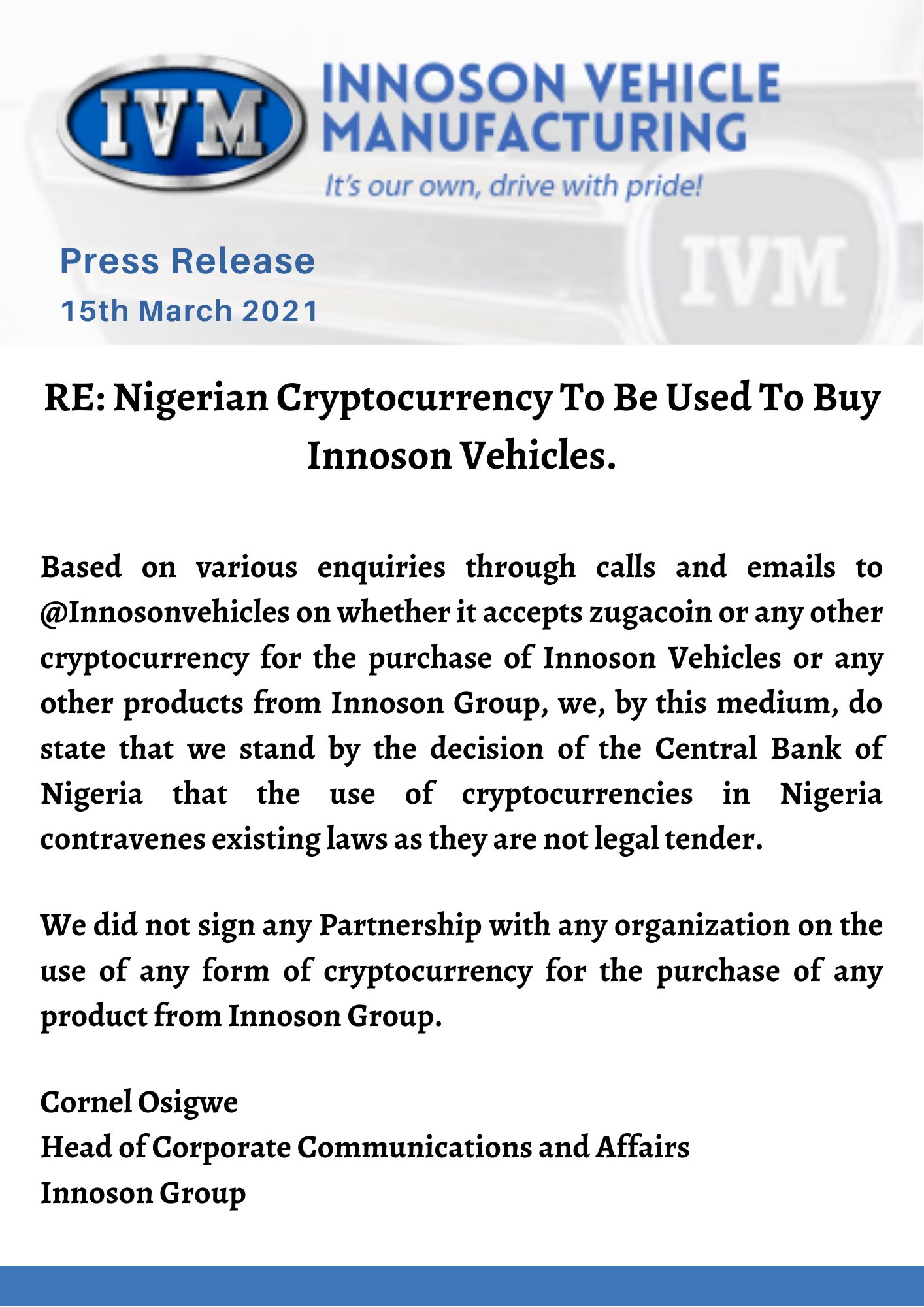

That is why , when innovation is taking place, regulators should be careful else they may stop an engine of global economic growth.

Before I explain what I will be sharing with you let me ask you this simple question.

What is the difference between information and value?

I will try to explain them in terms of communication technologies.

When A sends a copy of information such as image, email, pdf to B, he has sent a copy of the information.

That means, the original copy of the document remains with him.

This is what the current internet does.

Tell me, the last time you send email to people, do you still have the original copy?

The internet we have now simply helps in the transfer of information from one party to another.

But, see it from another angle. When A send a pdf document to B, and these happen;

- He no longer have the original document

- He sent the original document and not a copy

- He transfer the right of ownership to party B

- This is what we called the transfer of value

The next phase of the internet is the internet of value.

It will help to digitize everything that has value such as money, content, deeds etc.

The technology of that internet is the Blockchain.

If you don’t take this seriously you may not know how powerful this will be.

What do you think of this internet of value?