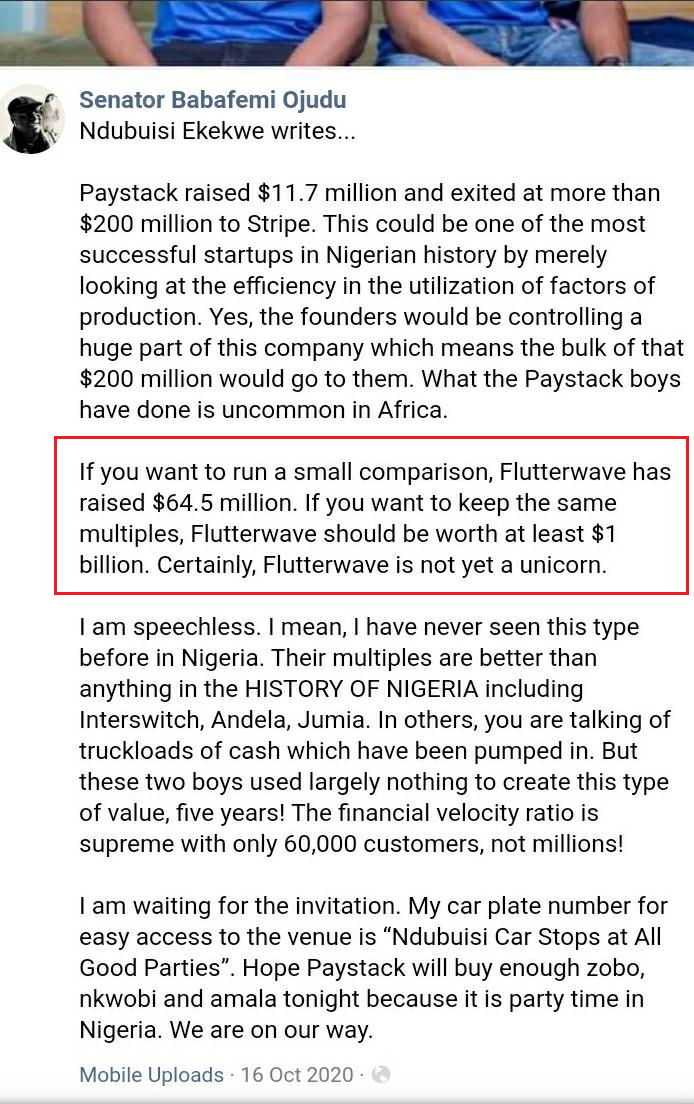

In October 2020, I wrote “If you want to run a small comparison, Flutterwave has raised $64.5 million. If you want to keep the same multiples, Flutterwave should be worth at least $1 billion. Certainly, Flutterwave is not yet a unicorn.” I had used Paystack numbers to extrapolate on the valuation of Flutterwave. That number came close to $1 billion but I quickly held by noting that Flutterwave was not yet $1 billion. But when it raised $170 million, this week, it completed.

Read this comment from Ladi:

