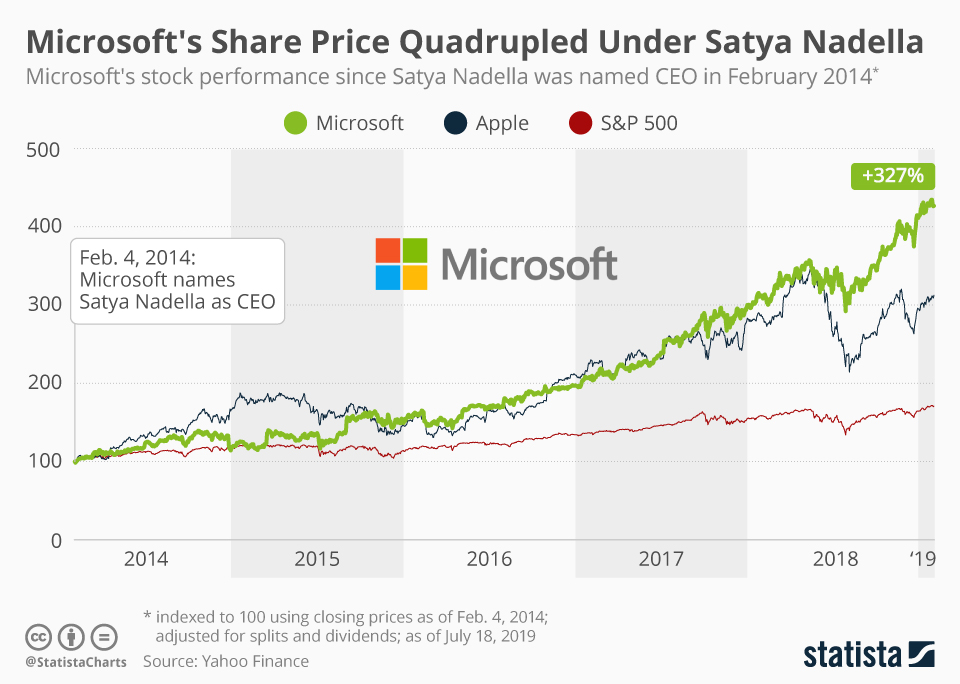

Nations rise when pioneering entrepreneurs emerge to make this equation come to pass:

- Innovation = Invention + Commercialization.

Without those pioneers, the capacity to combine factors of production to set a new basis of competition and fix market frictions stall. Interestingly, most nations always have those pioneers before they can advance. In other words, the state cannot be optimized before the emergence of these pioneers.

Why? It is through the wealth created by these entrepreneurs that the wealth of a nation is built, and through that wealth, the institutions of states are advanced. Nigeria cannot advance until it can produce great pioneering entrepreneurs, Aso Rock or no Aso Rock. Fixing Aso Rock, Nigeria’s seat of power, will go through markets because only markets fund the promises of politicians.

Before the American steel industry, Carnegie had to emerge. Before the US energy sector, Rockefeller existed. From JP Morgan to BY Mellon, men were ahead of the government in setting the ordinance of US banking. Nigeria cannot have it the other way around: the government has never led anything and we cannot expect everything to be anchored by bureaucrats.

Like Nollywood, Nigeria’s movie industry, which emerged without any memo to the government, our pioneering innovators must do the same in other sectors. Even in China, the rise has gone through markets, specifically its state-owned-enterprises, an invention in its market systems.

Pioneering innovators, we are waiting for you to transform Nigeria and Africa.