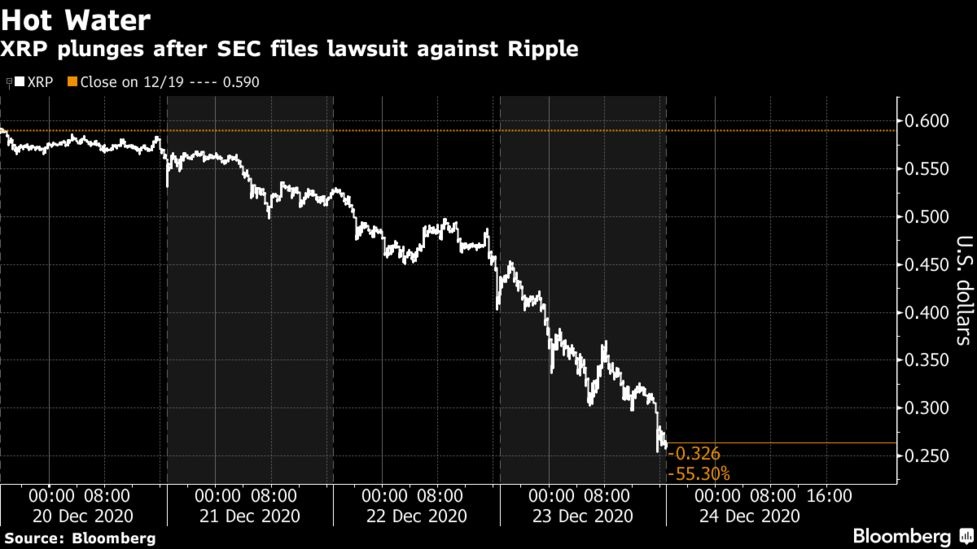

Ripple has been caught in the web of the U.S. Securities and Exchange Commission (SEC), in a controversial debate over the former’s right to make security offerings. On Tuesday, SEC charged Ripple, the blockchain payments associated with the cryptocurrency XRP, with conducting a $1.3 billion unregistered securities offering.

Two executives of Ripple were also charged by the Commission for benefiting from the offering.

The development thus exposed further loopholes in cryptocurrency regulation that has become a global fight to finish.

In a statement issued by Ripple lawyers, the world’s third cryptocurrency said that XRP is a currency and thus does not need to be registered as an investment contract.

“The SEC is completely wrong on the facts and law we are confident we will ultimately prevail before a neutral fact-finder. XRP, the third largest virtual currency with billions of dollars in trading every day, is a currency like the SEC has deemed Bitcoin and Ether, and is not an investment contract,” Andrew Ceresney, Debevoise & Plimpton said. “This case bears no resemblance to the initial coin offering cases the SEC has previously brought and stretches the Howey standard beyond recognition.”

In June, the SEC ruled that Bitcoin and Ether are not securities and will not be regulated as such. The surprising thing that has drawn a lingering debate is the exemption of Ripple from the mid-year ruling of the regulator.

The argument went beyond the decision of SEC back in June to the ruling by the US Financial Crimes Enforcement Network (FinCEN), in 2015. The five year old ruling is believed to supersede the Commission’s stand on XRP lately.

“FinCEN already signed an agreement with Ripple Inc. allowing them to continue their XRP sales. If XRP is an unlicensed security then FinCEN now has to explain why they signed an agreement allowing the sale of said unlicensed securities. Never going to happen, XRP isn’t a security,” Richard Holland tweeted in support of Ripple.

Bitcoinist, a cryptocurrency analyst blog noted a major factor in the controversy. In 2015, civil enforcement by FinCEN, Ripple Labs was accused of violating the Bank Secrecy Act (BSA) by acting as a money services business (MSB) and selling XRP without registering with FinCEN. It also failed to implement and maintain an adequate anti-money laundering (AML) program.

The issue resulted in criminal charges against Ripple, which was resolved with $450,000 settlement. The fine means that XRP was permitted to trade.

The settlement was believed to have set a precedent for the digital currency industry. Ripple Lab was asked to make enhancements to the Ripple Protocol to monitor future transactions. Then U.S. Attorney Melinda Haag, said she hoped the settlement set an “industry standard” in the digital currency space.

Holland and others believe that the settlement serves as an agreement that XRP is a currency.

“These are the agreed facts of the settlement where FinCEN agrees with prejudice that XRP is a currency and therefore not a security. This debate is over,” he tweeted.

The debate is not only questioning the supposed precedent set by finCEN ruling, it also set U.S. regulatory institutions into conflict.

“This complaint is wrong as a matter of law. Other major branches of the U.S. government, including the Justice Department and the Treasury Department’s FinCEN, have already determined that XRP is a currency. Transactions in XRP thus fall outside the scope of the federal securities laws. This is not the first time SEC has tried to go beyond its statutory authority. The courts have corrected it before and will do so again,” Ripple’s lawyers said in a statement.

Some Ripplers believe that SEC is making this move based on their illogical claim that XRP is somehow the functional equivalent of a share of stock.

Nevertheless, the conflict is as a result of lack of regulatory clarity for the U.S. crypto market, and the way forward is likely going to be determined by court. However, whatever decision the court makes may set the ball rolling for a holistic regulatory rule for the United States’ crypto industry.