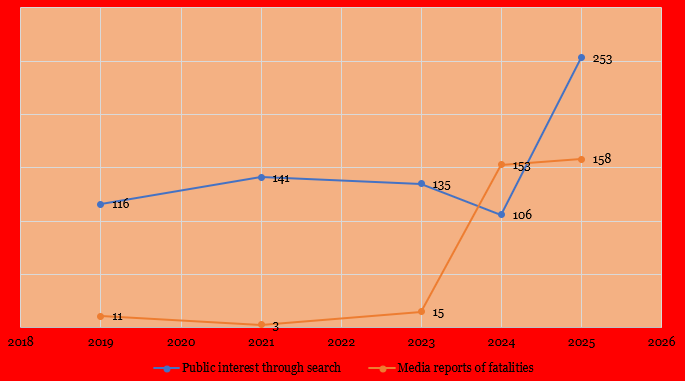

A review of truck-related accident data by Infoprations reveals a striking gap between public attention and the real toll on Nigerian roads. Records from 2019 to 2025 show that while fatalities surged into triple digits in the last two years, online search interest only spiked after repeated disasters. According to the analyst this indicates that public concern rises unevenly despite mounting deaths.

A Mixed Picture Across Six Years

Numbers compiled from major media reports and public search metrics chart a turbulent safety record. Reported deaths from heavy-duty vehicle crashes stood at 11 in 2019, dipped to just three in 2021, then began climbing again. By 2023, fatalities reached 15 as Lagos and Ogun corridors saw a string of container and trailer incidents.

The real inflection point came in 2024. Tanker explosions and multiple expressway collisions pushed the death toll to 153, eclipsing the cumulative total of the preceding four years. In October 2024 alone, more than 140 lives were lost in a single tanker inferno in Jigawa after residents rushed to scoop petrol from an overturned vehicle. Yet search interest for the year was measured at 106, lower than levels seen in both 2019 and 2021.

In 2025, reported fatalities edged even higher to 158 as disasters continued in Niger, Enugu and along the Zaria–Kano corridor. This time, search activity surged to 253, more than doubling any prior year, reflecting widespread online engagement with each tragedy.

Attention Spikes After Repeated Shocks

The data reveal that heightened awareness lags behind actual risk. Public curiosity did not peak at the moment of catastrophic loss in 2024. Instead, it accelerated months later as the accidents continued into early 2025. Analysts suggest that a single mass-casualty event may briefly dominate headlines but does not sustain digital engagement unless subsequent crashes keep the topic alive.

This delayed response mirrors patterns seen in other public-safety issues. Awareness often follows cumulative exposure rather than isolated incidents. In Nigeria’s case, the relentless cadence of January, February and March 2025 tanker disasters, followed by July expressway crashes, generated continuous news cycles that kept road safety at the forefront of conversation.

Interpreting the Disconnect

Several factors explain why interest lags behind fatalities. Rural disasters, though deadly, may be underreported or attract limited national debate. Social media amplification also drives searches; videos of overturned tankers or burning buses tend to circulate more widely when multiple incidents occur within weeks.

Infrastructure and enforcement deficiencies deepen the risk. Many highways lack freight-specific lanes, modern guardrails or effective weighbridge checks. Fuel tankers continue to ply long routes without fire-suppression systems or modernised braking technology. When mechanical failure intersects with congested roads or crowd behaviour, outcomes are severe.

A Persistent National Challenge

Nigeria’s expanding freight sector ensures that heavy trucks remain indispensable to commerce. Yet the record from 2019 to 2025 shows that preventable tragedies have grown, culminating in over 300 deaths in the last two years alone. Search patterns demonstrate that concern is episodic, often ignited only after successive disasters dominate the news cycle.

Bridging this gap requires sustained awareness, modern enforcement and investment in safer road design. Without deliberate effort, the country risks treating each mass-casualty crash as an isolated misfortune rather than part of an escalating systemic problem. Aligning public vigilance with the realities of the toll may prove as critical as any policy reform in saving lives on Nigeria’s highways.