Nigeria and cattle are on a collision. I cannot understand why we cannot manage this paralysis. Cattle could put this nation on a regrettable path. This is becoming “a savage custom, barbaric, outdated, rejected, denounced, accursed, excommunicated, archaic, degrading, humiliating, unspeakable, redundant, retrogressive, remarkable, unpalatable.”

You could have noticed that I quoted Wole Soyinka’s Lakunle, in The Lion and the Jewel, as the teacher spoke to Sidi. Yours truly acted as Lakunle in the secondary school’s drama society where memorizing drama, Shakespeare, etc was part of life. And most of those lines have refused to go! Sure, they helped those days Ifeoma was doing shakara. Lol

People, cattle must NOT destroy Nigeria. It is high time Mr. President shows leadership on this. We need to be living to eat meat in Nigeria. This is simply no more a distraction, it is a problem now. Yes, when the police lie to protect cattle, you will agree that Nigeria is on a bad path.

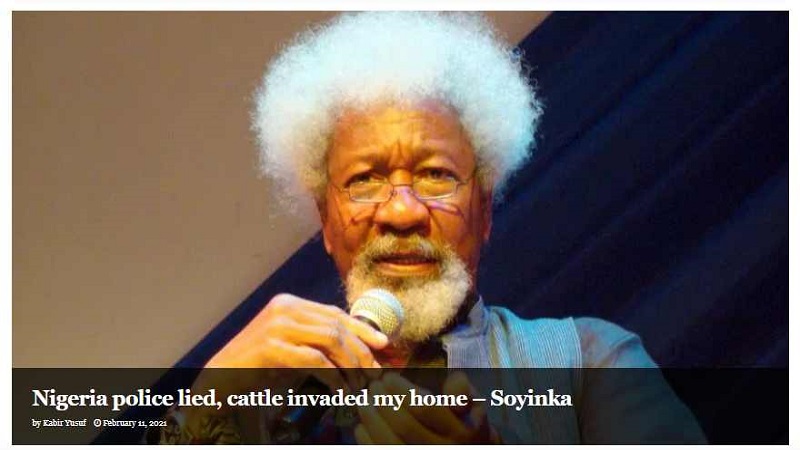

Wole Soyinka is a sage and one of the most respected academics in the world. In some societies, he would be a national symbol. But here,… very unfortunate. Mr. President, you need to lead on this cattle thing.

Mr Soyinka, in a statement sent to PREMIUM TIMES, narrated how the cattle invaded his home, how they were removed and how the police took time to arrive the scene after they were invited.

The police in Ogun had claimed in a statement Tuesday that only one cow stayed into Mr Soyinka’s compound.“The entire place was inspected by the DPO and it was established that it was just a case of stray cow as nothing was damaged or tampered with,” the police said.

Mr Soyinka has now said that the narrative of the police is false.

“I thoroughly resent the police version which suggests that the cows never invaded my home: home is not just a building; it includes its grounds. And it was not a stray cow, or two or three. It was a herd – we have photos, so why the lie? It is so unnecessary, unprofessional and suspiciously compromised,” Mr Soyinka wrote.