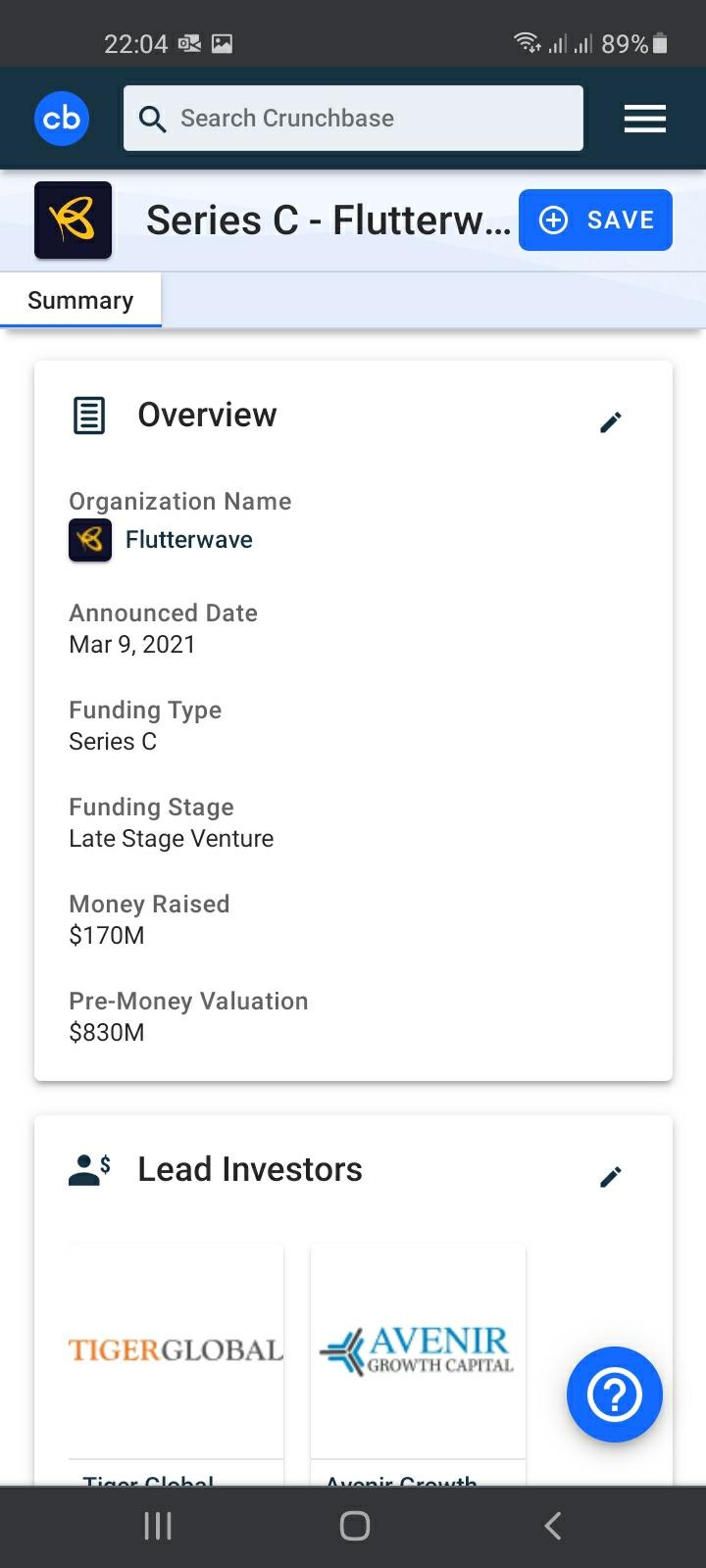

The recent $170m Series C funding (Total Funding = $234.7m) informed the $1 billion at 10 March March 2021 valuation ($830m before the $170m Series C Funding) – see attached as exhibit.

Your comments around October 2020 refers to Series A and B funding ($64.5m) only.

This critical factor was absent at the time of your submission and basing a company”s valuation on parallel (black) market exchange rate to USD is a fantasmal joke that’s not even funny at all.

It clearly seems that you’re trying to retrospectively fit the $1 billion valuation into a 2021 conjecture – by fire and by force Prof.

Velocity, Harvard Business Review or One Oasis valuation modelling have nothing to do with black market valuation; the $170m Series C funding fully explains causality ($830m + $170m).

He was referring to this post which was copied by a Senator

My response: “That makes me a zen master if I predicted months ago that Flutterwave should be worth $1 billion. I have even forgotten I wrote that. Thanks for sharing. So, I need to celebrate that call. I did say it was not $1b, so, the $170m completed it. I do not see what to fault there. I wrote that many months ago after extrapolating from Paystack number!

Another comment: Well done. The image above fully accounts for the difference. You have not yet demonstrated any model efficacy – One Oasis. Please do and don’t refer to black market valuation please.

My response: I do not know which image. You hard pre-money $830m which the $170 completed to $1b. I wrote it was $1b but quickly noted, it was not a unicorn. That $170M completed it. On model efficacy, you have no basis to judge. So, I leave it that way.

On black market, it is a number and we use it provided you declare it. You can also use official provided you declare it. They are numbers, just make it clear which one you are using. Bloomberg, Reuters, etc use black market rates and that I am using it should not be a taboo.

Yet, picking an Oct 2020 article to challenge one with more insights you have in March 2021 is another black market deal. You could have challenged me then. Do you not think an official rate would have focused on March 2021 and leave Oct 2020 alone? Read the full article which Senator Ojudu shared here – https://www.tekedia.com/paystack-is-the-most-successful-nigerian-tech-startup-on-large-value-creation-for-investors/ . I think I did very well, predicting March 2021. A hedge fund would have been happy to extend my contract.

Comment on the article: Uber and Lyft raised billions which continues to be debt their debt burden and they are still operating in the red. People should question what a business that’s on the market needs infusion of capital for. I dont consider funding as profit. A business that is on the market should be able to expand from market adoption, without such large infusion of cash, unless it is building infrastructure to meet demand. Lets just stop seeing fund raising as success. It’s not.

My response: You have a point but it misses how digital companies are valued and modelled. You are using an industrial age mentality to examine digital native companies. Amazon is worth $1.54 trillion today but was profitless for ages as it pursued that inflection point to make it a category-king.

Until you get to that state, no steady state has been reached as the golden virtuous circle of network effect cannot set in at scale with near-zero marginal cost. To assure that the money Uber raised is not lost, it did not drop to zero on IPO day. In other words, it created value after all “mass investors” have looked at it.

Next time I visit Nigeria, I plan to visit Nigerian Senate to have a chat on how we need to look at digital firms. It is not about profit. Amazon, an online firm, is America’s second largest employer.

Wish President Buhari can see this. We need to change how we look at these things in Nigeria. We can create 10 million in 4 years and employ everyone!